Mortgage for Overseas Property: Is It Worth It in 2026

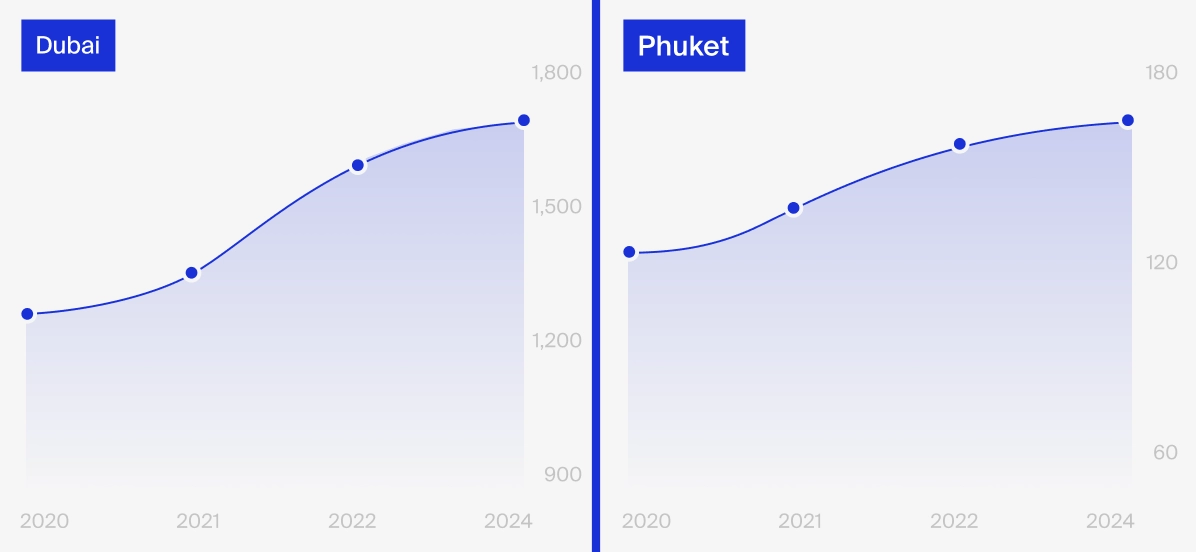

Dubai and Phuket are the two most popular overseas destinations among Neginski clients. In both markets, foreigners can buy property with a mortgage. But is it worth it? We break it down in this article.

Andrey Neginskiy

Real estate expert, CEO of Neginski

At a Glance

In 2026, foreign investors can buy property in Dubai and Phuket either via a developer payment plan or with a mortgage. If you compare the two, a developer payment plan is usually better for an investor: the term can match a mortgage, the paperwork is simpler and the interest rate is lower.

In Dubai, a mortgage is available for up to 25 years and typically covers 40–80% of the unit price, depending on the price and the type of property (completed or off-plan close to handover). The rate is up to 5% per year, depending on the term and the bank.

In Phuket, you can get a mortgage only for ready/completed residential property priced at least 1,000,000 THB (~$32,000). The term is up to 10 years, usually for 50% of the unit price, with an average rate of 12% per year.

An alternative to a mortgage is a developer payment plan with post-handover payments. Depending on the market, it can run for up to 9 years in off-plan property. Rates are set by the developer: in Dubai it is usually marketed as 0% interest, but projects with post-handover payments are less common. In Phuket, post-handover plans are common. Developers typically offer 3–7% per year, depending on the term.

What Is a Mortgage for Overseas Property

A mortgage is a loan provided by a bank or another financial institution to help a buyer purchase residential or commercial property.

The difference between a developer payment plan and a mortgage abroad:

1. Application requirements. Mortgages have stricter requirements. For example, in Dubai you typically need a UAE residency visa, and in Phuket you need a residence permit. Your income level and how long you have worked in the country also matter. By contrast, to get a developer payment plan, most of the time you only need a copy of your passport.

2. Interest rate and term. A developer payment plan is usually marketed as 0% interest, typically up to 4 years until handover and up to 3 years after. A mortgage is 3.7–5% per year for up to 25 years in the UAE and 12% per year for up to 10 years in Thailand.

