Phuket Areas: Where to Buy Property for Living and Investing in 2026

Neginski analysts help clients buy property in Phuket for living and investing. Here is what to look at when choosing an area: where returns are typically higher and where day-to-day life is easier.

Andrey Neginskiy

Real estate expert, CEO of Neginski

At a Glance

The right area depends on your goal: passive income, capital preservation or personal use. Passive income is more often linked to Bangtao, Patong, Kata and Naiyang. Capital preservation is more often linked to Bangtao, Kamala and Thalang. Living and holidays are more often linked to Bangtao, Thalang, Rawai and Naiyang.

Apartments in new developments start from $90,000, villas from $500,000. Short-term rental yield is often modelled at up to 12% per year and long-term rentals at 5–8% per year., but outcomes depend on occupancy, fees and management. Resale upside is sometimes modelled at 25–40% depending on the construction stage and market conditions.

You can pay in full, via a developer payment plan, a post-handover instalment plan or a mortgage. Instalments are the most common option in the market. A developer payment plan is marketed as 0% interest for the construction period (usually up to 4 years). A post-handover instalment plan is typically 3–7%, depending on terms (usually up to 5 years after handover).

Quick Area Match for Your Goal in Phuket

If you already know the basics and want a faster match, use this table. It links the area’s profile to your goal.

| Goal | Budget | Payment method | Area | Outcome |

|---|---|---|---|---|

|

Passive income |

$100,000–$150,000 |

Pay in full, instalments, post-handover instalments |

Bangtao, Patong, Kata, Naiyang |

Short-term rentals — up to 12% p.a.; |

|

Capital preservation |

$150,000–$500,000 |

Pay in full or instalments |

Bangtao, Kamala, Thalang |

Protecting capital from inflation through property price growth as a physical asset — on average from 10% in off-plan projects and from 5% in completed homes. |

|

Personal use |

$90,000–$250,000 |

Pay in full, instalments, post-handover instalments, mortgage |

Bangtao, Thalang, Rawai, Naiyang |

A home for living and holidays on a warm island — a villa or a residential complex with everyday infrastructure. |

If you are entering the market for the first time, the sections below explain how Phuket is structured and which areas tend to work best.

How Phuket Works

Island geography

Location is the key factor in property investment. In practice, it drives most of the outcome.

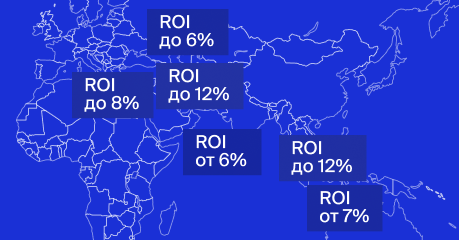

Most areas fall into three directions:

1. North-west Phuket. This is where premium areas sit: Bangtao (including Laguna), Kamala and Thalang, with beaches, resorts, villas and condominiums*.

Units in the north-west are usually more expensive than the market average, but rents and capital growth are also typically higher. The main growth drivers are beach proximity and premium infrastructure.

This part of the island works for most strategies: rentals, resale and personal use.

*Condominium — a legally defined property format in Thailand where the investor buys not just an apartment, but a specific ownership structure: a unit, a share in common areas and participation in management through the owners’ association.

2. Central-west Phuket. A busy part of the island with tourist beaches in Patong, Karon and Kata. Patong is the nightlife centre. Karon and Kata are calmer but still popular.

This direction fits investors who want passive income and aim for high occupancy in rentals.

3. South Phuket. A calmer part of the island, with key areas Rawai and Nai Harn. These locations are popular with families who relocate or winter in Phuket and with long-term tenants.

Get a Phuket property shortlist

tailored to your budget and goals

Skip dozens of listings and get 5 projects ranked by developer

reliability, ownership structure and income potential

Logistics

Thailand’s economy relies heavily on tourism. Phuket is one of the country’s main tourist hubs, so logistics affect both day-to-day life and rental performance. Here is what investors should factor in.

Logistics specifics in Phuket:

1. Overloaded road network. With limited roads, traffic jams are common, especially in peak season. Driving can be slow. A practical alternative is scooter rentals, which can cut travel time.

2. Weather seasonality. During the monsoon season (June to October), heavy rain and occasional flooding can disrupt transport. Sea routes can pause temporarily. Taxi fares are often higher than usual. At the same time, there are fewer tourists, so roads are less congested — private cars and songthaews can be easier to use.

In 2026, Phuket is undergoing large-scale modernisation to reduce traffic and improve links between the airport, the island centre and resort zones.

Phuket logistics projects for 2026–2028:

Phuket Expressway. A 1.85 km tunnel and motorway will connect Kathu and Patong Beach. The new route is expected to shorten travel time and reduce the island’s transport load.

New road to Phuket International Airport. The project is designed to separate tourist traffic from local traffic, which matters most in the north.

Main roads and public transport upgrades. The expansion of Highway 4027 is planned to finish in 2026. A tram line is also planned from the airport to the Chalong roundabout (42 km, 21 stations).

