Buying property in Thailand as a foreigner: high-yield real estate playbook

Grigory Kosych

Teamlead

Thailand is one of the most attractive real estate investment destinations in Southeast Asia — and for good reason. Property in Thailand remains affordable, with entry starting from just $100,000, while the potential returns are impressive.

Tourism is booming, with over 40 million visitors expected in 2025. This drives strong demand for both short- and long-term rentals, pushing rental yields as high as 12% annually. Meanwhile, property values are rising by up to 15% per year in key locations.

In this guide, we’ll walk you through how to invest safely, steer clear of common pitfalls, and pinpoint the best areas for strong returns.

$100,000+

Entry threshold

5–12%

Annual rental yields

5–15%

Annual property prices growth

5 reasons to invest in Thai property in 2025

Thailand offers a combination of macroeconomic stability, predictable regulations, and rising demand across key real estate segments. The market remains accessible to foreign buyers and continues to attract both lifestyle purchasers and private investors.

1. Stable economy, strong currency. Thailand’s economy is on solid ground. GDP grew by 3.2% in 2024 and is expected to grow by another 2.9% in 2025. Inflation is low — under 1% — and the Thai baht has stayed stable. For investors, that means fewer surprises and a better shot at long-term returns.

2. Resort prices rising fast. In resort zones like Phuket, off-plan property prices grow by 10–15% per year during the construction phase. Projects located near beaches and lagoons are especially attractive to both short-term investors and end users, which drives up entry prices early in the development cycle.

Upon completion, residential property in Thailand continues to appreciate at an average annual rate of 5–8%.

3. High rental income in top spots. In key locations, yields reach up to 12% per year. Rental demand is supported not only by inbound tourism but also by domestic trends. A recent survey by LWS Wisdom and Solutions found that over 66% of Thai Gen Z and Gen Y now prefer renting over ownership, citing flexibility and capital liquidity.

4. Reliable returns. Investors often target a payback period of 8–12 years in Phuket, assuming a mix of rental income and capital appreciation. That’s significantly shorter than in many major global cities: 17.7 years in New York, 24.5 years in Amsterdam, and up to 40 years in Paris.

5. Property can support long-term visas. Buying property in Thailand can support long-stay applications. Thailand Privilege Visa, formerly Thailand Elite, and Long-Term Resident (LTR) programmes allow qualifying investors to apply for residence permits of up to 10 years. These options include tax incentives, work eligibility and relaxed reporting requirements.

Grigory Kosych

Teamlead

Does buying property in Thailand grant residency? Thailand does not offer a residency-for-property program, unlike the UAE or several European countries. Buying property does not automatically lead to legal residence.

However, some developers include the Thailand Privilege Visa when buyers purchase units priced from THB 10 million — roughly $305,000.

Developers may also assist with the Long-Term Resident visa. This option is open to foreigners who meet specific criteria: holding at least $1 million in assets, earning an annual income of $80,000 or more, and being retired or working remotely.

Grigory Kosych

Teamlead

Where to buy real estate in Thailand: regional benefits explained

When considering where to invest in Thai property, three destinations typically dominate the conversation: Phuket, Bangkok, and Samui. Each offers its own appeal, but current market trends and development dynamics make Phuket the standout choice for many investors.

Phuket: high returns and room to grow

Phuket is Thailand’s top island for real estate investment — and here’s why it stands out:

5–12% rental yields and strong capital growth driven by booming tourism

Year-round demand thanks to airport expansion, new roads, and marinas — no longer a seasonal market

Limited land supply in prime areas like Bangtao and Rawai keeps prices growing

Sea-view units are especially sought-after and steadily appreciating

Still room to build — unlike Bangkok, Phuket offers attractive plots in top locations

Outside seismic zones, making it a more secure long-term investment

Foreign buyers can choose from beachfront condos, branded residences, and villa complexes — all supported by a growing premium infrastructure.

