How to Buy Real Estate in Phuket in 2026: Areas, Strategies, Prices and Key Documents

Neginski analysts can help you buy property in Phuket, supporting you at every stage of the transaction. In this guide, we explain how the market works and what to consider before purchasing.

Andrey Neginskiy

Real estate expert, CEO of Neginski

At a Glance

Properties in Phuket are typically viewed as a 'second home by the sea' or as a way to earn rental or resale income. One key nuance of the market is that foreign buyers cannot own land under freehold (outright ownership); they can only purchase the buildings constructed on it.

The minimum price for off-plan apartments in Phuket starts from $90,000, while villas begin at around $500,000. The projected gross rental yield for properties ranges from 5–8% per year for long-term rentals and up to 12% per year for short-term rentals. Buying can be done remotely, either via full payment or through an instalment plan. Developer payment plans are often marketed as ‘0% interest’, with no interest during construction. After handover, some plans apply interest of 3–7% (terms vary by project).

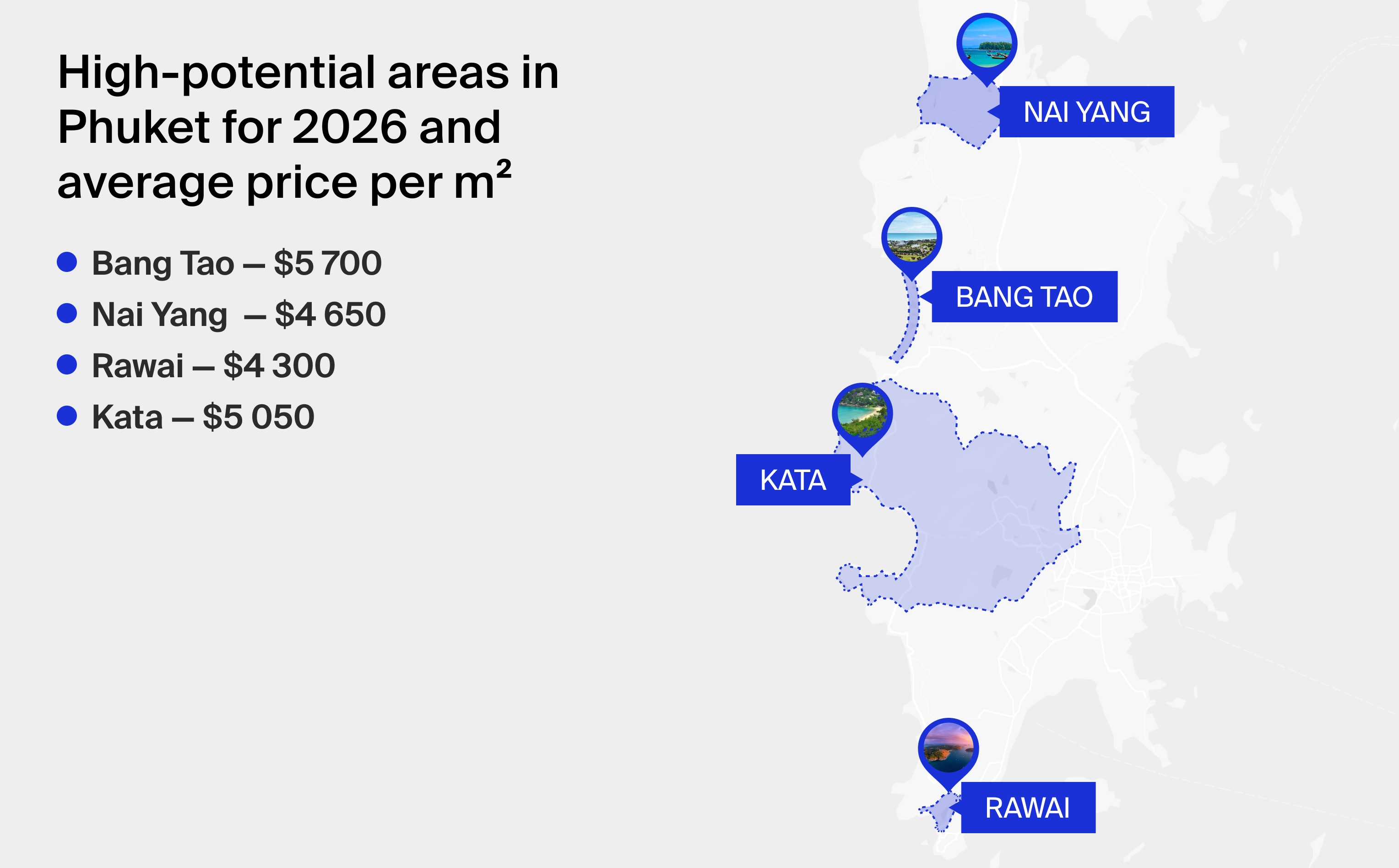

According to analysis by Neginski experts, some of the most promising locations for property investment in Phuket include the areas of Bang Tao, Rawai, Kata and Nai Yang. Key risks for investors can be loss of yield, property wear and tear, investing in an illiquid project and dealing with an unreliable developer. These risks are possible to mitigate by conducting thorough due diligence on the developer, the specific project and its location.

Get a Phuket property shortlist

tailored to your budget and goals

Instead, the options are 5 projects,

sorted by developer reliability,

ownership type, and income potential.

Three Reasons to Invest in Phuket Property

Phuket's economy is robustly supported by tourism revenue, which reached approximately $7 billion in the first five months of 2025, according to Thailand's Ministry of Tourism and Sports. The island consistently attracts digital nomads and expatriates with families, driving year-round demand for accommodation. Consequently, the real estate market is also growing: the number of property transactions in Phuket increased by 9% in the first half of 2025.

This dynamic is fuelled by new developments, comprehensive infrastructure and professional property management companies. As a result, the island remains attractive to investors, with property prices and rental rates typically appreciating annually alongside the maturation of locations.

Why investing in Phuket property is considered a stable strategy:

