Real Estate in the UAE for capital protection and growth with a yield of ~8%

We select high-liquidity properties for investment and comfortable living in the UAE. Our team handles all document verification and provides full support throughout the transaction

-

Transaction volume $241.1 BIn the real estate sector in the UAE in 2024

-

12% increase in value per 1 m²On average across the UAE for 2024

-

6–8% increase in yieldOn average from long-term rentals per year

Verified by Analysts: the Best Offers by Location, Infrastructure and Deadlines

Investing in UAE real estate: key numbers and facts

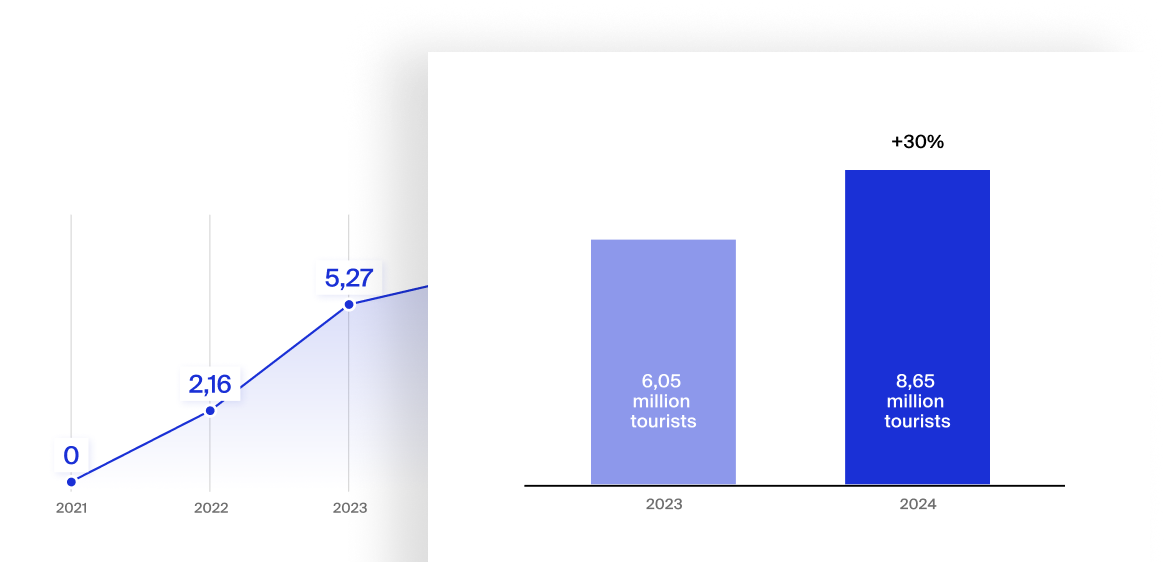

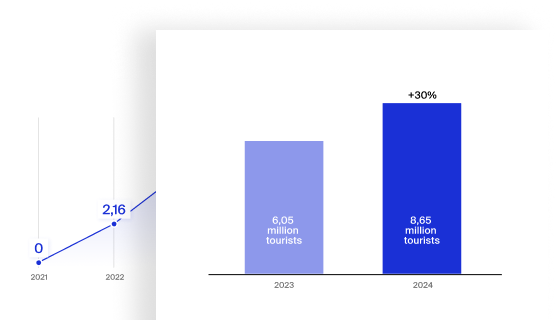

The UAE economy grew by 4% in 2024. The International Monetary Fund forecasts 5% growth in 2025

In 2024, 331,300 transactions were completed. In total, they reached $241,1. It was in Dubai, Sharjah and Ajman. It was almost 1.7 times more in terms of numbers. This metric became 16% more expensive than in 2023

In 2024, 38,500 new residential properties were commissioned in Dubai islands and 6,000 in Abu Dhabi

In 2024, mortgages in the UAE are issued at 3.7-5% per annum, with a term of up to 25 years

Buying real estate in UAE for $205,000 gives benefits. It allows you to get a two-year residence visa. You can also get an UAE Golden Visa. It is available for $545,000+ purchase

Income in the UAE from rent, resale, or earnings are not taxed, regardless of residency status

Real estate rental in the UAE: demand, profitability, prospects

In 2024, the United Arab Emirates welcomed 29.1 million tourists. This is a record figure, exceeding the 2023 result by 15.5%

During 2024, rental rates increased by 15.5% in Dubai and 12% in Abu Dhabi compared to 2023

Rental yields in 2024:

• in Dubai — 6.5%

• in Abu Dhabi — from 6%

• in Ajman — from 5.3%

• in Sharjah — from 5%

• in Ras al-Khaimah — from 5%

Forms of Property Ownership: Freehold vs Leasehold

Choosing the type of ownership depends on your purchase goals, budget, and investment strategy

Learn the key differences between Freehold and Leasehold

| Freehold | Leasehold | |

|---|---|---|

|

Ownership rights |

Full ownership |

Long-term rent |

|

Price |

Market price |

20-30% cheaper than freehold areas |

|

Tenure |

Unlimited |

99 years with the possibility of extension |

|

Possibility of resale |

No restrictions |

It is possible to sell the lease right with the consent of the owner |

|

Inheritance |

Available |

Available |

How to invest in UAE real estate: resale and rental as key strategies

by the time of project completion

for long-term leasing

on resale and real estate income

Popular emirates for investment, residence or rental

The largest city and international financial center in the UAE. Dubai South and Al Furjan are home to major Emaar investment projects, tourist infrastructure and high demand for rentals.

Property types in the UAE

Apartments

- from 30 m²

- from studios to 4 rooms

Access to fitness centers, swimming pools, lounge areas, and children's playgrounds. All properties for sale are fully finished, with built-in furniture — kitchens and equipped bathrooms

The price includes at least one parking space, and two spaces are for apartments with an area of 140 m² or more

$4,900

average price per m²

Townhouses

- from 120 m²

- 2–5 bedrooms

- several levels

Residents have access to the complex’s shared infrastructure: gyms, swimming pools, tennis courts and playgrounds.

Each townhouse has a separate entrance, individual parking, and a small courtyard.

$4,050

average price per m²

Villas

- from 200 m²

- 3-7 bedrooms

Each villa has its own territory with a garden, garage, and often a private swimming pool.

Some premium projects contain internal elevators.

$4,050

average price per m²

Neginski Experts Work in the Interests of the Client, not the Developers

-

We analyze the market to offer the best property in UAE for investment or residence

-

We select options within the budget, preferences for areas and type of housing

-

We provide support at all stages of the transaction for registration with the land department

We select properties for a safe purchase

-

Assess risks

Verify that the property is free from arrests, liens, and other encumbrances

01

-

Conduct developer audits

Research the developer’s history, completed projects, and buyer reviews

02

-

Analyze the contract

Conduct legal due diligence to eliminate hidden conditions

03

-

Handle property registration

Submit all documents for the official registration of property ownership in the UAE

04