The strongest price growth in modernisation zones is expected after 2029. To align with that cycle, consider projects whose handover dates match the end of major road works.

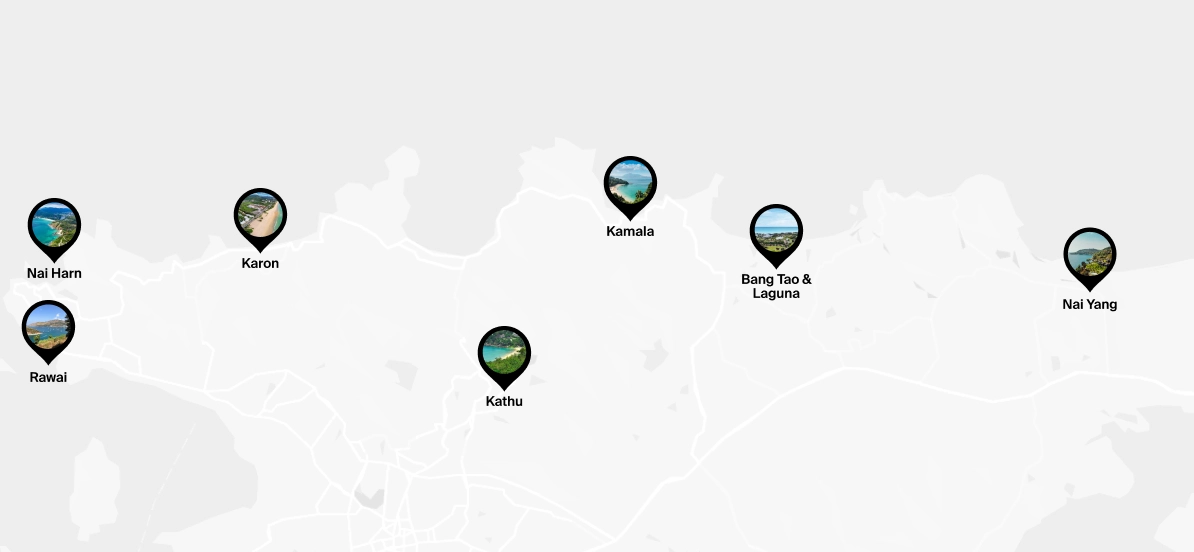

Key Phuket Areas for Living and Investing in 2026

We selected 7 locations that tend to work best for rentals, resale and personal use. We also prepared an average price-per-m² map using Properstar Phuket data as of February 2026, converted from THB to USD. The results are shown in the cards below.