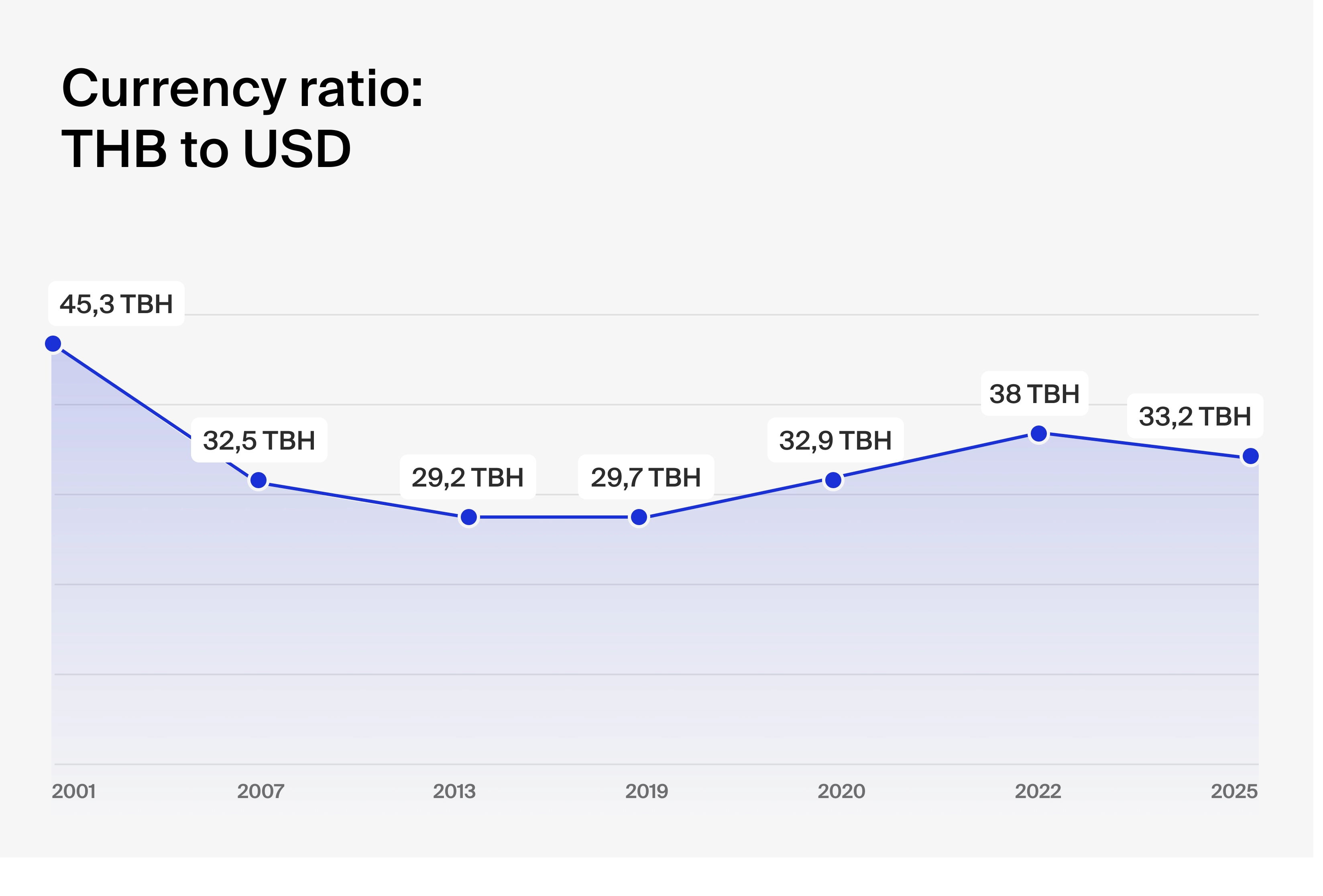

1. Strong currency. The Thai Baht has maintained a stable exchange rate of 32–34 THB to 1 USD for five years. Furthermore, the country's inflation rate was just 0.2% in 2025 — one of the lowest in Southeast Asia — supporting capital preservation.

2. Long-term growth. Property prices in Phuket have shown continuous growth for over 15 years. The rate varies by location, averaging from 10% per year in off-plan projects and from 5% per year for ready properties.

3. High liquidity. Phuket welcomes over 7 million visitors every six months. This drives consistent secondary market demand, frequently from rental investors. A unit in a sought-after area can be sold relatively quickly to liquidate your capital.

Property prices in Phuket are quoted in Thai Baht (THB) but are often payable in other currencies like USD, EUR, CNY or RUB

How to Invest in Phuket Real Estate: Three Ways

Properties in Phuket are often bought to preserve capital against inflation, support relocation, or generate passive income. We have analysed three potential scenarios in detail.

For rental income

According to the experience of Neginski analysts, rental properties typically yield an average of 5–8% per annum for long-term rentals and 7–12% for short-term rentals. For foreign investors, three primary short-term letting models are available: the rental pool, guaranteed returns programmes, or management through a licenced management company at market rates.

Rental pool: A management structure in which privately owned apartments within a development are combined and let commercially as one integrated operation, similar to a hotel. The total rental income is pooled and distributed to owners in proportion to their share. This model suits investors targeting higher potential yields who are comfortable with seasonal market variations.

Guaranteed returns: A programme offered by a developer or management company that provides a fixed annual return to the property owner for a set period, independent of the asset's actual occupancy or rental performance. This model is typically suited to investors prioritising predictable, low-risk income over potential market-rate gains.

The table below outlines the key distinctions between the rental formats available to foreign buyers.

