Invest in Georgia real estate: complete guide for 2025

.webp)

Sergey Aksenov

Teamlead

Georgia’s property market has quietly become one of the most attractive in Europe. Entry prices are still low, tourism is expanding fast, and foreign buyers face none of the usual red tape. You don’t need local residency, and the entire process — from first viewing to full ownership — can take as little as a week.

Rental yields are among the highest in the region, with long-term lets returning over 7% annually and short-term holiday rentals often exceeding 10%.

In this guide, we break down what’s driving Georgia’s real estate boom, which locations are worth your attention, and how to navigate the buying process as a foreign investor.

$45,000+

Entry threshold

7–12%

Annual rental yields

8–14 years

Average payback period

Why Georgia’s property market keeps attracting smart investors

Low entry prices, strong rental income, and a simple buying process — Georgia checks every box for property investors in 2025. Whether you’re looking for a holiday home with income potential or a straightforward buy-to-let investment, Georgia remains one of the few markets in Europe where both goals are still easy to achieve.

1. Affordable property from $1,100 per m2. Property in Georgia is still far cheaper than in many coastal or investment-driven markets across Europe. In Batumi, new apartments start from just $1,100–1,300 per square metre — roughly half the price of similar properties in Limassol or Porto.

2. Rental yields up to 12% annually. Georgia offers some of the highest rental returns in Europe. Short-term rentals in Batumi can bring in up to 12% gross annually during peak season. Long-term rentals yield 7–10% per year, supported by year-round demand from expats, digital nomads, and students.

3. No tax on buying property. There’s no purchase tax when you buy real estate in Georgia. The only mandatory fee is the registration charge, which ranges from 0.1% to 1% of the property's market value, capped at $60. For faster processing, you can pay a higher fee to complete the registration within 1 working day instead of the standard 4-day procedure.

4. Payback from rental income in 11 years. Thanks to low property prices and strong rental income, the average payback period in Batumi is just 8–14 years. That’s significantly faster than in comparable markets across the EU, where the same figure ranges from 16 to 25 years.

5. Interest-free payment plans. Many new developments in Georgia offer 0% interest instalment plans directly from the developer. You typically pay a 10% down payment and spread the remaining amount over 24 to 48 months, with no hidden fees or contract loopholes. Terms vary by project, but the principle remains the same: buy now, pay gradually, no interest.

6. Tourism and demand are rising fast. Tourism is a major growth engine. From January to April 2025, passenger traffic at Batumi Airport jumped by 43.7% year-on-year, hitting 233,700 travellers. This surge supports both high rental demand and rising property values — especially in coastal areas.

7. A $100,000 property can unlock residency. To apply for a Georgian residence permit, you’ll need to own real estate worth at least $100,000 and the property must be fully built and registered. Off-plan or under-construction units don’t qualify. This is still one of the most straightforward property-based residency routes in Europe.

Need help finding the right property?

We remove the guesswork from property investment by vetting each developer for track record, financial stability and buyer feedback — offering only secure, high-potential options.