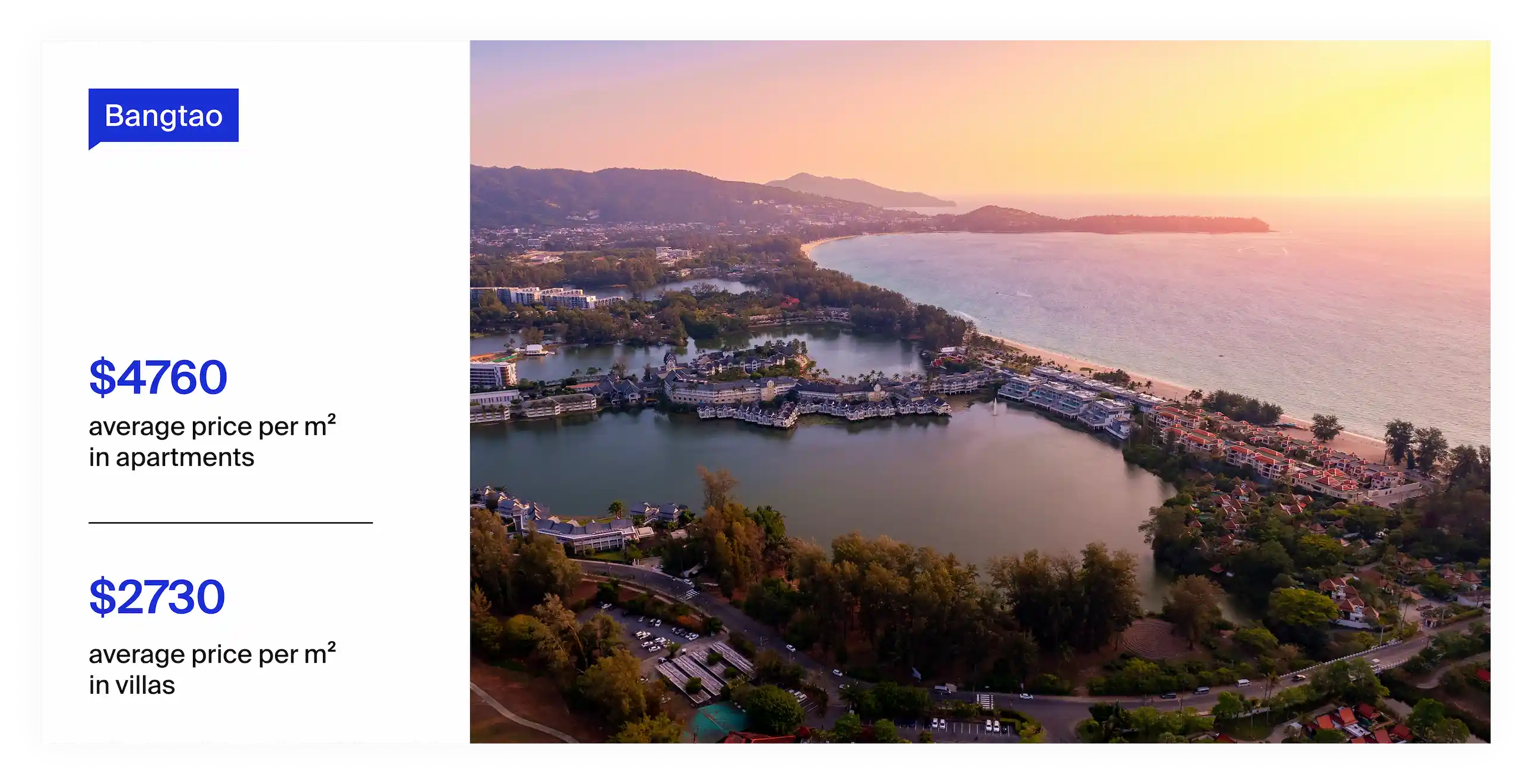

Bangtao

Bangtao Beach stretches for up to 8 kilometres and the area avoids dense development

Bangtao is one of the most popular areas with investors. The centrepiece is Laguna Phuket — a resort zone with lakes, a golf club, global hotel brands and waterfront restaurants. A 5-minute drive from Laguna is Boat Avenue (a retail street) and Porto de Phuket, with supermarkets, cafés, markets and open-air concerts.

What attracts investors:

a calm, premium environment: golf, yachting, well-maintained public space and no noisy nightlife;

strong growth in prices and rents as the area develops year after year.

Best-fit strategy: long-term and short-term rentals, resale, personal use.

Kamala

Kamala is home to the ‘Billionaires’ Mile’ — a cluster of luxury villas, Michelin-listed restaurants and the iconic Café del Mar

Kamala is one of Phuket’s calmest and most scenic areas, with a 3 km sandy beach, restaurants, massage salons and shops. Key attractions include the Phuket FantaSea theme park and Carnival Magic.

At Phuket FantaSea, you can see a show that combines acrobatics, special effects and animal performances.

Carnival Magic runs ‘River Carnival’ — a parade with advanced tech and light installations. The park is listed in the Guinness World Records in nine categories, linked to scale, lighting and the uniqueness of its attractions.

What attracts investors:

a ‘quiet luxury’ feel: premium villas that owners often hold rather than resell quickly;

higher rental income and higher ticket sizes in both rentals and resale for premium assets.

Best-fit strategy: long-term rentals, resale, personal use.