Ways to rent out property in Phuket

| Comparison category | Rental pool: via a management company | Guaranteed returns: via a management company | Short-term: via a management company | Long-term: self-managed |

|---|---|---|---|---|

|

Net yield (after all deductions) |

7–10% per year. |

5–7% per year, depending on the developer. |

Up to 12% per year. |

7% per year on average. |

|

Key features |

Income depends on occupancy and is distributed among owners in the hotel pool proportionally. |

1) Usually applies for 2–5 years. |

1) Income depends on occupancy and is calculated at market rates. |

Contracts are usually signed for 6–12 months. |

|

Advantages |

1) The unit does not have to be view-facing, as the management company fills the pool more evenly. |

1) Protects against early-stage income drops while the project is still developing. |

1) No restrictions on personal use of the unit within the complex. |

1) Yield is less seasonal because the core audience is expats rather than tourists. |

|

Disadvantages |

Typically, personal use of the unit is not allowed in the high season. |

Personal use is limited to 2–4 weeks per year. |

The unit may sit vacant. |

1) Less pricing flexibility. |

|

Management fee |

30–40% of total income. |

0% (all costs are included in the price of the guarantee). |

15–30% of total income. |

0%, as the owner manages the full process and upkeep. |

Neginski case: passive income of $8,600 per year from a long-term rental

In 2022, a client approached us seeking to invest in property to generate rental income. As this was his first investment in the market, the entry budget was capped at $150,000.

We helped select a fully-furnished, 36 m² completed unit in Nai Yang for $101,800. Nai Yang was chosen as the location due to its consistent short-term rental demand, given the proximity to Sirinat National Park, the beach and Phuket International Airport.

Why this represented a solid investment:

1. The project was handed over six months early. The client secured a long-term rental generating $8,600 per year — a projected gross yield of 8.5% per year — resulting in a payback period of approximately 12 years (excluding capital growth).

While short-term rental could have achieved a yield of up to 12% annually, the investor prioritised reliability and opted for a one-year lease.

2. The unit has also appreciated in value. Its current estimated resale value is $132,700, representing a capital growth of $30,900 or +30% on the initial investment.

For resale income

There are two common exit strategy timelines for reselling investment property in Phuket: a fast exit (within 1.5–3 years) and a longer approach aimed at capital protection/capital preservation over five years or more.

With a fast resale, capital growth in Phuket can reach 40% over the full holding period. It may be possible to sell an off-plan unit via assignment after making only a limited number of payments under the developer payment plan. In this case, investment returns can reach up to 50% on the capital invested. However, reselling within the first year after purchase can be difficult.

With a longer-term capital-preservation approach, you can typically expect annual price growth of 5–8% annually after handover, based on Neginski’s internal analytics and our many years of experience in the sector. On the secondary market, a property is usually sold in line with comparable units in the same location and class. Price growth is more probable when:

demand for buying property in the area remains strong;

the asset stays competitive in its features;

similar units do not come to market at lower prices.

Neginski case: 55% Return in Six Months via Strategic Resale

An investor approached us with the goal of purchasing property for resale. Their key criteria were a high-growth location, a total price below $100,000, and an initial deposit under $30,000.

Based on these parameters, our analyst recommended an off-plan unit in the Bellevue Lagoon project, located a five-minute drive from Bang Tao beach.

In January 2023, the investor purchased a 35 m² studio for $84,000, equating to $2,400 per m².

Upon securing the deal, they paid a booking deposit of $5,800 followed by an initial payment of $29,400, totalling 35% of the purchase price under the developer payment plan.

The next instalment of 35% was due later in the construction schedule. However, by June, the investor opted for an assignment sale, selling the purchase contract for $132,000 ($3,700 per m²).

After deducting a 10% agency commission and administrative transfer fees, the net profit from the resale was approximately $29,000. This represents a 55% return on the total capital invested ($35,200) in just six months.

For living

Thailand is a prime destination for winter getaways, particularly attracting visitors from colder climates such as Russia. This trend indicates that property in Phuket is sought after not only for permanent relocation but also for use as a seasonal residence during the winter months.

Purchasing property in Thailand does not grant the right to obtain a residence permit or residency visa. Long-term stays require a separate legal status, such as an Elite Visa, work permit or investment-based visa.

In Phuket, some developers offer a Thailand Elite visa — a long-term visa for foreigners and their families valid for 5–20 years — as an incentive when buying premium units. Additionally, certain developers assist with obtaining an LTR (Long-Term Resident) visa, a 10-year visa available to high-net-worth individuals (with assets over $1 million), retirees, remote professionals and their families. These options are particularly convenient if you are considering a property as a backup home or fallback option.