Tbilisi vs. Batumi: best areas to buy property in Georgia

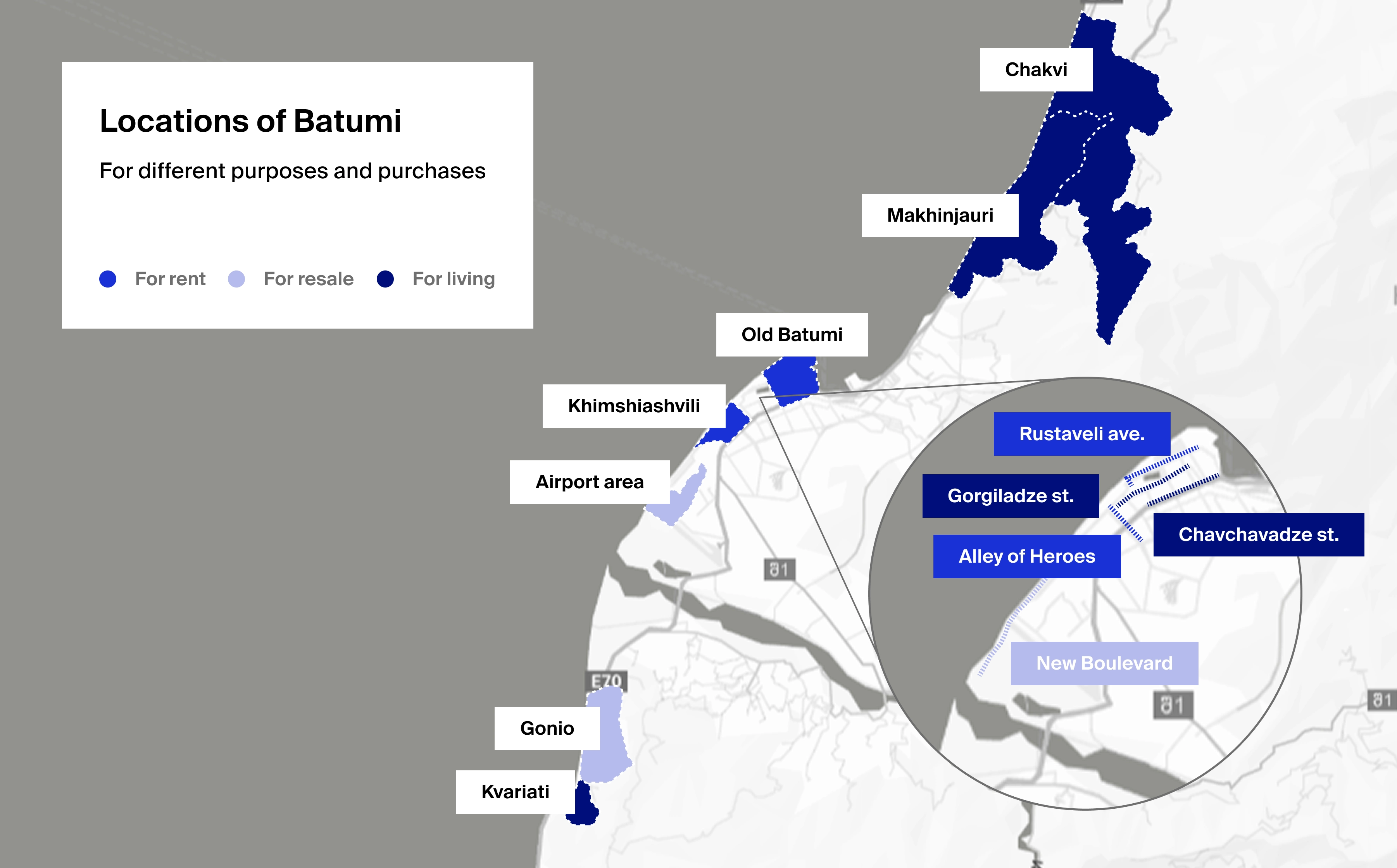

Georgia’s property market is driven by two main cities — Tbilisi and Batumi — but in 2025, Batumi is clearly ahead, and its edge is clear: the sea. As the country’s only major coastal city, Batumi offers a lifestyle and investment profile that no inland location can match. Beachfront living, sea views, and resort infrastructure make it uniquely attractive for both holidaymakers and property buyers.

But lifestyle isn’t the only advantage. Batumi also delivers lower entry prices, higher short-term returns, and a thriving tourism economy that supports rental income year-round. For investors focused on both yield and capital growth, this Black Sea city has become the top pick.

Recent data confirms the trend: in February 2025, property transactions in Batumi rose by 6.4%, while Tbilisi saw a nearly 9% decline. Prices in Batumi remain far more accessible — typically 25–30% lower than in the capital.

Batumi’s momentum is also fuelled by constant new development. Areas like New Boulevard and Gonio are seeing rapid growth, with modern complexes offering sea views, 0% interest payment plans, and strong short-term rental performance — all backed by rising international demand.

5 reasons Batumi stands out for foreign property investors in Georgia

1. Top coastal destination with year-round rental demand. Batumi is Georgia’s leading seaside resort, drawing in millions of tourists every year. In 2024, the country welcomed over 7 million visitors — and Batumi remains a key stop on nearly every itinerary. This steady inflow fuels high occupancy rates for short-term rentals, making it one of the most profitable markets in the country.