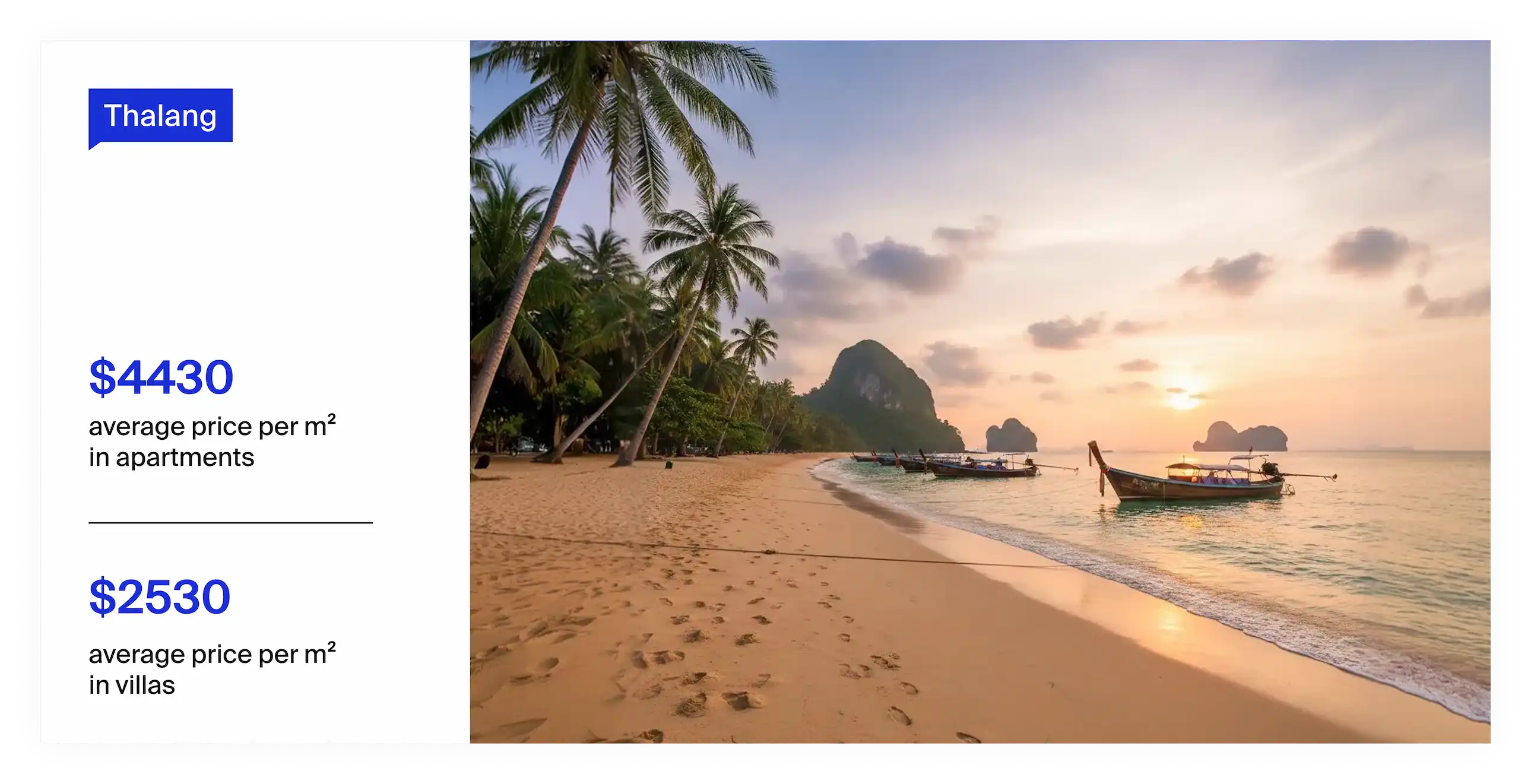

Thalang

Thalang is developing fast, with a wide choice of premium villas and condominiums

Thalang is a greener, northern part of Phuket. It includes some of the island’s best beaches: Bangtao, Surin, Nai Thon, Naiyang and Layan. Instead of nightclubs, you get waterfalls and the Phuket Heroines Monument, honouring the women who defended the island from the Burmese invasion in 1785.

What attracts investors:

international schools, marinas, shopping centres, top beaches and the airport are all in the wider area;

a practical alternative to Bangtao and Kamala with a lower entry budget.

Best-fit strategy: long-term rentals, resale, personal use.