A family home in Phuket: live here

in winter, rent it out the rest of the year

Comfortable for winter living, profitable as a rental the rest

of the year

Areas in Phuket for Living and Income

Neginski analysts have assessed 14 districts of Phuket and identified the 4 most high-demand locations on the island for rental/resale income and personal use. We have also compiled a map showing the average price per m², based on Neginski's internal analytics.

Bang Tao

A premier destination on Phхукet's west coast, this area is home to some of the island's finest resorts, private villas and luxury hotels. At its heart lies Laguna Phuket, recognised as Asia's first integrated resort. It features serene lagoons, a championship golf course, internationally renowned hotels and waterfront dining.

Just a five-minute drive from Laguna you will find the vibrant Boat Avenue shopping and dining street and Porto de Phuket mall, complete with supermarkets, cafes and a calendar of open-air markets and concerts.

The Bang Tao Beach coastline stretches for up to 8 kilometres

Rawai

A premium southern district known for its luxury villas, yacht clubs, elite schools and seafront dining, making it popular with expatriates. The area offers comprehensive amenities, including international schools, private clinics, sports complexes and markets.

It is also culturally rich, home to iconic sites like Promthep Cape and Wat Chalong Temple, with a seafront lined with cafes. Its proximity to beaches ensures lasting appeal for tourists and residents alike.

Rawai is considered one of the oldest settlements in Phuket

Kata

A popular area among tourists and expats in south-west Phuket, known for sandy beaches and clear water. Kata consists of two parts: Kata Yai — the livelier part with cafés, restaurants, bars and nightlife — and Kata Noi — a quiet, high-end zone with luxury villas and hotels.

Even during the rainy season, you can often find a calm sea in the northern part of Kata, which makes swimming more comfortable. The area is home to some of Phuket’s best surf schools — from April to September, you can learn to surf.

The area runs along Kata Beach, which is 1.5 kilometres long

Nai Yang

A quiet location in the north-west of the island, close to the airport. Nai Yang is home to Sirinat National Park, the area’s main attraction for tourists. The beach partly borders the park, which means there is less development in the area. There are cafés, shops and markets.

The location is popular with those who fly frequently or plan to rent out to tourists for whom proximity to the airport matters. Investors choose Nai Yang for stable rental income and capital preservation.

The entire Nai Yang zone falls within the protected Sirinat area, so there are no high-rise buildings in the area, and construction often focuses on natural materials

Freehold vs Leasehold: Ownership Differences in Phuket

In Phuket, there are two primary forms of property and land ownership: freehold and leasehold. Here is how they differ.

Freehold means full ownership of both the land and the property. The purchaser obtains ownership rights upon full payment. It allows the owner to resell the property or pass it on through inheritance without restriction.

For foreigners in Phuket, freehold ownership is typically available for a building (for example, a villa structure) or a condominium unit, but not for land. The buyer acquires full ownership of their apartment plus a proportional share in the common areas and infrastructure. For instance, this differs from some markets where ownership may be limited strictly to the unit itself.

Foreign ownership in any one condominium building is legally capped at 49% of the total floor area.

Leasehold is a long-term lease of the land and the property for up to 90 years. The owner can use, rent out or sell the property. However, in a resale, the new buyer only acquires the rights for the remaining lease term. Foreigners can only own land in Thailand under a leasehold structure.

A key nuance for villa purchases: only the building structure is held under freehold, while the land remains under leasehold. If the land lease expires, ownership of the building is retained, but the right to use the land is lost.

Freehold or leasehold: how to buy

Phuket property safely

Clear explanation of the key differences and risks between

ownership types, and how to protect the deal

Investing in Phuket Real Estate: How to Identify and Manage Key Risks

In Phuket, investment outcomes depend on choosing the right location and the unit’s entry price. But it is just as important that the property fits your planned income model and does not require unplanned expenses during operation. Below, Neginski analysts explain how to avoid the most common mistakes and reduce key investment risks.