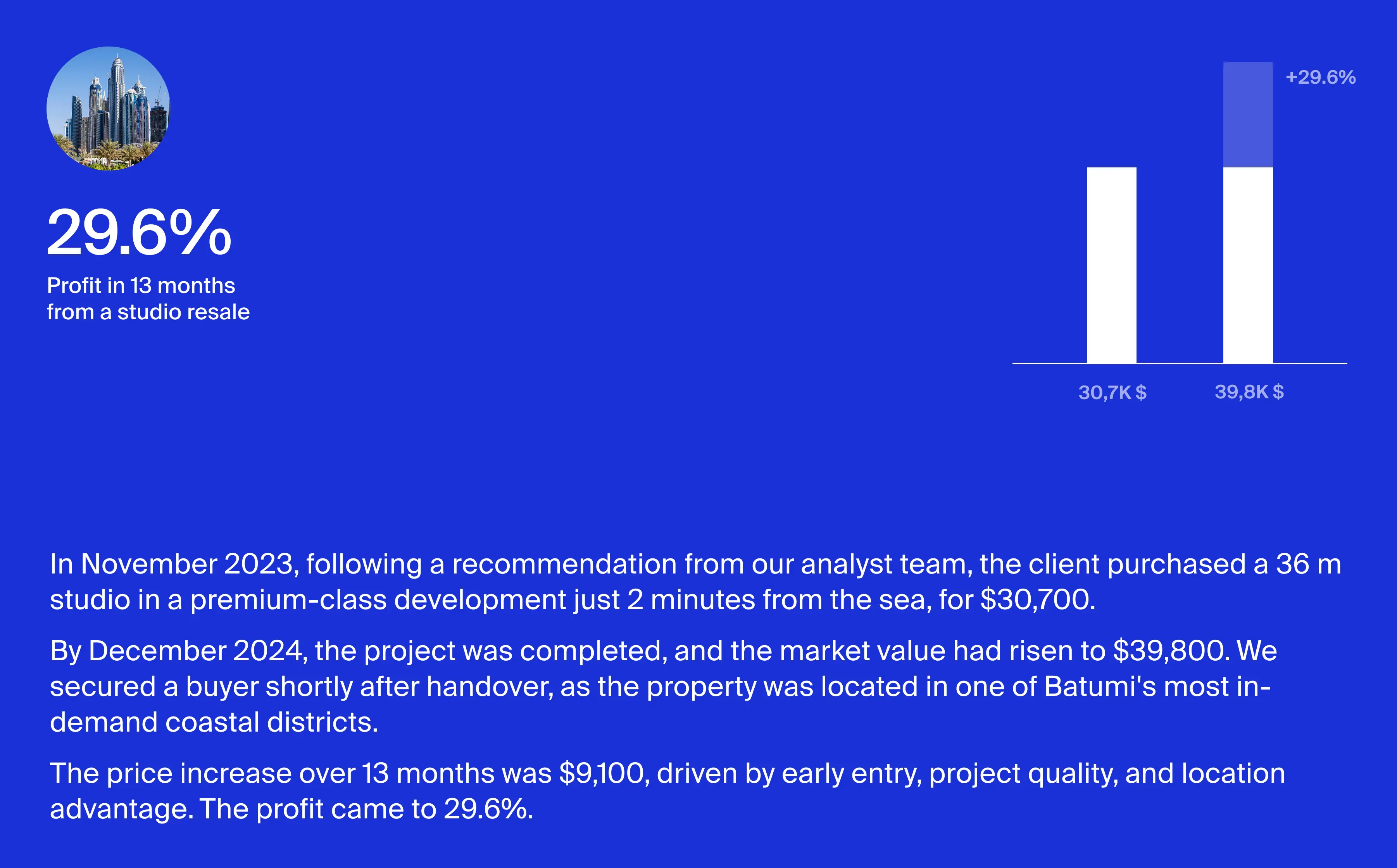

2. Rising values, limited space. Prices in Batumi have seen consistent growth. Resale units tend to appreciate by 6–9% annually, while off-plan and under-construction properties gain 10–30% per year, depending on location and build stage. With the sea on one side and mountains on the other, land is limited — supporting long-term value growth.

3. Massive infrastructure upgrades underway. Batumi is changing fast. What was once a quiet seaside town is now home to modern shopping centres, international cafés, app-based ride services, and a revitalised coastline. Getting around the city is easy and affordable — with taxi fares starting at just $1–2.

Major development projects are also reshaping the city:

Alliance Centropolis — a World Trade Center–style complex with office, hotel and residential zones

Artificial Islands Project — a new high-end district built on reclaimed land

ORBI City Mall — set to become the city’s largest shopping centre by 2026

New transport links — including a planned road to the Turkish border

Sport infrastructure — new arenas for swimming and ice sports already underway

These projects are not just for show — they’re drawing serious investor interest and laying the groundwork for long-term capital growth.

4. Strategic hub with international backing. Located just 30 minutes from the Turkish border, Batumi offers easy access to regional markets. Major global developers — including Emaar — have already invested here, adding international credibility to the city’s real estate scene.

5. Sea and mountains in one location. Batumi’s setting is unique: beachfront apartments with mountain views, all in one place. This rare combination gives it year-round lifestyle appeal — ideal for holidaymakers, expats, and property owners alike.

