Real estate investment in 2025: complete guide to profitable property abroad

Ksenya Kadesnikova

Investment-Focused Market Analyst

Every 5th investor builds their portfolio around real estate — and for good reason. Property delivers steady growth, protects against inflation, and gives you full control — unlike more volatile assets like stocks or crypto.

In fast-growing markets like the UAE, rental yields reach 6–8% and annual price gains often top 12%.

Planning to grow your wealth through real estate? Hotspots like Turkey, Thailand, Indonesia, Cyprus, the UAE, and Georgia offer high returns, investor-friendly laws, and lifestyle perks. This article explores the key pros and cons, smart strategies, and how to make your property investment a success.

1 in 5 investors

Chooses real estate as the foundation of their portfolio

6—12%

Rental yields in high-demand markets

$35,000

Lowest entry thresholds for real estate investors

Why do so many people invest in real estate?

Real estate meets both emotional and practical needs. It offers a balance of stability, income potential, and personal value. For many people, it’s the easiest and most familiar way to invest.

1. It’s stable and safe. Property protects your money from inflation and sudden market changes. Unlike stocks or crypto, real estate is tangible — you can see it, use it, and trust it. It also helps you store your capital in strong, reliable currencies.

2. It generates income. Real estate can provide regular, predictable income — especially when you invest in the right location:

Short-term rentals in tourist hubs can bring high daily returns. In Bali, for example, an average daily rate is $124.

Long-term leases in areas with strong expat communities offer steady monthly income. In central Dubai, for instance, the average monthly rent for a 1-bedroom apartment is $2,000.

High rental demand helps keep your property occupied and earning consistently. Take Phuket as an example, where the daily inflow of tourists is 25,000–28,000 people.

Another way to generate income is by buying off-plan properties in liquid markets and reselling them upon completion.

3. It builds wealth. Property values often rise in emerging or sought-after destinations. Countries like Turkey, the UAE, and Georgia have shown strong appreciation over recent years. Real estate is a long-term investment that helps you grow your wealth steadily.

However, real estate is all about location. Country-wide averages can be misleading because different areas perform very differently. For example, most investors go for Dubai in the UAE, Phuket in Thailand, Bali in Indonesia, and Batumi in Georgia — these places attract the highest demand. That’s why we show real data for each city, not just overall numbers for the whole country.

2024 residential price growth by city

| City | Price growth |

|---|---|

|

Bali |

15% |

|

Dubai |

12% |

|

Limassol |

7% |

|

Phuket |

10% |

|

Batumi |

12% |

4. It reflects status. Owning property in prime spots like Dubai or Bali is a sign of success. People often buy homes that reflect their lifestyle or aspirations — somewhere they can relax, enjoy life, or show their achievements:

David and Victoria Beckham own multiple luxury properties in Dubai, including a villa on Palm Jumeirah and an apartment in the Burj Khalifa

Celine Dion chose Bali for its privacy and beauty

Cristiano Ronaldo owns a $3 million villa in Izmir, Turkey

Shakira bought a luxury home at Cap St. George in Cyprus

5. It ensures comfort and legacy. Many invest to support their families. A home abroad can help with relocation, education, or long-term plans. It’s a gift of comfort — and something you can pass on.