What to buy in Phuket: curated property selection

Bangkok: limited space, modest returns

Bangkok remains Thailand’s capital and business center — but as an investment market, it’s more mature and constrained. Key points to know:

Limited new supply — central districts are already densely developed

Rental yields average 4.5%, lower than in Phuket

Capital appreciation is comparable to Phuket on the resale market

Fewer growth opportunities compared to emerging destinations like Phuket

Still attractive for rental income, especially in established neighborhoods

In short: Bangkok offers stability, but Phuket currently delivers stronger upside for those seeking higher returns.

Samui: scenic, private — and highly regulated

Koh Samui attracts buyers with its lush landscapes and laid-back pace — but it’s a very different market from Phuket. Here’s what you need to know:

Strict building rules — height limits and coastal bans sharply restrict new supply

Mostly villas — condos are rare due to zoning laws; low-density, private market

Less tourist traffic — buyers often purchase for personal use, not short-term rental

No guaranteed rental income — demand is seasonal, and returns are harder to forecast

Limited infrastructure and fewer services compared to Phuket’s investment ecosystem

Samui is best suited for long-term buyers seeking lifestyle and privacy — not fast returns or guaranteed yields.

Need help finding the right property?

We remove the guesswork from property investment by vetting each developer for track record, financial stability and buyer feedback — offering only secure, high-potential options.