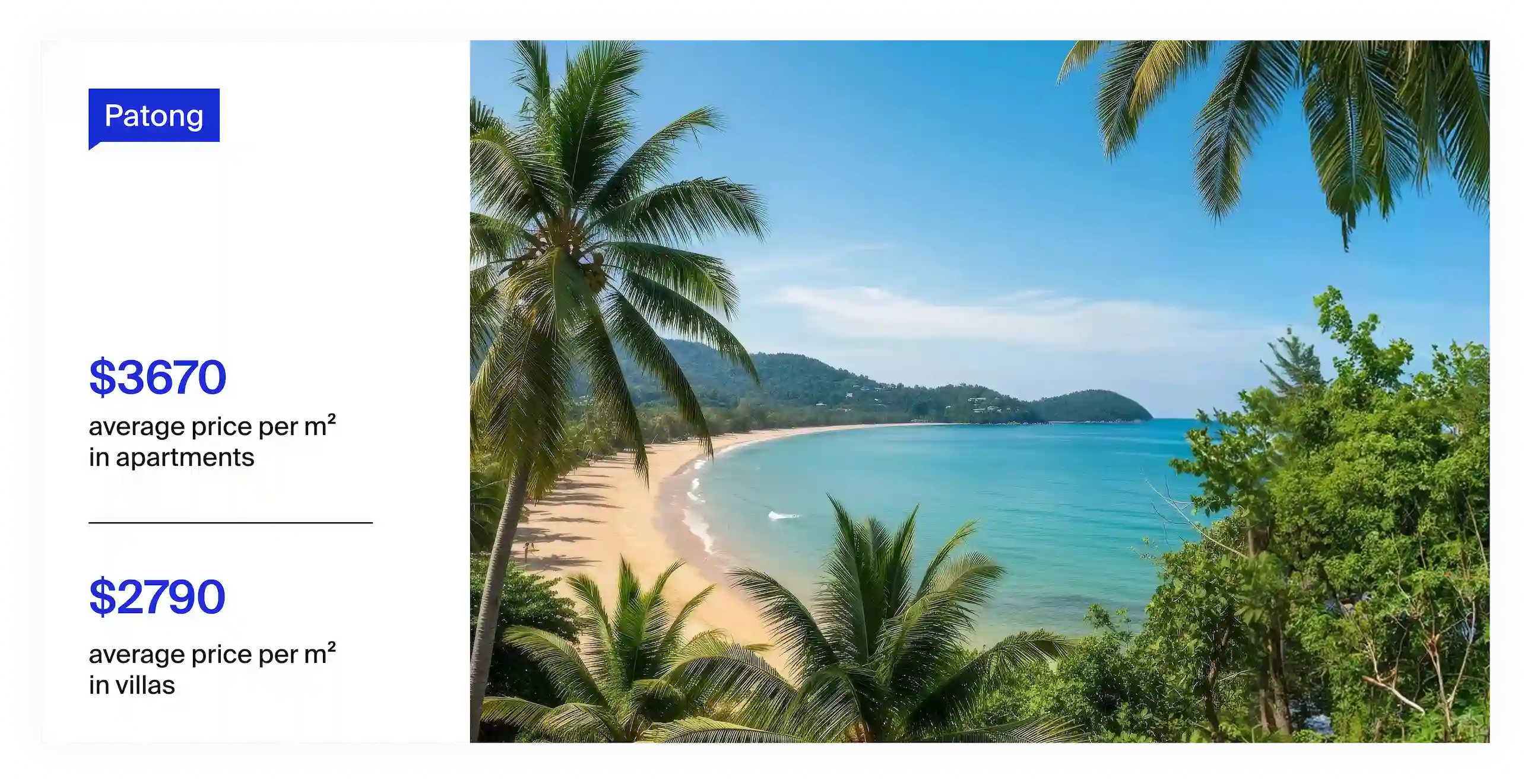

Patong

Bangla Road in Patong is the nightlife centre, packed with bars, clubs and discos

Patong is the island’s main tourist hub and its nightlife heart. This busy west-coast area has a 3 km beach, hotels, restaurants, the Jungceylon shopping centre and the famous bar street Bangla Road. It suits buyers who value an active holiday vibe.

What attracts investors:

strong infrastructure brings steady tourist flow and, as a result, a larger tenant pool;

consistently high occupancy, typically around 80–90%.

Best-fit strategy: short-term rentals, resale.

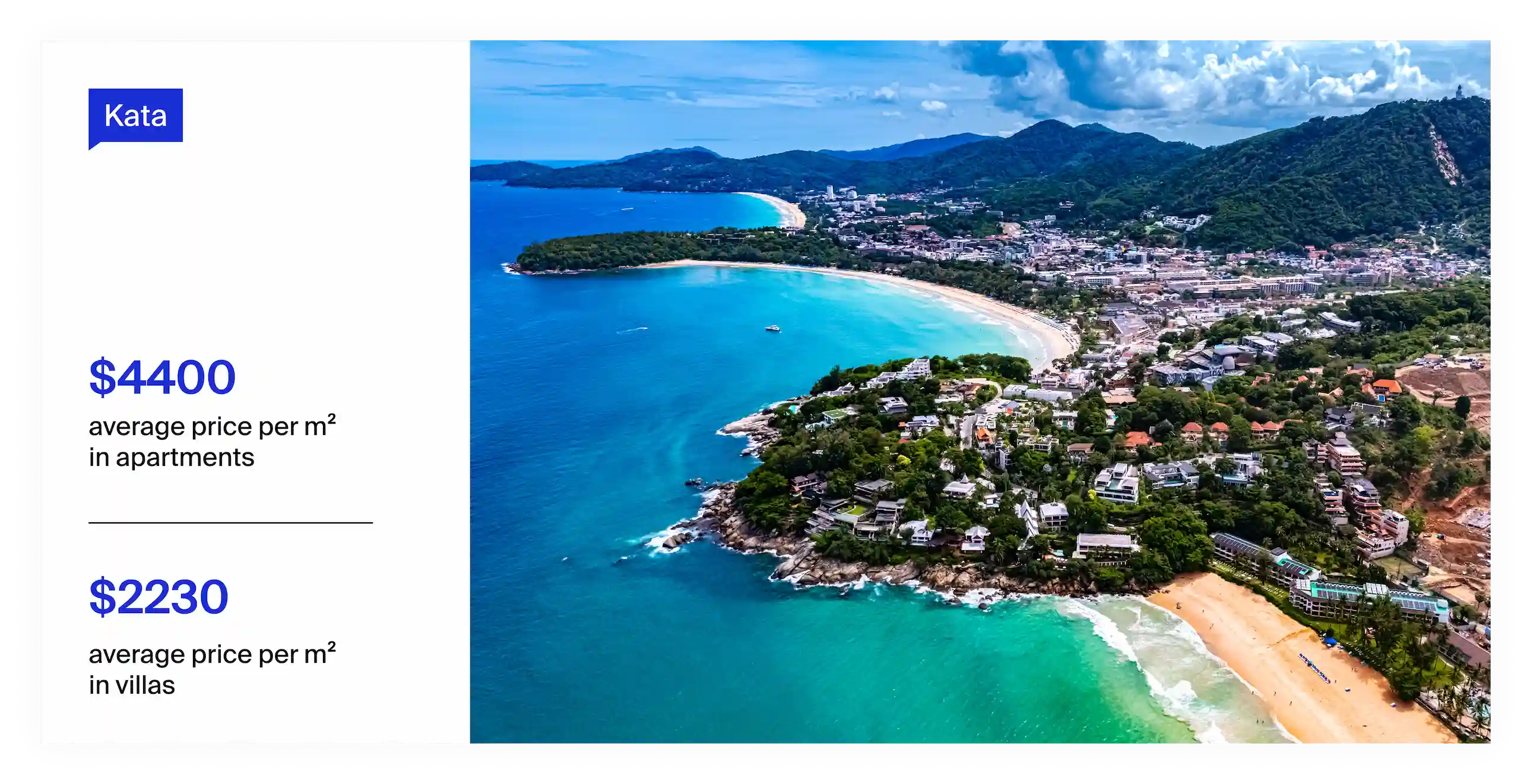

Kata

The resort stretches along Kata Beach (about 1.5 km). Do not confuse Kata with Kathu: Kata is on the coast, while Kathu is inland in the centre of the island