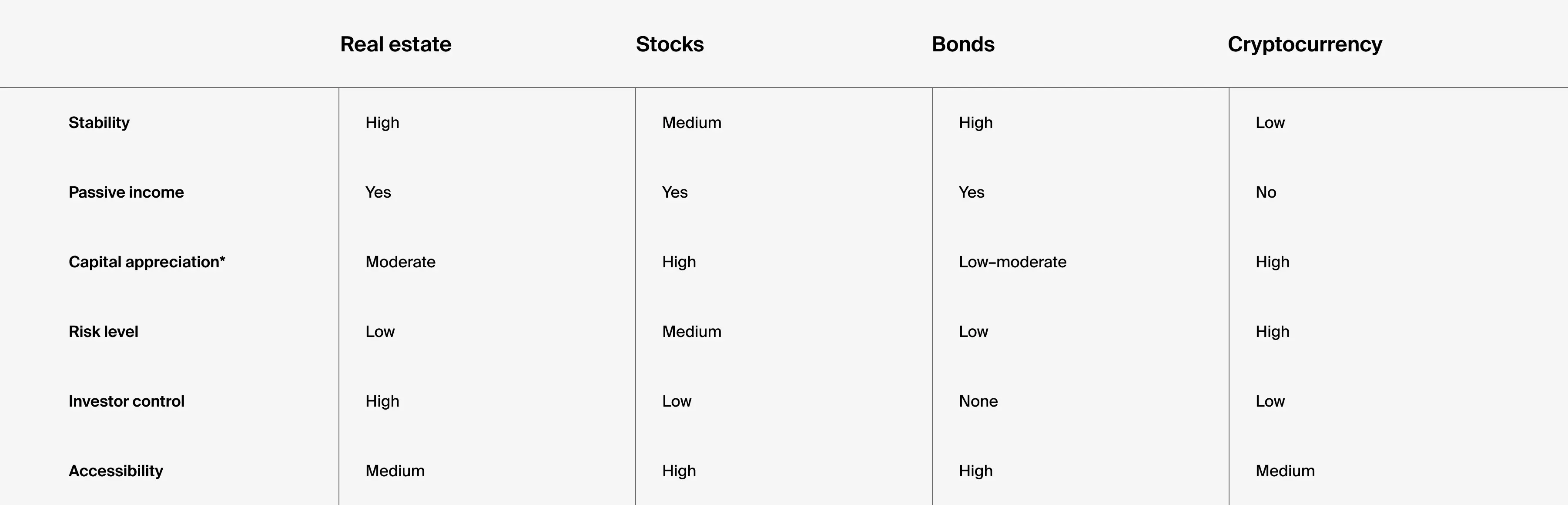

Real estate vs. other investment assets: side-by-side comparison

* Property prices don’t rise at the same rate everywhere. On average, global real estate grows by less than 5% a year. Some fast-growing markets like the UAE or Bali can offer higher rates of up to 20%, but this table shows general trends, not the results of any one country or city.

Pros and cons of real estate investment: turning challenges into opportunities

Some say real estate has dozens of downsides — and offer you to invest in stocks or crypto assets. Others, especially developers, highlight only the benefits. So who’s right? The truth is, neither side tells the full story. Most pros and cons lists don’t consider your personal goals, risk tolerance, or investment strategy. What’s a challenge for one investor can be an opportunity for another.

Off-season rental gaps vs. Stable passive income. One risk of property investment is inconsistent rental income, especially in seasonal markets. Destinations like Batumi or coastal Turkey experience booking gaps during off-peak months.

However, this is often balanced by premium short-term rates during peak tourist seasons, which can boost annual returns.That said, many investors still enjoy stable monthly cash flow — particularly in high-demand tourist or urban areas.

Take Bali as an example: tourist arrivals rose by 25% in Q1 2025 compared to the previous year. As short-term rental demand increases, so does the reliability of passive income — even in markets once seen as volatile.

Know your returns before you invest

We’ll assess your goals and opportunities and run the numbers

High entry costs vs. Leverage opportunities. Real estate requires a significant investment — the full cost of the property, plus legal and banking fees. In some markets, like Cyprus or Turkey, buyers must also cover taxes and registration costs, which can add to the initial burden.

But property also offers one key advantage: leverage. With the right loan, you can control a high-value asset while putting down only a fraction of the price.

In Dubai, for instance, many developers offer interest-free payment plans that lower the barrier to entry. In the case of a mortgage, which is available only to residents, the interest rate is around 3.7–5%, depending on the financial institution.

Regulatory barriers vs. Tax optimisation. In some countries, buying property as a foreigner isn’t as easy as it is for locals. You might face extra rules, like needing special permits or being limited to certain areas or types of ownership. These laws help prevent market overheating by controlling external demand and keeping growth steady.

Still, the extra effort often pays off, as it's balanced by attractive tax policies for property owners — in the UAE, for example, there are no property or income taxes on real estate.

Thailand is also a good example — particularly in places like Phuket. Foreigners can't own land outright, but they can buy condo units or lease land for long periods.

Maintenance and management vs. Asset control. Owning real estate gives you full control — but also full responsibility. Managing tenants, repairs, and paperwork takes time and effort. For international investors, this often means hiring local managers, which adds cost and complexity. In markets like Bali or Turkey, remote management is rarely practical or efficient.

