How to Invest in Overseas Real Estate in 2026: Dubai and Phuket Market Analysis

Neginski team selects properties in Russia and abroad. The most in-demand overseas markets among our clients are Dubai and Phuket. They are the leaders by number of deals: 1,750 properties over five years. In this guide, we explain how a primary market purchase works in Dubai and Phuket and what to watch out for.

Andrey Neginskiy

Real estate expert, CEO of Neginski

At a Glance

Overseas real estate is a common choice for capital protection and capital growth, depending on the market, currency and execution risks. Investors around the world buy property abroad both as an investment and for living.

Neginski, an analytical real estate agency, selects properties in Dubai and Phuket. Both markets have strong potential, but each has its own nuances.

Property prices in Dubai start from $180,000. Transaction costs are up to 5%. Estimated yield is 6.5% to 9% per year from long-term rental and up to 12% from short-term rental. Payments go through an escrow account. The property and the land are purchased as freehold, or full ownership.

The minimum price of apartments in new developments in Phuket is $90,000. Estimated yield is 5% to 8% per year from long-term rental and up to 12% from short-term rental. The property itself is often registered as freehold. The land is leasehold only, typically a long-term lease of up to 90 years. Some projects offer rental pool schemes and programmes marketed as guaranteed returns.

Investment Objectives for Overseas Property

Choosing your goal is the first step towards smart property investing. Below are three common goals.

Capital protection

For investors who want to protect their capital from inflation. Rather than leaving money idle, you can invest in a liquid property that is typically easier to sell on the secondary market when you decide to exit.

What to consider when buying:

Location: high demand, developed infrastructure and tourist attractions.

Area development plan: new construction should support demand, not block views or increase noise.

Availability of similar properties: estimate how many comparable units are already on the market and how many will appear soon, so you do not buy into a segment with heavy competition.

Property class: in a crisis, luxury assets are considered the most resilient. According to Knight Frank, prime residential prices grow on average each year: in 2024 the increase was 3.6%.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Neginski case: +40% on the property price in two years

In 2023, an investor contacted the agency to buy an apartment in Dubai Marina. The goal was capital protection.

The client liked a residential development with handover the following year and a post-handover instalment plan. This meant he could avoid pulling funds out of his business.

Despite the attractive terms, analyst Maria advised the investor not to proceed. It was the developer’s first project, the build quality was average and this could have reduced the rental rate.

Instead, our expert suggested a launch by Ellington in JLT:

• A proven developer with a strong build-quality track record: apartments can rent out at higher rates than in neighbouring developments.

• A developing location where prices were expected to rise as infrastructure appeared.

• An early project stage: a chance to lock in the best price.

The client agreed and chose an apartment for $394,000. With Maria’s support, he kept working capital in the business, spread payments over two years through the instalment plan and achieved capital growth of +40%: in 2025, similar units were already priced at about $545,000.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Passive income

For investors who want regular rental income and minimal involvement in day-to-day operations. The result often depends on occupancy.

What to consider when buying:

Location: close to tourist hotspots or near major transport links that help guests get around.

A property management company on-site: handles operations, from finding guests and check-in to reporting and profit payouts. The management fee can be up to 30% of the rental income.

A recognised brand: large hotel operators and chains have their own global client base, which increases demand and, as a result, yield.

Get a Dubai new-build

shortlist for your strategy

Up to 5 options with strong resale potential

and trusted developers

Living and relocation

People also buy property abroad for personal reasons: relocation, spending winters away or as a fallback option for the family in case you need to move quickly.

What to consider when buying:

Location: Location: close to shops, schools, nurseries and clinics, with an easy commute to work or leisure areas.

On-site amenities: your daily travel time and costs can drop if the development has a gym, pools, cafés, a children’s playroom and co-working spaces.

Unit features: for one or two people, buyers usually choose compact units in an apartment building. For relocation with a family, you need more space, so townhouses or larger apartments are more common, with storage, multiple bathrooms and parking.

Investor bonuses: some developers help with a visa or residency when purchase conditions are met and may offer gifts, for example an annual golf club membership.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Neginski case: residence visa for purchasing property

Anastasia had long considered investing in Dubai real estate. She wanted to relocate, obtain UAE residency status and open a bank account.

The challenge was timing. The purchase was urgent and fell during Ramadan, a month-long Muslim holiday. During this period, government offices work reduced hours.

From the options proposed by the analyst, she chose a unit in Al Habtoor Tower for $844,000. For a Golden Visa, the required investment starts from $545,000.

The applicant must be physically present in the country for every stage of the process, from medical tests to immigration approval. Anastasia had only five working days for this, and we helped her complete the required procedures on time.