Kata sits in a bay between Kata Noi and Karon beaches. The sea is shallow, the entry is gentle and the sand is clean. Local points of interest include the Dino Park theme attraction, the Kata–Karon viewpoint and two temples: the Buddhist Wat Kitti Sangkharam and the Taoist Po Seng Ti-Te.

Tourists choose Kata for water activities. You can rent a jet ski, a banana boat, a parasail, a surfboard, a boat and more.

What attracts investors:

calmer than Patong but still in demand — many tenants are families visiting for a few days;

high seasonal occupancy, up to 90%.

Best-fit strategy: short-term and long-term rentals, resale.

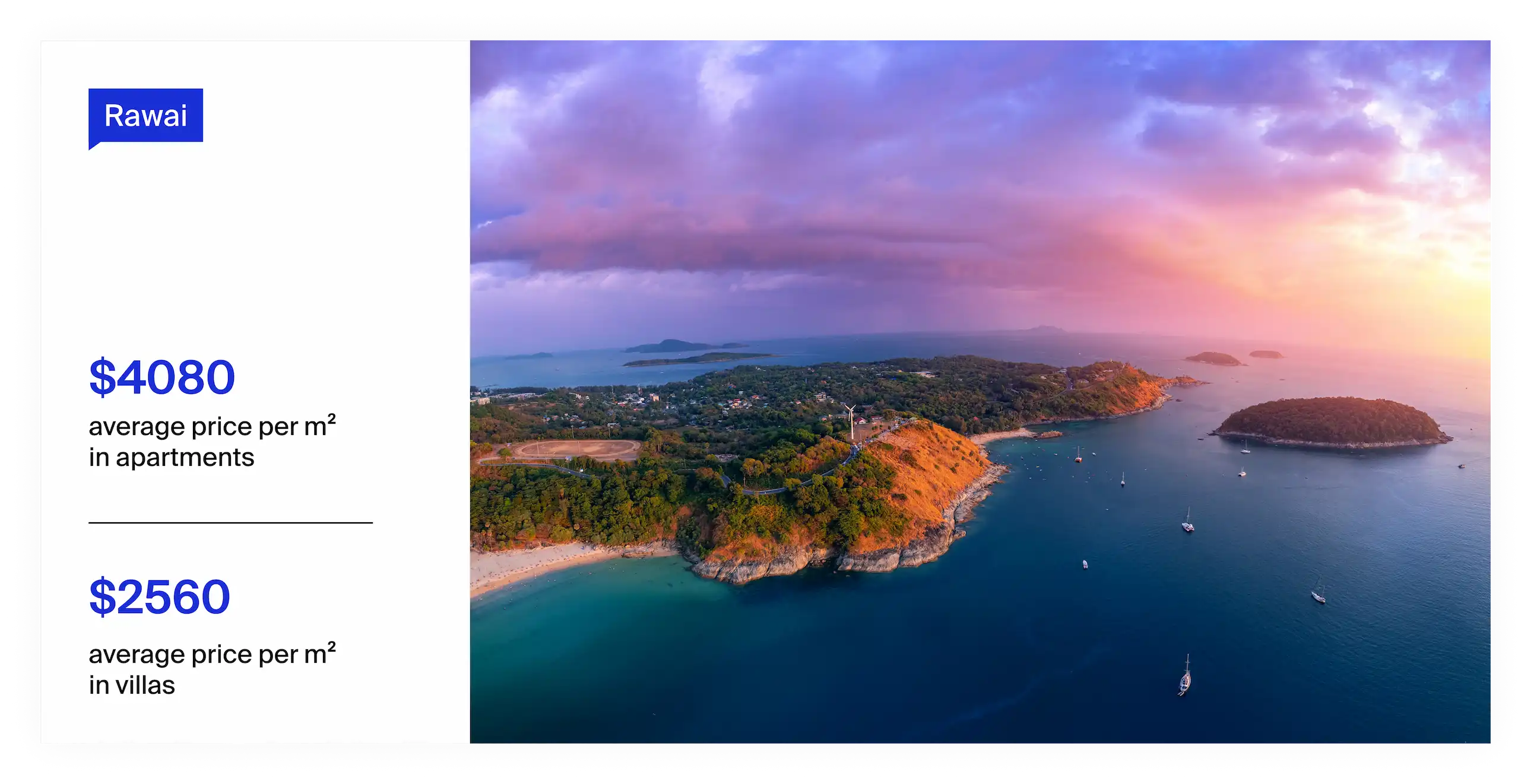

Ravai

Rawai is considered one of Phuket’s oldest settlements

Rawai is a cosy southern area known for its “village” feel and the Rawai Seafood Market with fresh seafood. Nearby are Promthep Cape and Nai Harn Beach, both popular for outdoor leisure.