That level of involvement doesn’t suit every lifestyle — especially for investors seeking passive income. This is where Neginski’s Care Department plays a key role.

Focus on the profits — we’ll take care of the rest

From paperwork and tenants to daily management, our Care Department handles every step of your property investment

Illiquidity vs. Capital appreciation. One drawback of real estate is its usually low liquidity. Selling a property can take months and often involves transaction costs. This makes it less suitable for short-term gains or quick exits.

However, for long-term investors, property offers the potential for strong capital growth. As values rise over time, the returns can significantly outweigh the lack of liquidity. The UAE illustrates this well: infrastructure development and lifestyle upgrades are driving property prices higher.

Ras Al Khaimah, for example, recorded over $653 million in primary home sales in Q1 2025 — a 39% increase year-on-year. Major projects like Etihad Rail and expanded air routes are expected to support continued growth. The upcoming casino resort on Al Marjan Island could accelerate this trend, mirroring results in Cyprus, where similar developments boosted prices and rental yields by up to 30%.

Ksenya Kadesnikova

Investment-Focused Market Analyst

In times of rising living costs and market volatility, real estate stands out as a stable and resilient asset. It not only protects against inflation — in some cases, it can significantly outperform it. The UAE is a prime example — while property prices rose by 12% in 2024, inflation was just 1.7%.

Real estate also adds long-term stability to your portfolio. Unlike stocks or crypto, it’s a tangible asset with more predictable returns. Plus, it helps diversify across currencies and regions, reducing overall risk.

Ksenya Kadesnikova

Investment-Focused Market Analyst

Real estate investment strategies

There’s no one-size-fits-all approach to investing in property. The right strategy depends on your goals, timeline, and how much risk you're comfortable taking. Some people want steady rental income. Others focus on buying and selling for a profit. Many look for a mix — using the property themselves while earning money from it too.

Here are some of the most popular strategies.

1. Buy and hold is a classic and well-established strategy. You purchase a property and rent it out over the long term, earning ongoing rental income. Over time, the property's value may appreciate, giving you both cash flow and capital gains.

There are two main ways to rent out your property:

Long-term rentals: You lease the property to tenants for 6 months or more. This option provides steady, hands-off income and works well in urban areas with stable demand — such as Dubai or Batumi.

Short-term rentals: You rent out the property through platforms like Airbnb or Booking.com. With higher nightly rates, this can boost your returns — especially in tourist hotspots like Bali, Phuket, or Cyprus. However, it requires active management or hiring a reliable property manager.

2. Off-plan flipping is a growing trend in busy, fast-developing markets. The idea is simple: you buy a property before it’s built — often at a lower price than finished homes, as these early-stage units are usually 15–30% cheaper than their completed value.

As the project nears completion, demand tends to rise — especially if the location is good or the development is backed by a well-known brand. By the time construction is finished, the property’s value has often gone up, giving you the chance to sell at a profit before or just after handover.

3. Fix and flip is a proven strategy used worldwide. You buy a property in poor or outdated condition at a discounted price, renovate it, and sell it for a profit. Some investors also hold briefly without renovating, relying on natural appreciation.

4. Hybrid use is increasingly popular, especially among lifestyle investors. You use the property yourself for part of the year, such as for holidays or remote work, and rent it out short-term the rest of the time to generate income.

Comparing real estate investment models

| Strategy | Where it’s common | Who it’s best for | Main risks |

|---|---|---|---|

|

Buy and hold |

Urban centres, growing suburban areas, emerging markets |

Passive investors, retirement planners |

Vacancies, unreliable tenants, high maintenance costs |

|

Off-plan flipping |

Dubai, Abu-Dhabi, Bali, Batumi |

Short- to mid-term investors looking for quick capital gains |

Market shifts during construction, developer delays |

|

Fix and flip |

US, UK, and cities with older housing stock |

Active investors with renovation skills or access to contractors |

Unexpected costs, renovation delays, resale uncertainty |

|

Hybrid use |

Tourist hubs like Phuket, Bali, Spain, Cyprus |

Digital nomads, expats, and second-home buyers |

Seasonal demand, local rental laws, property management |

Smart start: what to consider in order to invest successfully in real estate

A successful investment starts with the right plan. Here are five key steps to help you choose the best property for your goals — and avoid costly mistakes.