3. Minimum deposit. To get a developer payment plan, you pay the first instalment under the developer’s schedule: on average up to 20% in Dubai and from 10% in Phuket. To get a mortgage, you usually need to pay at least 50% of the unit price.

4. Who provides it. A developer payment plan is a payment schedule offered by the developer, not a loan, so it is not treated as a mortgage. With a mortgage, the bank pays part of the unit price and the borrower repays the bank over an agreed term, so it is treated as a loan.

Waiting to buy could be costing

you money

Let's calculate the potential loss, with examples

from Dubai and Phuket

Mortgages for Foreigners in the UAE

If an investor plans to buy completed property on the UAE secondary market or on the primary market where there is no developer payment plan, they can apply for a mortgage. But it is much harder than buying on a developer payment plan. Below are the key requirements for the investor and the property.

Mortgage terms in Dubai:

1. Amount. For primary market property, the mortgage is typically available for the final payment under the developer payment plan: usually 40–60% of the unit price. For secondary market purchases, up to 80% of the price.

2. Term. From 5 to 25 years, depending on the borrower’s age and income.

3. Borrower’s age. From 21 to 65.

4. Property status and price. Only residential completed property or off-plan property in freehold zones that is close to handover is eligible for a mortgage.

5. Foreigner status. In practice, banks mostly approve mortgages for investors who have a UAE residency visa.

6. Deposit and rate. The down payment is 20%, excluding additional costs. The interest rate is 3.7–5% per year, depending on the bank and the borrower profile.

7. Additional costs.

application review fee — 1% of the property value;

income protection insurance — 0.5–1%;

title insurance — 0.05%.

The last type of insurance protects the investor from losing title if the transaction is unlawful or if third parties challenge the ownership rights.

8. Employment status. To get a mortgage approved, the investor needs to:

take a job with a company in the UAE or set up their own business in the country;

confirm source of funds and stable income (bank statements for the past 3 months);

if the investor is a business owner, complete a business audit.

Mortgages for Foreigners in Thailand

In Thailand, banks rarely work with foreigners, but other financial organisations do. For example, MBK. Below are the key requirements for the investor and the property when buying with a mortgage.

Mortgage terms in Phuket:

1. Amount. The loan can be up to 70% of a villa price and up to 60% of an apartment price. In practice, foreigners are usually approved for only 50% of the unit price, and villas are almost never financed.

2. Term. From 1 to 10 years. Terms may vary depending on the financial organisation.

3. Borrower’s age. From 25 to 60. By the end of the loan term, the borrower must be no older than 70.

4. Property status and price. You can buy with a mortgage only completed residential property priced at least 1,000,000 THB (~$32,000).

5. Foreigner status. As in the UAE, non-residents can legally get a mortgage in Thailand, but in practice it is unlikely. Usually you need a work visa or residency, a stable income in Thailand and a Thai citizen as a guarantor.

6. Deposit and rate. Terms vary by lender: the down payment is usually from 50%, but options from 30% may be available. The average rate is 12% per year.

7. Additional costs.

loan arrangement fee — 1.25% of the loan amount;

mortgage registration fee — 1%;

stamp duty — 0.05%;

early repayment fee — 2% of the prepaid amount;

life insurance — 0.5% to 2% of the loan amount

Property valuation, property insurance, agent fee on the secondary market and registration with the Thailand Land Department are paid separately.

8. Employment status. To get a mortgage approved, the investor must have:

a valid work permit;

at least 1–2 years of employment in Thailand;

proof of stable income that is three times the monthly mortgage payment, but not less than 80,000 THB (~$2,565).

Select a Property for Capital

Preservation in Dubai or Phuket

We’ll shortlist properties built for hard-currency returns

with lower exposure to freezes and restrictions

Is a Mortgage for Overseas Property Worth It for a Foreigner

High rates, complex approval, strict requirements for the investor and the property: all this makes a mortgage less attractive than a developer payment plan. But there are cases where a mortgage is the only option for the buyer.

From Neginski’s experience, mortgages are usually chosen by investors who buy property to relocate. This payment method helps avoid a single large upfront expense.

There is also an alternative: a developer payment plan with post-handover payments. This option also spreads payments over a long period, but with a lower rate and without additional approval costs.