What attracts investors:

the area is built up with residential homes and villas, but has fewer hotels, so long-term rentals are in demand;

a strong everyday network of restaurants, cafés, minimarts and markets makes the area comfortable for personal use.

Best-fit strategy: long-term rentals, personal use, resale.

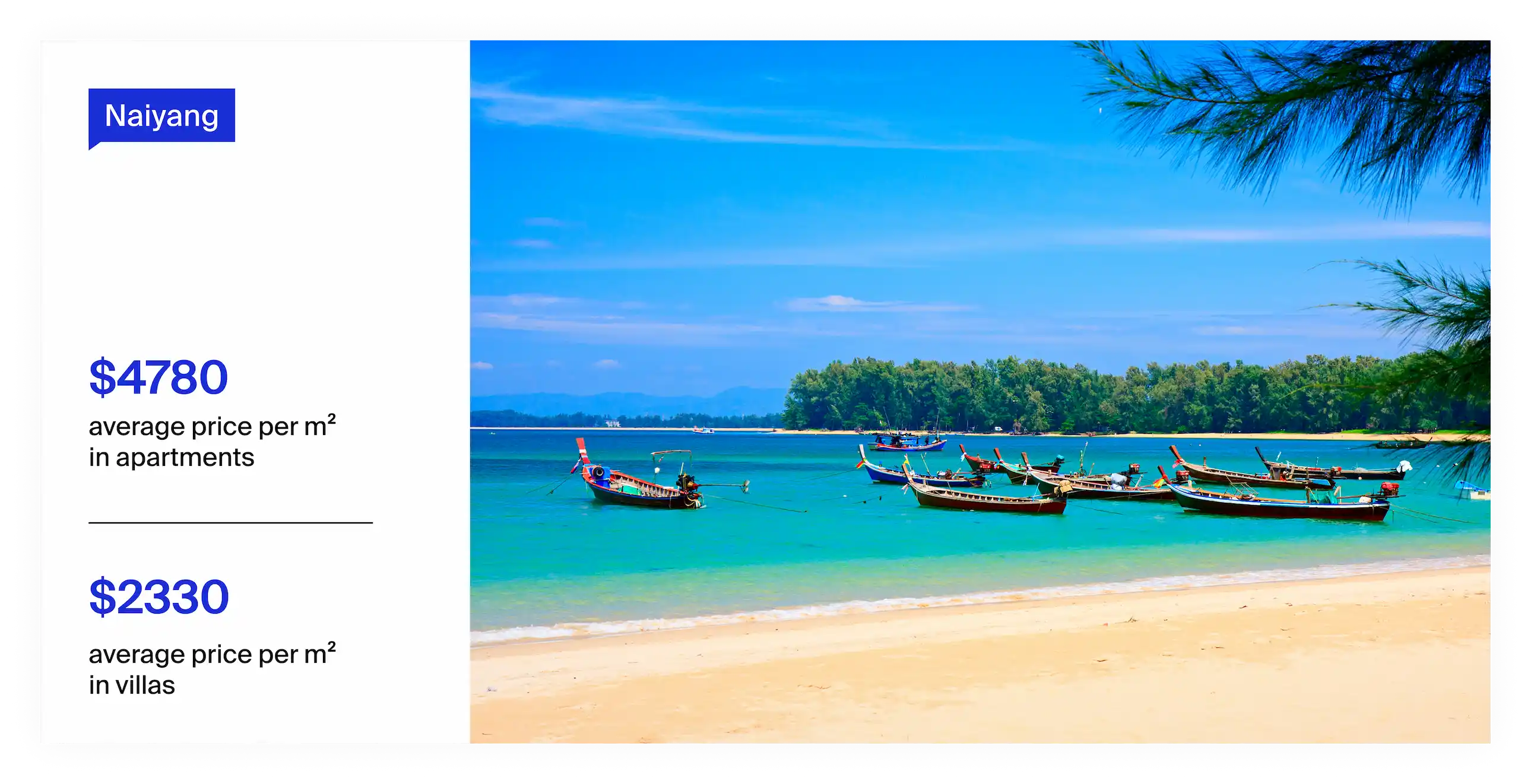

Naiyang

The whole Naiyang zone is within the protected Sirinat area, so there are no high-rise buildings or large hotels. As a result, long-term rentals are the main format here

Naiyang is a quiet north-west location close to the airport. Sirinat National Park is the main attraction. Part of the beach borders the park, so there is less development density. You still have cafés, shops and local markets.

What attracts investors:

airport proximity drives seasonal short-term demand, while in slower periods long-term rentals are common;

the national park border reduces the risk of noisy overdevelopment and helps preserve natural landscapes.

Best-fit strategy: short-term and long-term rentals, personal use, resale.