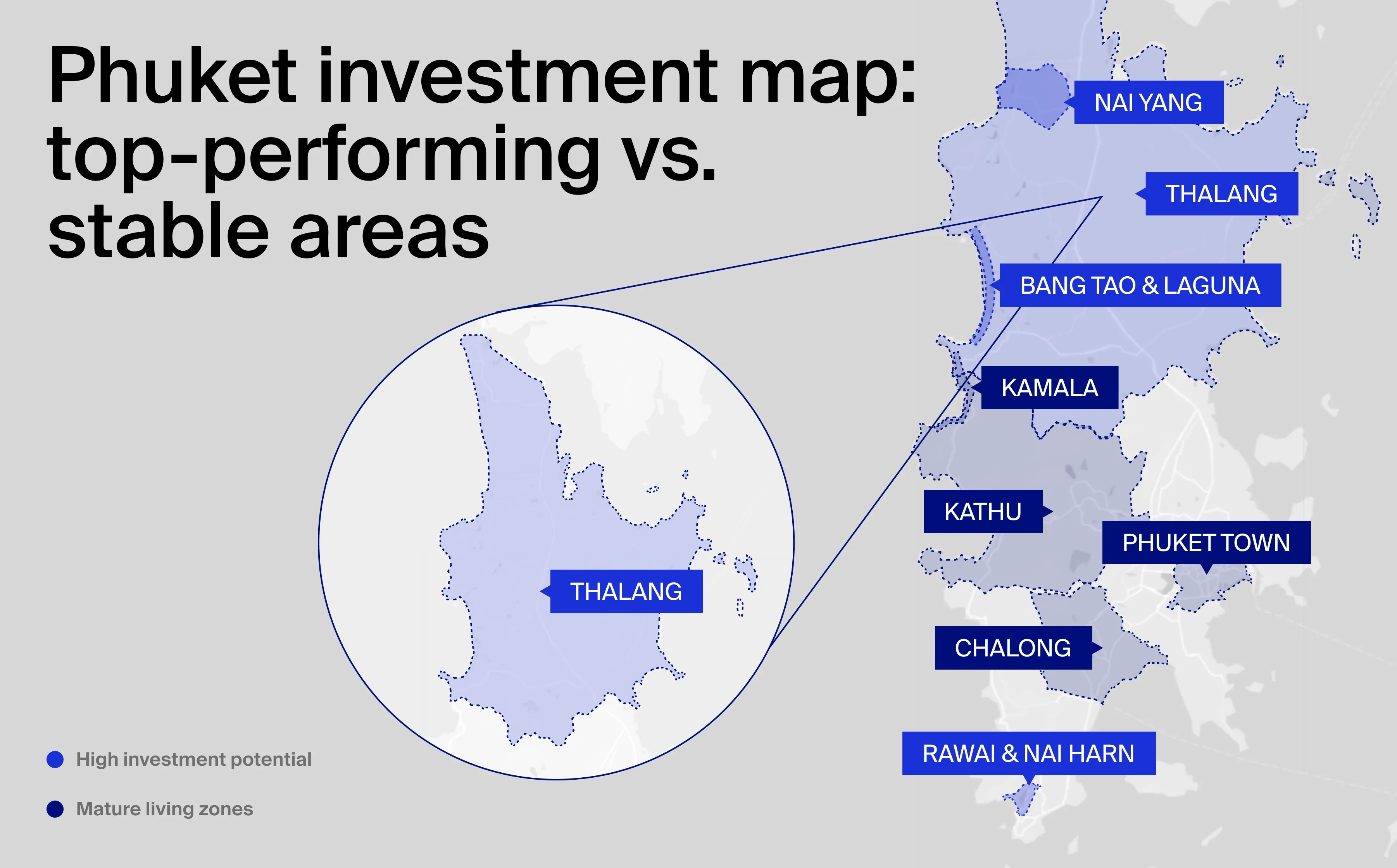

Best areas and winning investment strategies across Phuket

Investment strategies in Phuket are not confined to specific zones. Many modern condominium projects allow both short- and long-term leases within the same building, offering operational flexibility for investors. Neighbourhoods outside the main tourist areas primarily attract longer-term tenants — including expatriates, retirees, and remote professionals.

Bang Tao & Laguna — high liquidity, premium appeal. This is the most versatile zone on the island. Key features:

Ideal for short-term rentals, mixed strategies, and off-plan resale

Laguna adds international prestige and steady rental demand

Strong infrastructure and consistent price growth

Rawai & Nai Harn — stable cash flow, long-stay demand. This area is preferred by expats and families who rent year-round. Key features:

Quiet coastal living with access to key amenities

Long-term rentals perform well; short-term lets also possible

Suits rent-and-hold strategies with gradual appreciation

Nai Yang — early-stage market with future upside. This is an undervalued location near the airport. Key features:

Limited supply today, but infrastructure is improving

Not ideal for short-term gains, but promising for capital growth

Best for patient investors focused on mid- to long-term plays

Kamala — lifestyle market with limited liquidity. It is a scenic, low-density area with limited new development. Primarily chosen for personal living or long-term holds. Less suited for short-term investment or resale-focused strategies due to niche demand.

Thalang — residential scale, limited investment pace. It sits in the northern part of the island and covers a large, mostly residential area. While not as central or tourist-oriented, it offers access to international schools and proximity to the airport. Suitable for lifestyle buyers or long-term tenants, but capital growth is modest and rental demand can vary by sub-district.

Phuket Town, Chalong and Kathu — stable, local demand. These are older, local-centric areas serving families, students and some expats. Best suited for affordable long-term rentals, though growth is limited and competition can be high due to dense development.

Freehold vs. leasehold: how foreign buyers own property in Thailand

Foreigners in Thailand typically choose between two legal forms of property acquisition: freehold ownership and long-term lease agreements. Each follows a clear Thai law framework and applies to different types of assets.

Freehold is the closest equivalent to private ownership as understood in Western countries. The buyer receives full legal title to the condominium unit or villa, with the right to sell, transfer, inherit or gift it without restrictions.

Key features:

A building may allocate up to 49% of its total floor area to foreign ownership quota.

The purchase must be made with foreign currency transferred from abroad, supported by a Foreign Exchange Transaction form.

Land ownership is not permitted for foreigners, but buildings such as villas can be acquired freehold while the land is leased separately.

Transfer fees are higher for freehold units.

Leasehold is a long-term lease model that provides foreign buyers with full usage rights, usually for 30 years, with options to renew twice — totalling up to 90 years.

Key features:

Used not only to buy land; villas and condominiums can also be purchased on a leasehold basis.

Leasehold prices are typically 5–10% lower than comparable freehold units.

Transfer fees are lower.

The property is not subject to foreign ownership tax or declaration.