Mortgage vs developer post-handover payment plan

| Criteria | Mortgage | Post-handover payment plan |

|---|---|---|

|

Term |

In Dubai — up to 25 years; |

In Dubai — up to 4 years during construction and up to 3 years after handover; |

|

Rate |

In Dubai — 3.7–5% per year; |

In Dubai — 0% per year; |

|

Documents |

In Dubai — passport, UAE residency visa or entry stamp, proof of income, bank statements showing funds and no outstanding debts, property documents; |

In Dubai — passport, sometimes proof of funds; |

|

Additional costs to arrange a mortgage or a payment plan |

Yes |

No |

If your goal is to preserve the real value of the asset, the best option is a developer payment plan or a post-handover payment plan. A mortgage is typically the least favourable option for investors, but it can be convenient for people relocating for personal use.

At the same time, post-handover payment plans are less common in Dubai: projects with this option are usually more expensive. In Phuket, post-handover payments are offered by many developers.

How to Earn Passive Income in Hard

Currency from Overseas Real Estate

Find projects with proven rental demand, clear running costs

and fully managed rentals

Which Payment Method Fits Your Goal

Neginski has been helping investors shortlist property for 6 years. Over this time, we have completed 1,750+ transactions worth more than $800,000,000. From our experience, there are three most common investor types. In the cards below, we suggest the best payment options for each.

If your goal is passive income, almost any payment method works except a mortgage: the interest rate increases your total investment and extends the payback period

If your goal is relocation, any type of developer payment plan or a mortgage can work: it extends the payment term and helps you focus your finances on other relocation tasks

If your goal is capital preservation, we recommend paying in full or in stages before handover, so you invest the funds before inflation erodes their value

About the Author & the Company

Andrey Neginskiy

Real estate expert, CEO of Neginski

This article was prepared by the Neginski team — an international real estate agency with teams in the UAE, Phuket and Moscow. We support clients at every stage, from clarifying goals and selecting a project to completing the purchase and managing the property.

We work with 300+ developers, get early access to off-market launches, source rare listings and negotiate discounts. More than 30% of our clients come back for repeat purchases. Learn more about us.

Disclaimer

The information in this article is for general guidance only and does not constitute individual legal, investment or immigration advice. Property purchase terms, instalment plans, mortgage financing, rental and resale rules in UAE and Thailand depend on the specific project, developer, bank, property status and the buyer’s individual profile.

UAE laws and regulatory requirements may change. Before making any decisions, we recommend getting personalised advice and confirming the latest terms with the Dubai Land Department (DLD) and Thai Land Department, the developer, the bank or licenced advisors.

Sources

This article is based on publicly available data, Neginski’s analysis and the team’s hands-on experience.

Links:

Dubai Land Department — taxes in 2026

FAQ

-

A developer payment plan is better if your goal is capital preservation in a stable currency or passive income. If you need a longer payment term, look for projects with post-handover payments.

-

Primary market transaction costs include the 4% DLD fee and an apartment admin fee ($1,000–$1,500). Arranging the mortgage itself includes:

application review fee — 1% of the property value;

income protection insurance — 0.5–1%;

title insurance — 0.05%.

-

In Thailand, the complexity of mortgages for foreigners is linked to how land and property ownership works: foreigners cannot own land as freehold (full ownership). A mortgage requires pledging the asset (land and house) to the lender. If a foreigner cannot own the land, they cannot pledge it, which increases risk for the financial organisation.

-

With a developer payment plan, the main risks are high financial pressure and construction delays or freezes. With a mortgage, the risks are overpayment and losing the property if you default. You can reduce these risks if you buy with support from an experienced analyst.

-

Before you buy on a developer payment plan, check these points in the contract:

payment dates and amounts;

late-payment penalty amount.

-

There are several cases where even a mortgage is not the best way to reduce financial pressure. Consider a cheaper property if:

your mortgage payment exceeds 30–40% of your net income;

the property you want is much more expensive than similar options in the same area;

after paying the deposit, you have no savings left for job loss or illness;

you plan to sell in 2–3 years: high bank fees and interest overpayment may not be covered by price growth.