Real estate in Turkey for living and investment with up to 30% increase in value

We select high-liquidity properties for investment and comfortable living in Turkey. Our team handles all document verification and provides full support throughout the transaction

-

More than 1.4 million real estate transactionsIn Turkey in 2024

-

High-liquidity properties start at $120,000On the Turkish real estate market

-

Rental yields up to 12%Depending on strategy

Top picks by Neginski: best spots, strong infrastructure, high rental yield

Top Reasons Investors are Turning to Turkey

-

The cost for real estate on average grows by 10-20% in dollars every year

01

-

Purchase in Turkey using an international passport without additional documents

02

-

Residence permit for the object purchase from $200,000

03

-

Full family citizenship available with property purchases starting from $400,000

04

Real estate investment in Turkey: key numbers and facts

According to TÜIK — Turkish Institute of Statistics

-

Rental income: short-term — 8-12%, long-term — 5-8% per annum

-

Sustainable tourist flow: 62 million tourists visited Turkey in 2024

-

Average investment return period of 8-10 years with rental yield of 8-12% per annum in Turkey

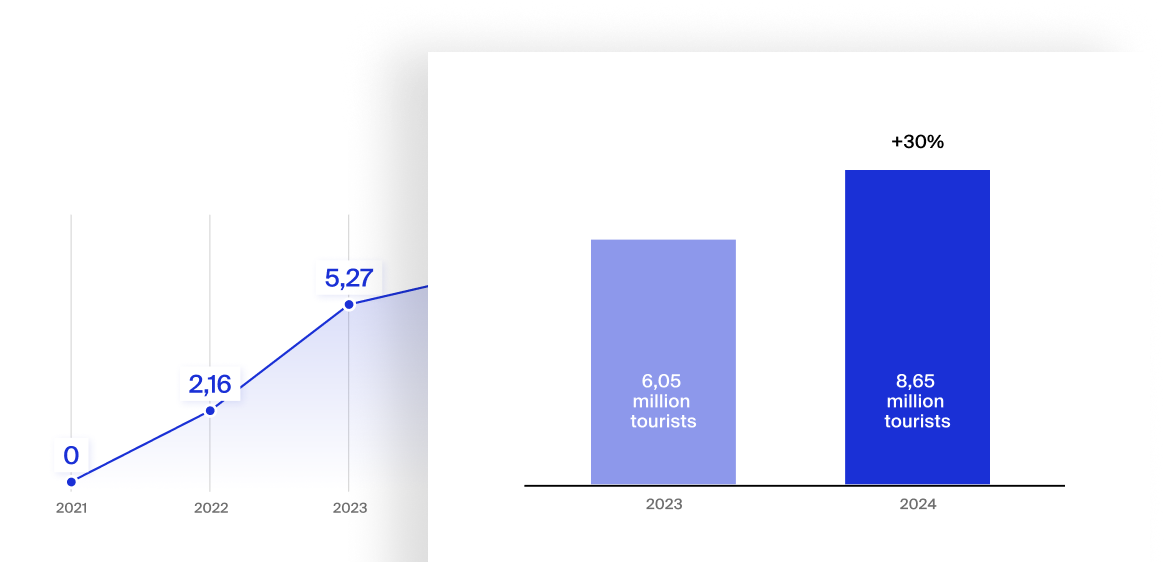

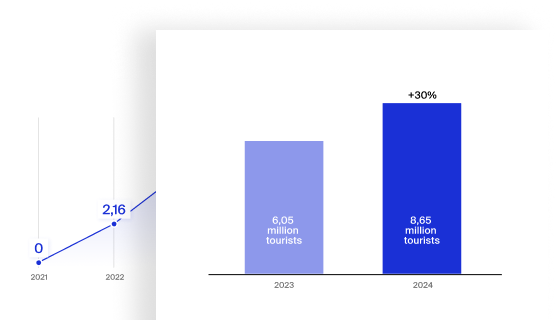

Interest growth dynamics for Turkish real estate

-

In 2024, Turkey sales increased by 20.6% compared to 2023

-

In 2024, more than 484.4 thousand new buildings were sold in the same period, which is 28% more than in the previous year

-

In 2025, the forecasted value of Turkey real estate in currency will increase by 10-20%

Popular regions in Turkey for investment, living, or renting

-

$2,000/m²Average cost of comfort class

-

$2,000–3,000/m²Average cost of business class

-

$3,000–5,000/m²Average cost of premium class

-

from $5,000/m²Average cost of elite class

The largest city and business center of Turkey. It represents the whole range of housing: from new projects of comfort class to elite residences in the historical center and on the Bosphorus.

average cost per 1 m²

Types of real estate in Turkey

Apartments

- from 50 m²

In the tourist regions of Turkey, fully furnished apartments with one or two bedrooms are popular — they are easier to rent out. Turkey homes with three or more bedrooms are more often bought for personal residence

from $120,000

Aparthotels

- from 20 m²

Real estate in Turkey in complexes where apartments are sold in ownership but managed by a hotel operator. Convenience for investors: reception and cleaning services

from $200,000

Houses and villas

- from 150 m²

Gated residences with private pools and recreation areas. Suitable for long-term living or as a holiday home. Popular in the resort regions of Bodrum, Fethiye, Dalyan, and Kalkan; also in the suburbs of major cities, like on the Bosphorus shores in Istanbul

from $300,000

What taxes in Turkey do investors pay

- 4% — Title Transfer Tax — Tapu Devir Vergisi

- 15–35% — tax on the difference between the purchase and sale price, adjusted for inflation; paid if owned by individual sellers less than five years after purchase

- 15–40% — tax on rental income, depending on the amount of revenue

- 0,1–0,2% — property tax depending on the region

Your success is our strategy. That’s the Neginski way

-

We search for the best real estate listings within the budget, preferences for neighborhoods, and construction property type

-

We help you to invest and buy real estate, taking into account local nuances, offers, and opportunities

-

We support you at all the stages of the transaction — from the first meeting to the documents transfer with developers for state registration

Full support from choice to keys — we’re by your side

-

01

Object selection

- We take into account goals, type of housing, area, amenities and budget

- We organize viewings online or offline

- We negotiate with the seller

- Term — 1-2 weeks

-

02

Reservation of real estate

- Deposit of $1,000-5,000 is required

- We send the application for re-registration in the cadaster

- We fix the price and payment terms

- Term — 1 day

-

03

Evaluation and insurance

- We open a bank account

- We deposit cadastral value and exchange it into liras

- We obtain a DAB certificate of legal currency exchange

- We carry out an evaluation of the object if required

- Term — 2-3 days

-

04

Signing of the contract and registration in the cadaster

- We set the date of the transaction

- We draw up a power of attorney if necessary

- We handle payments of cadastral value and taxes

- We arrange for a licensed translator in Turkey

- Term — around a week

-

05

Transaction completion and funds transfer

- The remaining balance is paid in cash — a common market practice in Turkey.

- We organize the money transfer

- We obtain a Turkey property certificate