Her Emirates ID card was ready five days later. Anastasia collected it on her return to Dubai, when she also arranged Golden Visas for her husband and children and opened a bank account.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Investment Strategies for Overseas Real Estate

If your goal is to earn income or capital growth from a property purchase, we recommend choosing the location and the property format first (residential development, hotel or villa) and only then selecting the specific unit. Some units perform well as rentals but are not suited for resale. Below are the key differences between strategies and the outcomes they may lead to.

Renting out

The highest annual income typically comes from short-term rental. The most stable comes from long-term rental. You can rent out through a property management company or independently. The first is more convenient, the second can be more profitable.

Before buying, clarify the profile of your potential tenant and base your decision on their needs for location and layout. Solo travellers looking for short-term rental often choose studios up to 35 m² with scenic views and compact villas up to 50 m². Families with children looking for long-term rental tend to choose apartments of 45–55 m² with two or three rooms.

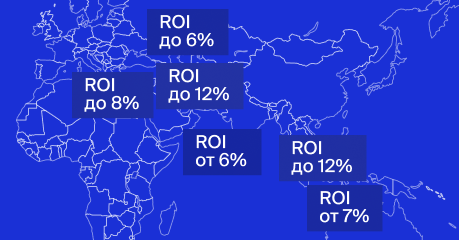

Potential yield from renting out:

In Dubai: up to 9% per year for long-term rental, up to 12% per year for short-term rental.

In Phuket: up to 8% per year for long-term rental, up to 12% per year for short-term rental.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Neginski case: bought a unit and rented it out immediately

Viktor was looking for a property in Dubai for passive income. He was not ready to spend a lot of time searching for tenants and wanted to simplify the process. We handled the entire deal cycle.

Within his budget, we selected a 121 m² apartment with a terrace for $1,002,000 in a low-rise residential development with a pool and fitness centre, opposite a park in the Dubai Hills master community.

There are few tourists in this area and plenty of walking spaces. A 5-minute drive away there are 18-hole golf courses and some of the best schools in Dubai. The development was already completed, so tenants could move in immediately.

Due to high demand for the area, we quickly found a suitable tenant. We prepared the contract within 24 hours and let the unit for a year for $78,400, paid upfront. The yield was 6.6% per year in $ with potential for growth.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Resale

If you buy with resale in mind, it is also important to understand the profile of your future buyer and choose a format that is in demand. Location matters. The most liquid units are still those by the water, with coastline views.

There are several resale routes:

Buy before construction starts and resell by assignment before the building is completed. This requires careful legal checks and a lower entry budget. Pre-sale prices are the lowest. You can also buy on a developer payment plan, with the remaining instalments paid by the next buyer.

Buy during construction and sell once the development is completed. During construction, you can buy either from the developer or from an existing buyer. Legally, at this stage the buyer is not yet the owner because there is no Title Deed. Instead, they hold an off-plan contract and, in Dubai, an Oqood certificate.

Buying by assignment involves higher risk, but it is possible with thorough document checks. Buying from the developer is faster. If the price feels high, you may be able to negotiate a discount.

Buy to hold for longer and sell after two to three years. This means buying an off-plan or ready property either from the developer on the primary market or from an owner on the secondary market. Choose a property in a location that will remain in demand and liquid over time.

Potential capital growth:

In Dubai: up to +35% by handover for apartments, up to +100% for penthouses.

In Phuket: up to +40% by handover for off-plan apartments, penthouses and villas.

The Neginski care team in Dubai will help you choose a property for your needs and resell it on the secondary market

Mixed strategy

There are two common options: live in the property and rent it out the rest of the time, or rent it out and sell after three to five years.

What to keep in mind:

Many projects limit personal use if you rent out the property through rental pool programmes* or guaranteed returns programmes** (typically to 14–28 days). If you choose a rental model, decide what matters more to you: holidays or income.

If you plan to rent out and then resell after three to five years, we suggest choosing long-term tenants (contracts for six to 12 months). With daily rental, the risk of wear-and-tear increases, and selling a property with damaged finishes is harder.

* rental pool is a rental format where apartments are pooled into one fund and operated like a single hotel, with profits split proportionally between owners.

** guaranteed returns is a programme where the developer or the property management company fixes the profit amount and pays it annually regardless of actual occupancy.

Dubai and Phuket: Key Differences Between the Property Markets

Dubai and Phuket operate under different legal systems that protect investor rights. In Dubai, property rights registration is governed by Law No. 7 and regulated by RERA (an entity of the Dubai Land Department). In Thailand, the Condominium Act applies, overseen by the Land Department.

From an investment perspective, the markets also behave differently. Dubai offers strong price growth and freehold ownership. But the entry budget is higher than in Thailand and there are fewer rental formats.