1. Set your goals

Are you looking for rental income, long-term growth, or a home for relocation or lifestyle? Your answer will guide every choice — from country and property type to how you manage or exit the investment.

2. Choose the right country and property type

Each market has its pros and cons. Some offer high rental yields and strong legal protections, while others stand out for low prices, easy purchase rules, or tax perks and residency options.

Once you’ve chosen a country, the next step is picking the right property. Focus on where it is and how you plan to use it — these two factors will shape your returns and how easy the investment is to manage.

Here’s what to consider:

Location. In cities, aim for areas near transport, schools, and business hubs. In resorts, look for tourist hotspots with steady rental demand.

Property type. Match the property to your goals: urban flats — good for long-term rental or resale; villas — ideal for personal use or holiday lets; off-plan units — best for capital growth and early entry.

Construction stage. Buying early is cheaper but takes longer to deliver income, while ready or resale properties cost more but generate returns faster.

Profit potential. Check rental rates for similar homes and estimate the payback period.

Condition. Resale homes may need renovation, while new builds are move-in ready, often with modern finishes.

Developer reputation. Choose a reliable builder with a solid track record and positive buyer reviews.

Need help finding the right property?

We take the guesswork out of property investment. Our team carefully checks every developer — from past project delivery to financial stability and real buyer feedback. Only 24% of properties pass our strict Due Diligence process, so you see only the most secure and profitable options

3. Understand legal and tax regulations

Buying property abroad isn’t the same as buying at home. Each country has its own laws, and missing key steps can lead to delays or financial loss. Some countries limit what foreigners can buy or require special permits. Others — like Cyprus or the UAE — make it easier for international buyers, but usually only in specific areas or for certain types of property.

Before you invest, make sure to:

Check if foreigners can own the property outright — freehold, or only lease it for a set number of years — leasehold.

Understand the full buying process, including legal steps and timeline.

Know which documents you’ll need for contracts, registration, and payment.

See if owning property gives you the right to live there, such as a residence permit or visa.

4. Plan your budget and calculate ROI

When buying property, your budget should cover more than just the purchase price. Make sure to include:

Down payment;

Loan costs or interest, if you’re financing;

Taxes and registration fees;

Legal and notary services;

Furniture and renovations, if needed;

Ongoing costs, like maintenance, management, and insurance.

To make a smart decision, don’t just look at rental income. Your ROI, Return on Investment, should reflect your net profit after all expenses, not just the top-line earnings. That’s how you compare properties fairly — and avoid low-return investments.

5. Prepare for purchase and management

Open a bank account that supports international payments if you do not have one. Many developers and sellers expect quick payments and full documentation — having the right account saves time and stress.

Decide who will handle the property after purchase:

Will you hire a local manager?

How will you manage bookings, repairs, and cleaning?

Finally, make sure your property is properly insured and registered with local authorities.