How to finance property in Georgia: mortgages and instalment plans

One of the reasons Georgia is so accessible to international buyers is the flexible approach to financing. Whether you're buying with cash, using a bank loan, or paying in instalments directly to the developer, the process is fast, simple, and open to foreigners.

Developer instalment plans. For off-plan and new-build projects, most foreign investors prefer to work directly with developers. Instalment plans are widely available, don’t require income checks, and often come with 0% interest.

What to expect:

Down payment: from 0% to 50%

Balance: paid monthly or quarterly

Standard offer: 10% upfront, then 2% per month over 24–48 months

Terms: often negotiable — especially in early construction stages

Entry-level apartment prices in Batumi

| Apartment type | Starting price | Minimum size | Down payment | Monthly instalment |

|---|---|---|---|---|

|

Studio |

$45,000+ |

28 m² |

$4,500+ |

$600+ |

|

1-bedroom |

$60,000+ |

40 m² |

$6,000+ |

$800+ |

|

2-bedroom |

$80,000+ |

60 m² |

$8,000+ |

$1,000+ |

|

3-bedroom |

$100,000+ |

75 m² |

$10,000+ |

$2,000+ |

Mortgages. While less common than installment plans, Georgian banks do offer mortgages to foreign buyers, but mainly to those with a local residence permit or income within Georgia.

Typical terms:

Down payment: 30–40%

Interest rate: 10–15% per year

Term: up to 10–15 years

If you hold a Georgian residence permit, you’ll usually qualify on the same terms as locals. Some banks may also lend to non-residents, but only in specific cases — usually for nearly completed apartments, and only to cover the final payment stage.

Sergey Aksenov

Teamlead

What if you can’t keep up with payments? If you stop paying, developers can cancel your contract and keep up to 20% of the unit price. But in practice, most are open to solutions.

Smart strategies to reduce risk:

Choose a project that allows resale before full payment. This clause lets you transfer ownership to a new buyer and recover your investment — even if you haven’t paid the full amount.

Stay in contact. Georgian developers are often flexible. If you communicate early, many will agree to adjust the schedule or offer a grace period.

Sergey Aksenov

Teamlead

Low taxes and simple rules for property owners in Georgia

Georgia has one of the most investor-friendly tax systems in the region — low rates, clear rules, and fast processing. Whether you’re buying to rent or hold for capital growth, the tax setup makes it easy to manage your property with minimal overhead.

No taxes on purchases. There’s no property transfer tax, and buyers usually don’t pay agent fees — commissions are paid by the developer. The only required fee is a registration charge ranging from 0.1% to 1% of the property’s market value, capped at $60. Faster registration options are available for an additional fee.

Annual property tax: often 0%. Georgia doesn’t apply a flat annual property tax. Instead, it’s based on your household income earned within Georgia:

Income under GEL 40,000 ($15,000): 0%

Income from GEL 40,000 to 100,000 ($15,000–37,000): 0.05–0.2%

Income over GEL 100,000 ($37,000): 0.8–1%

If your income is earned abroad, you won’t be taxed on it locally — making this structure especially appealing for international buyers.

Rental income tax: just 5%. Any rental income — whether short-term or long-term — is taxed at a flat 5%. In practice, many owners don’t report income, but paying this tax regularly is recommended if you plan to apply for a residence permit later. It shows financial ties and tax compliance.

Capital gains tax: only if you sell early. Sell a residential property within 2 years, and you’ll pay 5% on the profit. After 2 years, there’s no tax at all on resale gains. For commercial properties, tax can be up to 20%, depending on the case.

Know your returns before you invest

We’ll assess your goals and opportunities and run the numbers.

Hidden risks when investing in Georgian properties

Georgia offers clear advantages — low prices, high rental yields, and one of the easiest property ownership systems in Europe. But like any fast-moving market, it has risks worth understanding before you invest.

Buying off-plan in Batumi can come with trade-offs:

Delays are common — developers are legally allowed up to 6 months over the original handover date.

Marketing vs. reality — gyms, pools, restaurants and other features are often promised but not delivered on time, or at all.

Restricted resale — many developers don’t allow assignment sales before completion. Always confirm this if you plan to resell early.

Manual registration — ownership isn't automatic. You must register the unit in the public registry yourself, or risk legal complications.

Tied management contracts — some projects force buyers into long-term service agreements with steep fees, sometimes up to 40% of rental income. Read the fine print before you commit.