Leaseholders can resell their lease rights at any time, but the deal must be formally arranged via the Land Department. More details are available in our dedicated article on Thai real estate laws and legal structures available to foreign buyers.

Leasehold remains the most common form of property ownership for foreigners in Thailand, particularly for its lower costs and simpler registration process.

Grigory Kosych

Teamlead

How secure is property ownership for foreigners in Thailand? All property transactions in Thailand — freehold or leasehold — are registered with the Land Department. Ownership rights are documented in a Chanote, which includes legal details such as ownership history, encumbrances, and the buyer’s name in Thai.

For freehold, the Chanote confirms full legal ownership. For leasehold, it certifies the leaseholder’s rights over the property or land for the agreed term.

While leasehold is not legal ownership, the leaseholder has full control during the lease period. The landowner cannot sell, mortgage, or interfere with the leased asset.

Grigory Kosych

Teamlead

Step-by-step guide to acquiring property in Thailand

Foreigners can legally purchase property in Thailand — either freehold or leasehold — if they follow the correct procedure. At Neginski, we guide clients through each step — from first contact to key handover and legal registration — making the process smooth, transparent, and secure. Here’s how it works in practice.

1. Choose the project and the specific unit

Your budget, investment goals and lifestyle preferences shape the selection. Neginski’s analysts help you assess each villa or condo project in terms of location, infrastructure, developer reputation, floor plans, legal structure, and view potential. Title search and initial due diligence begin at this stage.

2. Negotiate the terms

This step includes discussions on pricing, discounts, payment schedules, furniture packages, and rental terms. For off-plan deals, it’s important to clarify the construction timeline and delivery guarantees from the developer before signing anything.

3. Reserve the property

A short deposit agreement is signed to reserve the unit and remove it from the market. The deposit typically ranges from 2% to 5% of the property price.

While this payment is generally non-refundable if the buyer cancels entirely, it can often be transferred to another unit within the same project, depending on the developer's policy.

4. Make the first instalment

You confirm the final price, payment schedule, and contract terms. This is when both parties sign the official Sale and Purchase Agreement or Lease Agreement. The initial instalment is typically 20–35% of the unit price and locks in your rights to the property.

5. Follow the instalment schedule

The remaining amount is paid in phases according to construction milestones — either based on construction progress such as foundation, structural works, roofing, and finishing, or according to a fixed time schedule like quarterly or semiannual payments. The final 10–20% is usually paid when the property is complete and keys are handed over.

6. Accept handover

Once the unit is finished, a property inspection takes place. You don’t need to be in Thailand for this — it can be done via video. Your representative at Neginski will verify the condition, finishes, appliances, and utilities before signing the handover report.

7. Register the ownership

At this stage, the property is formally registered with the Land Department. For freehold purchases, you receive a Chanote title deed in your name. For leasehold deals, your rights are recorded against the property. All taxes and transfer fees are paid at this point, typically split between buyer and developer.

Focus on the profits — we’ll take care of the rest

From paperwork and tenants to daily management, our Care Department handles every step of your property investment.

How much does it cost to own property in Thailand?

Thailand’s property market offers relatively low entry costs, with moderate taxation and a standardised registration process. To assess the full cost of ownership, foreign buyers should consider three elements: property price, one-time transaction fees, and taxes related to holding or resale.

Property prices in Phuket vary based on location, distance to the sea, project quality, and the stage of sales. Apartment prices start from THB 125,000, which is $3,500–4,000 per m², while premium developments can reach up to $8,000 per m².

Proximity to the coastline has a strong impact on pricing:

Beachfront — from $5,500 to $10,000 per m²

500–2,000 metres from the beach — from $4,000 to $7,000 per m²

2–5 km from the beach — $3,000 to $5,000 per m²

Over 5 km from the beach — from $2,500 per m²

Taxes on purchase. Transaction costs depend on the form of ownership. For freehold ownership, total transfer fees and taxes amount to 6.3% of the property’s appraised value. This amount is usually split equally between buyer and seller, meaning the buyer pays 3.15%.