Low yield

This can happen if an investor chooses an illiquid asset or overestimates the rental income. Yield figures in developer presentations are almost always calculated at the ‘top end’ and often exclude some costs.

How to prevent this:

Factor in transaction costs and operating costs: the management fee, utilities, maintenance (service charges), repairs and vacancy periods between tenants.

Model two yield scenarios: a baseline case and a realistic maximum.

Check rental pool terms in advance: ask the developer for a full list of all deductions and expenses that will be withheld before payouts.

Wear-and-tear during operation

A tropical climate creates specific operational requirements. Key risks include heavy rains and local flooding, high humidity (mould), corrosion and, at times, storm periods.

How to minimise this:

Arrange property insurance — this can cover damage and reduce the financial impact of unexpected events.

Carry out regular preventative maintenance: servicing air conditioning and ventilation, humidity control, mould treatment and inspections of waterproofing and drainage. For villas and ground-floor condominium units, this is important.

Choose homes with a ‘smart home’ system — it helps monitor indoor conditions, save resources and manage appliances, reducing the risk of mechanical failures.

A non-competitive asset

In many coastal parts of Phuket, there is limited land by the sea and there are development restrictions. This supports prices, but it also creates the risk of overpaying and later competing with new projects where terms may be more attractive.

How to minimise this:

Compare the property with current equivalents in the area: assess differences in price, handover timelines, build quality and the amount of on-site infrastructure, layout features and instalment plan terms.

Choose assets in developing locations — for example, demand is currently higher for properties within Laguna Phuket, and infrastructure plans suggest the area will continue to expand.

Be ready to make decisions quickly on promising launches — this can help you secure a unit with few comparable options on the market, at more favourable prices due to the early stage.

An unreliable developer

If a developer has limited experience, they may delay construction or deliver with quality issues.

How to minimise this:

Check reputation: completed projects, adherence to announced timelines, materials quality and after-handover service.

Carry out legal due diligence before substantial payments: confirm the construction permit and check for ongoing court proceedings.

Choose a payment schedule tied to construction milestones, and set out the acceptance process and defects list in the contract.

Engage a lawyer — they will review the contract for key risks: delay penalties, termination conditions, assignment rules and the parties’ rights and obligations.

Andrey Neginskiy

Real estate expert, CEO of Neginski

At Neginski, we employ a multi-stage due diligence process to evaluate every property development. This rigorous vetting means only 24% of developers — those whose projects meet our strict standards for reliability and growth potential — are selected for our portfolio. This selectivity is designed to shield our clients from common investment risks.

Our assessment covers several key areas:

Developer Track Record: we examine the quality and on-time delivery of their past projects.

Location Viability: we assess renter and buyer demand in the area to gauge long-term appeal.

Legal Compliance: we verify land status, construction permits, and all project documentation.

Income Potential: we analyse occupancy rates, price trends, and projected yield of comparable properties.

Purchase Terms: we review the availability and structure of payment plans, including instalment options.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Three Ways to Pay for Property in Phuket

Thailand does not use escrow accounts where the buyer’s funds are held until the building is commissioned. However, this does not mean Phuket’s residential market is unsafe. The rights of foreign property owners are governed by Thailand’s Condominium Act, and courts can protect an investor if their contractual rights are breached.

You can buy property in Phuket in three ways:

Full payment. This is rarely used in the market, but it can be beneficial — some developers offer discounts of up to 10% for a one-off payment.

Instalment plan. This is typically marketed as ‘0% interest’ until construction is completed. The average down payment starts from 15%, followed by scheduled payments until handover or until a set date. Terms depend on the developer and the project. Some projects offer post-handover instalments — paying 40–50% over 1–5 years after completion at 3–7%. This payment method extends the purchase timeline, and if you rent out the property, the remaining balance may be covered by rental income.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Neginski Case: how to start investing in Phuket with just $30,200

A client approached us with a request to buy a unit without taking all their capital out of circulation at once. The plan was to purchase on developer payment plan and resell it after paying part of the unit price by handover.