Properties selection in the world’s most promising real estate markets

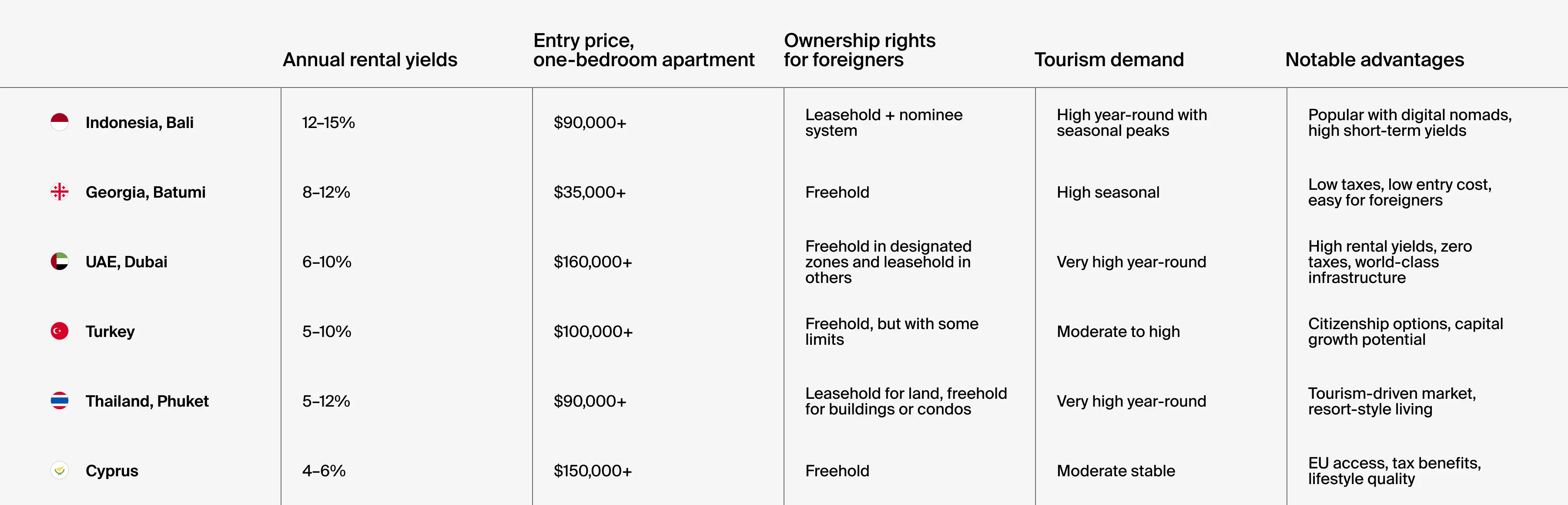

Top countries for real estate investment in 2025

In 2025, property investors aren’t just chasing high returns — they’re looking for a mix of profit, stability, and lifestyle. The countries below stand out for their strong growth, solid rental demand, and investor-friendly policies.

Here are top picks:

UAE — High rental yields, modern infrastructure, a transparent market, and strong legal protection for investors.

Thailand — A holiday rental hotspot, ideal for short-term stays and strong daily income, also popular with expats and digital nomads, many of whom buy property to settle long-term.

Indonesia — Great for villa rentals in tourist areas, especially among digital nomads and luxury travellers.

Turkey — A fast-moving market with cultural appeal and the option to gain citizenship.

Cyprus — A lifestyle destination offering tax perks and flexible residency options.

Georgia — Low property prices, growing tourism, and a simple buying process.

Each offers a unique value proposition, whether you're focused on short-term income, long-term capital appreciation, or a personal relocation plan.

Where to invest in 2025: property market breakdown by country

Final thoughts: why invest in real estate?

Real estate offers three key advantages:

It helps protect your money from inflation.

It can provide steady rental income.

It often grows in value over time.

The two most common investment strategies are:

Renting out the property for regular income.

Buying and reselling for a profit as prices rise.

Each option comes with different returns, timelines, and how much time or effort you’ll need to be involved. To choose the right approach, think about your goals, how much you plan to invest, and how long you're willing to wait for results.

Whatever your strategy, a smart investment starts with research, choosing the right property, and making sure the legal side is clear and secure.

FAQ

-

The best investment depends on your goals. For passive income, short-term rentals in tourist areas like Bali or Batumi work well. For long-term capital growth, off-plan properties in Dubai or Ras Al Khaimah offer strong potential. Choose a strategy that matches your budget, timeline, and level of involvement.

-

Start by choosing a location with high rental demand. Research local regulations, ownership rights, and taxes. Then calculate expected income and costs for maintenance, management, insurance. Work with local agents or developers to find tenant-ready properties, or use platforms like Airbnb for short-term letting.

-

The most profitable investments balance strong rental income with rising property values. Short-term rentals in fast-growing tourist areas, like Phuket or Dubai Marina tend to offer high yields. Off-plan properties in emerging locations often deliver large resale gains when timed well.

-

There are five key steps to make your investment secure, profitable, and aligned with your goals.

Define your goals — income, growth, personal use.

Choose a region and select a property with the help of local experts.

Research the legal and tax landscape.

Plan your budget and calculate ROI.

Select a property with the help of local experts.

Decide how you’ll manage it — personally or through an agency.

-

Location determines rental demand, price growth, legal safety, and liquidity. Prime tourist zones boost short-term returns. Urban centres with growing populations support long-term value. Always assess infrastructure, transport, job markets, and local development plans.