How we minimise these risks at Neginski

With hundreds of new developments on the market, not all are created equal — and identifying the right ones takes more than just a good sales pitch. Here’s how we help our clients avoid costly mistakes:

Data-led project selection – our in-house analytics team monitors the market, negotiates directly with developers, and picks projects based on performance metrics, not marketing promises.

Strict quality screening – only 24% of available listings meet our internal standards. We filter out risky, unfinished or poor-quality developments before they ever reach our clients.

Bespoke purchase terms – with our wide developer network, we’re able to secure exclusive terms and payment plans tailored to each client’s goals.

Whether you're buying remotely or on the ground, our team helps you navigate Georgia’s fast-moving real estate landscape with confidence.

How to buy real estate in Georgia: step-by-step with remote options

One of the most common questions from foreign investors is: how quickly can I buy property in Batumi? The answer — in as little as a week. What’s more, the entire transaction can be completed remotely with the help of a local representative. Below is a clear step-by-step breakdown of how the process works.

1. Property selection

Your agent will help you find a property that fits your goals and budget. Viewings and meetings are usually done via video call. Once you choose a unit, the team negotiates the best terms and payment schedule on your behalf.

2. Reservation and deposit

To reserve the unit, a deposit of $1,000 to $5,000 is typically required. At this stage, your purchase agreement is prepared — outlining the total price, instalment terms, and other deal specifics. This legal and document-checking phase usually takes up to 2 weeks.

3. Contract signing and first payment

You’ll sign the sale and purchase agreement remotely or in person — depending on what works best for you. This is when the first instalment is paid, usually 10–50% of the total property price. Most developers offer flexible interest-free instalment plans.

4. Construction period and payment schedule

If you're buying off-plan, the remaining payments are made according to the agreed schedule — monthly, quarterly, or even semi-annually or annually, depending on what’s been negotiated. Payment terms typically span 1 to 5 years.

5. Property registration

Final registration is done once the property is complete: you’ll receive an official ownership certificate issued by the national registry.

You can choose how fast to register: same day, next day, or within 4 business days. The standard fee ranges from 0.1% to 1% of the property’s market value, capped at $60. Faster processing is available for an additional fee.

For new builds, the developer usually handles the registration remotely. If you’re buying a resale property, it’s processed at the House of Justice.

Final thoughts: is Georgia still worth it in 2025?

Georgia continues to stand out as one of the most accessible real estate markets in Europe — and one of the few where low entry prices still meet high rental returns. The process is fast, foreigner-friendly, and fully digital. You don’t need residency, you don’t need to be on site, and you can complete the entire purchase remotely.

Batumi leads the way in 2025. With rising tourism, active construction, and 0% interest payment plans from developers, it offers a rare mix of affordability, short-term yield, and long-term growth. Add to that a simple tax system and minimal red tape — and you can see why thousands of international investors are choosing Georgia every year.

Yes, there are risks. Construction delays, resale limits, and market saturation in certain zones are all real concerns. But with proper due diligence, a reliable local partner, and a clear investment plan, those risks can be managed — and the upside remains strong.

For buyers looking for a low-barrier, scalable way into property investment, Georgia still offers one of the best entry points on the European map.

Want early access to top investment deals?

We’re among the first to know about Batumi’s hottest presales — and we help clients secure the best units before public launch. Book a consultation to explore high-yield opportunities.

FAQ

-

Yes, foreigners can buy and fully own both residential and commercial real estate in Georgia. There are no restrictions — no need for a local partner, visa, or residency permit. The process is fast, secure, and fully available to non-residents, including remote buyers.

-

Georgia offers one of the most attractive property markets in Europe. Property prices remain low, with new apartments in Batumi starting from $1,100–1,300 per m² and full studios from $45,000. Rental yields are high — up to 12% annually for short-term lets and 7–10% for long-term rentals. The average payback period is just 8–14 years, far quicker than in most EU markets.

-

Batumi is the best city to buy an apartment in Georgia in 2025. It combines strong short-term rental demand with long-term capital growth, thanks to its status as a top seaside resort with limited land and rising property values.

The city offers beachfront living with mountain views, easy regional access, and major infrastructure projects — including new malls, transport links, and premium developments backed by international investors.

-

The most affordable real estate is found in the outer areas of Batumi and Tbilisi, as well as in smaller cities like Kutaisi. In Batumi, budget-friendly districts include Agmashenebeli, Bagrationi, and the Airport zone — all further from the coast, but well-connected and rising in popularity.

Studios in early-stage projects in these areas can start from $45,000 — with strong rental potential once completed.