If the property is resold within 5 years, the full 6.3% fee applies again. In most resale scenarios, the buyer usually covers the full amount. After 5 years of ownership, the fee is reduced to 3.5%.

For leasehold transactions, the registration fee is lower — 1.1% of the declared value — and is paid in full by the buyer. This rate remains unchanged regardless of how long the property is held.

Annual ownership tax. Thailand applies a land and building tax, with rates depending on the ownership structure and how the property is used:

Leasehold properties and freehold properties used to generate income are taxed at 0.3% annually.

Freehold residential units registered as a primary residence are taxed at 0.02% annually.

Tax on rental income. Rental income in Thailand is taxed progressively, from 0% to 35%, based on total earnings. Foreign property ownership must be declared, even if tax is also paid in the owner’s country of residence.

Thailand has double taxation treaties with many countries, including EU member states, which allow tax credits or exemptions under certain conditions.

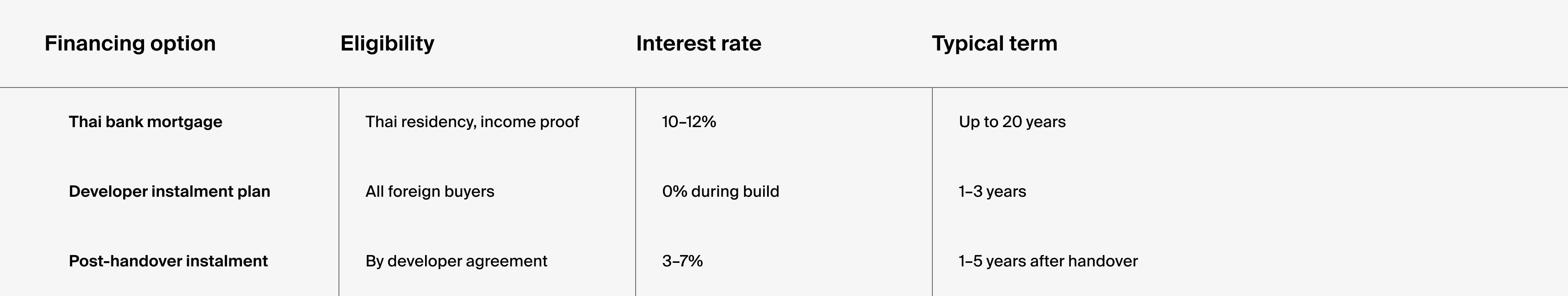

Financing options for foreign buyers

Thai property is not always acquired through full payment. Most foreign buyers use developer-backed installment plans, which offer flexible terms, lower entry thresholds, and the chance to benefit from capital growth during construction.

Mortgages. While bank financing is technically possible for foreigners, it’s rarely used due to strict requirements: Thai residency, a valid work visa, and proof of two years of local income. The property must be freehold, and interest rates are high — typically 10–12% annually. These terms exclude most overseas buyers. Some Thai banks do offer products for foreigners, but access remains limited.

Developer installment plans. Instead, foreigners typically rely on instalment options from developers, available on nearly all off-plan properties in Phuket. These are simple, flexible, and usually interest-free during construction.

Advantages:

No credit history or Thai bank account required

Passport is sufficient to sign the contract

0% interest during the build phase

Optional post-handover plans with 3–7% rates

Developers typically offer several financing models to choose from, based on either construction stages or fixed time intervals.

Mortgage vs. instalment plans: what works best for foreign buyers?

6 common challenges and how to overcome them

Generating consistent returns requires a clear understanding of local dynamics and disciplined financial planning. Below are the main challenges investors face — and structured ways to address them.

1. Choosing the wrong property type. A property may look appealing but still fail to align with an investor’s goals, especially in terms of demand and profitability.

If you plan to earn income through short-term rentals, consider apartments or villas in tourist zones.

For long-term lets, prioritise properties with infrastructure suited to expats and families.

2. Poor location. Famous or well-known areas don’t guarantee expected returns. A property in a district with weak transport links or no infrastructure nearby is unlikely to perform well. Evaluate real occupancy levels, nearby infrastructure, beach access, and strategic location based on development plans.