How to Choose a Phuket Area for Investment: A Step-by-Step Algorithm

You can buy property in Phuket remotely. The key is due diligence: check the location and the developer for reliability and investment potential. At Neginski, we run risk screening first — only 24% of offers pass our filter.

Below are 4 steps to choose a project and an area that match your goal.

Step 1. Define your goal and strategy

Do not mix these up. Goals include relocation, capital preservation and passive income. Strategy matters mainly for the last two.

For example, if your goal is capital preservation, your strategy is about whether you plan to exit and when.

If your goal is passive income, there are several approaches. In Phuket, you can rent out the property yourself, use a property management company or join a developer-run model: guaranteed returns* or a rental pool*. You can also resell at different stages: during construction, after completion or via flipping*.

*rental pool — a rental format where units are combined into one pool and operated as a single hotel. Income is shared among owners pro rata. It fits investors aiming for maximum yield who are comfortable with seasonality.

*guaranteed returns — a programme where the developer or the property management company fixes the profit amount and pays it annually regardless of actual occupancy. It fits first-time investors and anyone who wants a simple, predictable income model.

*flipping — buying a worn resale unit at a low price, renovating it and selling at a higher price.

Step 2. Set your budget

Minimum entry prices for new-build apartments from reliable Phuket developers start from $90,000, villas from $500,000. Developers often offer 5–10% discounts for paying in full. There are also promotions and closed launches, which are easier to track with an analytical agency.

Step 3. Choose a payment method

In Phuket, you typically have three options:

1. Pay in full. Since there are no escrow accounts in Phuket, this option is less common. Still, developers may offer special terms for full payment.

2. Instalments or post-handover instalments. Instalments are marketed as 0% interest until the end of construction. The down payment is typically from 15%, followed by staged payments until handover or a fixed date. Terms depend on the developer and the project.

A post-handover instalment plan usually means the final payment (often 40–50%) is spread over 1–5 years after handover at 3–7% p.a. This can reduce purchase pressure. If you rent the property out, rental income can help cover the remaining balance.

3. Mortgage. Technically available to foreign buyers, but often requires Thai residency, a work visa and proven local income for 2 years. Rates are typically 10–12%. In practice, this is harder to qualify for than instalments and can reduce net yield if your goal is passive income. Mortgages are more relevant for relocation buyers.

Step 4. Pick an area and a unit

Bangtao, Patong, Kata and Naiyang more often fit passive income: renting out the unit while the price grows. A typical exit is resale after 2–5 years.

For capital preservation, Bangtao, Kamala and Thalang are often stronger. These areas include premium projects that tend to hold value better during downturns.

For personal use, Bangtao, Thalang, Rawai and Naiyang are usually more comfortable due to quieter, family-friendly everyday infrastructure.

If you get stuck at any step, Neginski analysts can review your case and support the transaction. We stay with you end to end: from negotiating terms with the developer to handover inspection.

Where to invest $200,000–$500,000

in Phuket for a premium, low-risk buy

Sea-view and prime-location projects that fit your budget,

with risk kept in check and a clear exit in a few years

About the Author & the Company

Andrey Neginskiy

Real estate expert, CEO of Neginski

This article was prepared by the Neginski team — an international real estate agency with teams in Phuket, Moscow and the UAE. We support clients at every stage, from clarifying goals and selecting a project to completing the purchase and managing the property.

We work with 300+ developers, get early access to off-market launches, source rare listings and negotiate discounts. More than 30% of our clients come back for repeat purchases. Learn more about us.

Disclaimer

The information presented in this article is for general guidance only and does not constitute individual legal, investment or immigration advice. Property purchase terms, instalment plans, mortgage financing, rental arrangements and residency visa options in Thailand depend on the specific project, developer, bank, property status and the buyer’s individual profile.

Thailand’s laws and regulatory requirements may change. Before making any decisions, we recommend seeking personalised advice and checking the latest terms with the Land Department, the developer, the bank or licenced advisers.

Sources

This article is based on publicly available data, Neginski’s analysis and the team’s hands-on experience.

Links:

Phuket:average price per m² Properstar

Phuket FantaSea – The Ultimate Thai Cultural Theme Park | Official Site

FAQ

-

For rentals, Bang Tao, Patong, Kata and Nai Yang are usually the strongest picks. For personal use, Bang Tao, Thalang, Rawai and Nai Yang are typically more comfortable.

-

For income rentals, both matter. Proximity to the sea boosts demand, while infrastructure supports price and liquidity, especially in premium locations.

What to keep in mind:

short-term rentals depend more on walkability to the beach and tourist hotspots;

long-term rentals and living depend more on everyday infrastructure (shops, schools, transport).

-

Patong is best treated as a short-term rental or resale play. It is the nightlife centre, with many bars and clubs, so it suits tourists and active holidays more than personal living.

-

Choose areas close to nurseries and schools. HeadStart is one of Phuket’s strongest schools and is popular with expat families from Europe and Asia. It is located in the Bang Tao area.

-

The developer must be reliable. Check documents and tie payments to construction milestones.

What to verify:

building permit;

any ongoing litigation;

reputation and delivery record of past projects;

whether the appointed property management company is licenced.