We selected an apartment in Laguna priced at $151,000. At purchase, the investor paid just 20% — $30,200. Six months later, when the keys were issued, they paid a further 30% — $40,300.

Over this period, the unit price increased by 14%. The client sold the property, recovered their initial investment and earned income from capital growth — a total of $91,600.

The new owner pays the remaining 50% under the instalment plan. The result was 30% growth on the capital invested without full payment. The strategy worked thanks to the right timing and the right choice of location.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Mortgage. In practice, this can be available to foreign buyers, but it typically requires Thailand residency, a work visa and proven in-country income for the past two years. The interest rate is 10–12%. These requirements are often harder to meet than instalment-plan criteria, and payback can take longer. A mortgage is mainly convenient for buyers whose goal is relocation to the island.

In Thailand, land can be owned only by Thai citizens and companies with a controlling shareholding

The Costs of Holding Property in Phuket

The property management company covers the majority of operational expenses, meaning the owner does not need to budget individually for repairs or utility bills. There is no management fee under a guaranteed returns programme, and in a long-term rental, the tenant is responsible for utilities.

For a practical illustration, we have calculated the costs using the example of the new eco-friendly Laguna complex with an infinity pool, a 29 m² unit priced at $147,500. The table below summarises the net income, accounting for all costs over a 5-year period.

| Purchase costs | Rental operating expenses | Taxes | 5-year financial summary |

|---|---|---|---|

|

Property unit — $147,500 |

Property management company fee — $5,300 |

Income tax — $1,980 (15%) |

Total outgoings (without unit price) — $24,015 |

|

Land Department registration fee — $1,475 (1%) |

Wear and tear costs — $3,800 |

Property tax — $443 (0.3%) |

Rental income — $66,000 |

|

Service charges — $737 |

Sinking fund — $2,800 |

Summary: $2,423 per year or $12,115 for 5 years |

Net yield for 5 years — $41,985 |

|

Registration fee — $3,600 |

Summary: $11,900 for 5 years |

||

|

Summary: $153,312 |

Six Steps to Buy Property in Phuket

The property can be acquired either on-site or remotely. At Neginski, we pre-screen all developers and projects against our risk-management criteria — just 24% of all market offerings pass our filter.

Step 1. Meeting with an analyst

We start by identifying the investment goal, which determines the suitable location, property type and project. Our analyst discusses your criteria and compiles a preliminary shortlist.

Step 2. Project consultation

Property viewings are conducted via Zoom or in person at the developer's sales office, where you can tour a showroom of the future project. This allows you to ask the developer's representative direct questions regarding price, payment schedule, discounts, and furnishings. A Neginski analyst can assist in negotiating individual benefits, such as a payment deferral.

Step 3. Unit reservation and booking deposit

Typically 2–5% of the property price. Payment is made via bank transfer to the developer's account. Should the buyer decide to cancel the transaction, the deposit is generally non-refundable.

Step 4. Receiving the SPA and first payment

The SPA (Sales and Purchase Agreement) is the contract that legally defines the property specifications. It is designed to ensure the apartment layout and features will not be altered during construction. The SPA is issued after the booking deposit is paid.

The down payment typically ranges from 15–40% of the total property price. Subsequent payments follow a schedule linked to key construction milestones.

Step 5. Handover and snagging inspection

You can visit the island in person or authorise our analyst to complete the process for you. With a signed power of attorney, the specialist will conduct the final inspection and handle all registration formalities in your name.

Step 6. Registration with the Land Department

All government fees and taxes are typically shared between the buyer and the developer on a 50/50 or 70/30 basis, depending on the developer's terms. These fees generally amount to between 1.1% and 6.3% of the property value.

Neginski analysts guide clients through every stage of the transaction: they negotiate terms with the developer, review the contract and payment schedule, identify any hidden charges and manage all legal complexities. This approach replaces uncertainty with a clear, step-by-step framework.