Phuket attracts buyers with a lower entry point and guaranteed income programmes, but there are restrictions on land ownership. A foreign buyer cannot purchase land as freehold (full ownership). Land is available only as leasehold, a long-term lease of up to 90 years. The building itself is set as freehold.

Below are the key differences to help you decide which market fits your financial goals and risk appetite.

Key differences between the Dubai and Phuket property markets

| Criterion | Dubai | Phuket |

|---|---|---|

|

Entry budget |

From $180,000 |

From $90,000 |

|

Transaction logic |

Funds go to an escrow account. The developer receives them in stages after construction milestones are completed. |

Funds go to the developer’s account under the contract. With instalments, payments are tied to construction milestones. |

|

Purchase costs |

DLD fee: 4%; |

Registration at the Land Department: 1%; |

|

Capital growth |

7–10% per year. |

10–15% during construction; |

|

Rentals and management |

You can rent out independently or via a property management company. For short-term rental without a management company, a DTCM licence is required. |

Independently, you can typically do long-term rental only. Short-term rental is usually via a management company or through rental pool and guaranteed income programmes. |

|

Rental yield |

Long-term: 6.5–12% per year; |

Long-term: 5–8% per year; |

|

Ownership structure |

Full ownership when buying in freehold zones. |

In full ownership, a foreign buyer can only buy the building itself (a house as a structure) or an apartment in a condominium. Land for a foreign buyer is typically structured as leasehold, a long-term lease of up to 90 years. |

How to Calculate Returns on Overseas Real Estate

The yield shown in a developer’s brochure is almost always a gross figure. It does not include annual operating costs and taxes. To make a decision, you need a net return (ROI, Return on Investment) that shows the actual percentage return on your invested capital.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Net ROI formula:

ROI = (Annual rental income − Annual property costs) / Total investment × 100%

Costs include the property management fee, utilities, insurance, taxes, service charges and a reserve for repairs and vacancy periods.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Example calculation for a Dubai apartment priced at $500,000.

Total investment:

Property price: $500,000

DLD fee (4%): $20,000

Furnishing: $25,000

Total invested: $545,000

Annual rental income: $45,000 (a developer will show: 9% of $500,000)

Annual costs:

Property management fee: $6,750

Service charge (annual): $4,000

Utilities: $2,400

Repairs and vacancy reserve (5% of income): $2,250

Total costs: $15,400

Net annual profit: $45,000 − $15,400 = $29,600

Net ROI: ($29,600 / $545,000) × 100% ≈ 5.43% per year

How to Earn Passive Income in Hard

Currency from Overseas Real Estate

Find projects with proven rental demand, clear running costs

and fully managed rentals

Main Risks in Overseas Real Estate Investing and How to Reduce Them

Based on Neginski analysts’ experience, first-time investors often overlook legal and operational risks that can turn a good deal into a loss. Below are the key risks investors face when buying in Dubai and Phuket, with practical ways to avoid or reduce them.

Risks when investing in overseas property

| Risk | How to reduce |

|---|---|

|

Handover delays and poor build quality |

Choose a developer with a proven track record; review timelines and the build quality of completed projects. |

|

Financial losses due to an unfinished project |

In Dubai, pay via the project’s escrow account; |

|

Low yield |

Analyse the location (rental demand, competing supply, infrastructure plans); |

|

Poor liquidity on resale |

Avoid identical layouts in remote locations or in complexes without internal infrastructure; |

|

Loss of ownership rights |

Work only with licenced brokers and lawyers |

Andrey Neginskiy

Real estate expert, CEO of Neginski

For transparency, Neginski analysts carefully verify escrow account registration on official government portals. Only 24% of properties pass our safety checks, including financial safety.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Step-by-Step Plan to Buy Property in Dubai and Phuket

The property can be acquired either on-site or remotely. Neginski experts run a risk check on developers and projects in advance and filter out 76% of offers. This selection helps us find properties that match investor expectations and support the best possible outcome.

Step 1. Meeting with an analyst

We precise your goal: capital protection, relocation or rental income. This determines the area, property type and project. The analyst clarifies your preferences, answers questions and shares an initial shortlist.

Step 2. Project consultation

A viewing via Zoom or an in-person meeting with the developer. In the sales office, you can see a showroom unit and ask the representative directly about price, the instalment plan, discounts and furnishing. A Neginski analyst helps negotiate individual bonuses, such as deferred payments.

Step 3. Reserving the unit

In Dubai: In Dubai: first, you may pay an EOI (Expression of Interest), a deposit used for early access to a sales launch. Refund terms depend on the specific launch. To reserve a specific apartment, you then pay a booking fee. It is non-refundable but is counted towards the total price.

In Phuket: you pay a 2–5% deposit. You can pay by bank transfer to the developer’s account or in cash. If the buyer cancels, the deposit is typically non-refundable.