3. Developer reliability. Some developers miss deadlines or deliver properties that do not meet the stated quality. Check the developer’s track record, inspect past projects and make sure construction permits are in place.

4. Financial risks. Payment issues, falling yields or sudden currency fluctuations can directly affect final profit. Calculate ROI before purchasing and look into flexible payment schemes. Always set aside a reserve fund for common area maintenance fees and operating costs.

5. Market volatility. Economic downturns, pandemics, and other external shocks can reduce demand and affect pricing. To minimise losses, invest in properties with long-term appeal — near beaches, landmarks or golf clubs.

6. Entering too late in the project cycle. Timing matters — it affects both costs and returns. Buying at the pre-sale stage typically secures prices 20–30% below completed unit values, with additional benefits often available to early buyers. These can include free furniture and appliance packages, better payment plans, and exclusive early-bird discounts.

Purchasing post-completion carries lower risk, but limits short-term appreciation and access to these early incentives. Entering early in high-demand, well-branded developments with flexible terms can significantly enhance overall returns.

Want early access to top investment deals?

We’re among the first to know about Phuket’s hottest presales — and we help clients secure the best units before public launch. Book a consultation to explore high-yield opportunities.

Final thoughts about buying property in Thailand

Thailand combines lifestyle appeal with strong investment fundamentals. Annual property value growth of 5–15% and rental income yields of up to 12% make local real estate a viable strategy — not just a lifestyle purchase.

Phuket, in particular, offers a wide range of options — from affordable condos to premium landed property — each suited to different investment goals. The average payback period is around 12.5 years, placing the island among the top global housing market performers in resort destinations.

With proper due diligence and knowledge of Thai laws, buying property in Thailand can deliver long-term returns, asset security, and lifestyle benefits in one.

FAQ

-

Yes, but with limitations. Foreigners are not allowed to purchase land under Thai law, so buying a villa typically involves purchasing the structure and securing the land through a lease agreement — commonly structured as 30+30+30 years.

However, foreigners can legally acquire condominium units on freehold, provided the foreign ownership quota in the project does not exceed 49%. These purchases must be funded in foreign currency, with proper documentation submitted to the local land office. -

Yes — especially in strategic resort markets like Phuket, where property prices grow by 5–15% annually and rental yields reach up to 12%. The Thai real estate market remains accessible, with relatively low entry barriers, favourable property tax rates, and a well-regulated system of land and building tax.

With proper legal planning, a clear understanding of Thai property law, and an informed choice of location, buying property in Thailand can deliver stable income and long-term value. -

Key risks include choosing poorly located assets with weak demand, misunderstanding differences between leasehold and freehold, or engaging with unverified real estate agents. Overestimating rental yields or underestimating transaction costs can also impact performance. A full title search, due diligence, and expert legal review are strongly advised.

-

Yes. For owner-occupied freehold residential properties, the property tax is just 0.02% per year. For leasehold properties or units used for income generation, the rate is 0.3%.

-

Thailand's administrative structure differs from many Western countries — it has relatively few formal “cities.” Instead, most areas are organized as provinces with districts and subdistricts. For example, Phuket Island is a province, not a city, but it's widely seen as one of the top destinations for resort-style property.

Popular coastal areas like Bang Tao, Rawai, and Nai Harn are not official cities, but function like independent zones — each with its own market, infrastructure, and buyer profile. They offer luxury condos, branded villas, and strong investment potential. -

Phuket remains the strongest choice overall — not as a single city, but as a province with high-yield resort zones and a mix of lifestyle and investment opportunities. Bangkok, the country’s capital, also offers stable urban demand and full infrastructure, but with limited price growth.

-

Foreigners can legally buy property in Thailand — including condominium units under freehold ownership, or villas via long-term lease agreements. The buying process includes selecting a project, signing a deposit agreement, conducting a title search, and completing a sale and purchase agreement or lease agreement.

Ownership is registered with the Land Department, and relevant transfer fees are paid. For off-plan properties, buyers typically follow an installment plan tied to construction milestones.