About the Author & the Company

Andrey Neginskiy

Real estate expert, CEO of Neginski

This article was prepared by the Neginski team — an international real estate agency with teams in Phuket, Moscow and the UAE. We support clients at every stage, from clarifying goals and selecting a project to completing the purchase and managing the property.

We work with 300+ developers, get early access to off-market launches, source rare listings and negotiate discounts. More than 30% of our clients come back for repeat purchases. Learn more about us

Disclaimer

The information presented in this article is for general guidance only and does not constitute individual legal, investment or immigration advice. Property purchase terms, instalment plans, mortgage financing, rental arrangements and residency visa options in Thailand depend on the specific project, developer, bank, property status and the buyer’s individual profile.

Thailand’s laws and regulatory requirements may change. Before making any decisions, we recommend seeking personalised advice and checking the latest terms with the Land Department, the developer, the bank or licenced advisers.

Sources

This article is based on publicly available data, Neginski’s analysis and the team’s hands-on experience.

Links:

Phuket has already been visited by 7.6 million tourists from abroad this year

THB/USD 0.0322 (▲0.27%) | Google Finance

Foreign buyers cannot own land under freehold in Thailand

FAQ

-

Yes, provided it is a condominium unit and the building still has foreign ownership quota available.

Key points:

under freehold, foreigners may own up to 49% of the total floor area in any single condominium building;

if the foreign quota for a condominium is full, the unit can only be acquired under a leasehold;

when purchasing a villa, freehold ownership applies only to the building structure itself, while the land remains under a separate leasehold agreement.

-

A minimum benchmark starts from around $90,000 for apartments in off-plan condominiums within a 15-minute drive of the beach, and from $500,000 for villas.

the specific location, unit size, and extent of project amenities;

it is essential to verify the developer's track record and the quality of their previous completions, as a lower price may reflect the use of substandard materials.

-

For short-term rentals of under one month, you must use a licenced property management company, because this type of letting requires a specific permit that private owners typically do not have.

What you should keep in mind:

the higher yield figures in developer presentations usually exclude taxes and operational costs, so yields above 12% per annum should be treated with caution;

short-term rental income is more susceptible to seasonal fluctuations and depends heavily on the quality of management;

guaranteed return programmes are usually limited by both their duration and specific terms and conditions.

-

For property investment, the areas of Bang Tao, Rawai, Nai Harn, Nai Yang, and Kata are among the most promising.

The choice of location should be guided by the target tenant's needs:

for short-term rental income, proximity to the beach and on-site resort-style amenities are key advantages;

for long-term rental stability, family-oriented infrastructure such as schools, clinics, and shopping is more important;

for potential resale, compact formats like studios and one to two-bedroom apartments are often most liquid, as they are frequently purchased by buy-to-let investors.

-

A guaranteed returns programme fixes a set profit percentage for a predetermined period. A rental pool involves placing your property into a managed collective where total rental income from all pooled units is shared proportionally among owners.

Key considerations when choosing a rental model:

guaranteed yield protects against vacancies and underperformance initially, but it limits your potential income for the duration of the guarantee;

participating in a rental pool can offer higher earnings potential, but it requires accepting seasonal fluctuations and vacancy risks.

-

Key additional costs include the Land Department registration fee, contributions to a maintenance (sinking) fund, property and rental income taxes, the property management company's fee, and the cost of refurbishing interiors due to wear and tear.

Important nuances to consider:

when budgeting for a purchase, you should allocate up to 6.3% of the property price for the official registration process;

the difference between the gross rental income and the final net yield can be as much as 5 percentage points.

-

You can independently let your property for long-term rentals (typically one month or more). For short-term rentals of under one month, you must use a licensed property management company, as operating this type of rental yourself requires a specific permit which only such companies hold.

-

Conduct thorough due diligence on the developer and project documents, ensure payments are linked to construction milestones, and plan a realistic exit strategy.

What to verify when selecting a project:

a valid building permit and all necessary planning permissions;

any history of or ongoing litigation involving the developer;

the developer's reputation and track record for delivering previous projects on time;

the licence and credentials of the appointed property management company.