Step 4. First instalment and signing the SPA

The SPA is the contract that fixes the unit’s specifications. It is meant to ensure the unit’s key characteristics do not change during construction. It is issued after the first instalment.

In Dubai: 10–20% of the property price. At this stage, you also pay the registration fee: 2–4%.

In Phuket: 15–40% of the total property price. The rest follows a schedule tied to key construction milestones.

Step 5. Registering the transaction

In Dubai: registration is completed with the Dubai Land Department (DLD). Within 1–4 weeks, the buyer receives an Oqood certificate by email, confirming rights to an off-plan property.

In Phuket: registration is completed with the Thailand Land Department. At this stage, the buyer pays all government fees and taxes: from 1.1% to 6.3%, depending on the ownership structure.

Step 6. Handover inspection and obtaining ownership documents

In Dubai: the ownership document is the Title Deed.

In Phuket: the ownership document is Chanote when buying a villa and the Condominium Unit Title Deed when buying an apartment in a condominium.

You can collect the document in person or delegate it to our specialist. They will accept the property under a power of attorney and complete all documents in your name.

Buy an overseas apartment

remotely safely

A step-by-step guide to completing the purchase online:

documents, payments, and title registration

About the Author & the Company

Andrey Neginskiy

Real estate expert, CEO of Neginski

This article was prepared by the Neginski team — an international real estate agency with teams in the UAE, Moscow and Phuket. We support clients at every stage, from clarifying goals and selecting a project to completing the purchase and managing the property.

We work with 300+ developers, get early access to off-market launches, source rare listings and negotiate discounts. More than 30% of our clients come back for repeat purchases. Learn more about us

Disclaimer

The information in this article is for general guidance only and does not constitute individual legal, investment or immigration advice. Property purchase terms, instalment plans, mortgage financing, rental and resale rules in UAE and Thailand depend on the specific project, developer, bank, property status and the buyer’s individual profile.

UAE laws and regulatory requirements may change. Before making any decisions, we recommend getting personalised advice and confirming the latest terms with the Dubai Land Department (DLD) and Thai Land Department, the developer, the bank or licenced advisors.

Sources

This article is based on publicly available data, Neginski’s analysis and the team’s hands-on experience.

Links:

Key takeaways from this year’s Prime International Residential Index

CBUAE | Central Bank of the UAE

THB/USD 0.0322 (▲0.27%) | Google Finance

Real Estate Regulatory Administration

FAQ

-

Define your goal, budget and risk tolerance. Then study the market’s legal basics: ownership structure and taxes.

Next, speak to an analyst to:

get a shortlist;

arrange viewings;

negotiate terms with the developer and complete the transaction with documents.

-

Dubai offers higher legal certainty thanks to escrow accounts and freehold ownership of land and units. Phuket attracts with a lower entry point and guaranteed income programmes. Both can be safe if you work with vetted partners and check the legal and financial side.

-

Developers typically show gross yield. It ignores annual operating costs and taxes, so the figure looks higher than what an owner may actually receive after expenses.

How do you calculate net ROI?

use the formula: ROI = (Annual rental income − Annual property costs) / Total investment × 100%;

costs include taxes, the property management fee, service charges and, if you rent out independently, repairs and utilities.

-

A foreign buyer can own the building itself. Land is typically structured as leasehold, a long-term lease of up to 90 years.

Important features:

apartments can be bought as freehold if the project has a foreign quota (49% of total residential area);

when buying a villa as freehold, you purchase the structure only. When the land lease ends, your right to use the plot ends unless the lease is renewed. You should confirm renewal terms in advance.

-

DLD fee is the Dubai Land Department’s state registration fee. It is 4% of the property price and is paid by the buyer when the transaction is registered. It is a core mandatory cost when buying in Dubai.

-

In Phuket, you can avoid managing occupancy by joining a rental pool or a guaranteed income programme. If you rent out independently in Phuket or Dubai, you need to raise competitiveness:

choose a location with year-round demand (by the sea or in business areas);

work with a licenced property management company with its own client base;

keep the fit-out, furniture and appliances in strong condition.

-

For short-term rental, a management company is almost always required. It handles marketing, guest check-ins, payments, cleaning and maintenance. For long-term rental, you may manage without one, but it requires local law knowledge, language and personal involvement. For non-residents, a management company is usually the best option.

-

You can delegate checks to specialists: agencies monitor the reliability and transparency of the process. If you buy independently, check:

Dubai: the developer’s licence (RERA), the SPA, the payment schedule and the Oqood certificate;

Phuket: the land lease agreement (if leasehold), the developer’s licence and the building permit;

general: construction progress reports and warranty terms.