Dubai property investment guide 2025: how to make the right move in a fast-changing market

Ksenya Kadesnikova

Investment-Focused Market Analyst

Dubai’s real estate market still offers strong returns — but in 2025, success depends on strategy, not hype. Zero income tax, capital growth, and rental demand continue to attract investors and end-users alike.

But buying “something in Dubai” is no longer enough. Now it’s about buying the right property with a clear plan.

This guide breaks down five working models: from rentals and off-plan resale to family living and hybrid use. The goal isn’t to chase the trend — it’s to align your investment with your intent.

$175,000

Entry threshold

6.5–12%

Annual rental yields

10–15 years

Average payback period

What is the best property investment in Dubai?

Dubai’s real estate market is vast, fast-moving, and full of opportunity. But these same qualities can overwhelm unprepared buyers. That’s why the most successful investors start not with districts or floor plans — but with strategic clarity. What do you want this investment to do for you: protect your capital, generate income, create lifestyle freedom, or unlock long-term upside?

There’s no such thing as the “best” property in Dubai — only the one that best serves your purpose.

Ksenya Kadesnikova

Investment-Focused Market Analyst

Let’s say you’re aiming for monthly income. The approach will be fundamentally different from someone chasing a quick resale or buying a base for their family. Dubai accommodates all of these — but mixing strategies without a framework is where most mistakes happen.

We’ve seen it too often: someone buys in a quiet residential area expecting short-term tourist demand — and ends up with poor occupancy. Or they try to flip a unit in an overcrowded district full of copy-paste listings. Others count on a surge in tourism in a desert suburb that hasn’t yet materialized. It’s not the property that fails — it’s the mismatch between goal and format.

Ksenya Kadesnikova

Investment-Focused Market Analyst

5 core strategies and how to use them right

1. Long-term rental. If your goal is capital preservation through consistent yield, this is the most hands-off model. Target units with family appeal in areas with schools, greenery, and metro access — Dubai Hills, Creek Harbour, JVC. Expect 6.5–9% net annually, minimal volatility, and strong demand.

2. Short-term rental. This format suits those seeking higher yields and flexible use. Locations matter more than finishes: proximity to beaches, metro, and landmarks drives bookings. Look at Dubai Marina, Downtown, Business Bay. With proper management, yields reach 7–12% net, but expect seasonality and more oversight.

3. Capital gain on resale. Buying early into off-plan projects and exiting just before handover can deliver 20–35% capital appreciation — but only if you pick the right developer and catalyst-driven location. Areas like Dubai Islands, Maritime City, Mina Rashid are tied to infrastructure growth. This strategy requires patience, insight, and timing — not gut feeling.

4. Buy-to-live. For clients prioritizing family life, education, and long-term comfort, yield is secondary. Safety, greenery, and schools take center stage. Properties in City Walk, Tilal Al Ghaf, Arabian Ranches, and Dubai Hills offer both livability and appreciation potential.

5. Hybrid use. Live part-time, rent out when away. This appeals to digital nomads, entrepreneurs, or buyers not ready to relocate full-time. The trick is flexible formats: branded residences, managed units, or areas with dual appeal — for example, JLT, Business Bay, Bluewaters.

How we help clients define their objectives and choose the right strategy

At Neginski, our process doesn’t start with listings — it starts with a structured brief:

Budget

Risk tolerance

Liquidity horizon

Expected involvement

Legal and tax context

Future use scenarios

From there, we filter dozens of options down to a handful that serve your intent. Whether that’s a branded studio in Marina with 10% net yield, or a townhouse in Expo City with upside tied to infrastructure — every recommendation is anchored in strategy, not impulse.

Dubai rewards clarity — and punishes guesswork. If you know what you want, the city delivers. If you don’t, the market will decide for you — often to your disadvantage. So before you browse portals or fly in for viewings, pause and reframe the question: not “What can I buy?” but “What should this investment do for me?” Only then does the right property become obvious.

Need help finding the right property?

We remove the guesswork from property investment by vetting each developer for track record, financial stability and buyer feedback — offering only secure, high-potential options.

Strategy 1: Long-term rental — stable income with minimal oversight

At first glance, the numbers made perfect sense. A one-bedroom apartment, bought off-plan at launch with a generous discount and a smooth payment plan. Yields promised in the brochure were above market. Visuals showed rooftop gardens, panoramic windows — everything a tenant could want.

Until handover. The building stood alone on the edge of the city, disconnected from transport, schools, or daily infrastructure. Months passed without a tenant. Rent had to be dropped. The “promised yield” never materialized.

Ksenya Kadesnikova

Investment-Focused Market Analyst

This story isn’t about a bad property. It’s about a property detached from how the long-term rental market in Dubai actually works. What drives success in this strategy isn’t the property — it’s alignment with tenant logic.

In long-term rentals, the tenant is your business partner. Your return depends not on hype or brochures, but on someone choosing to live in the space, long-term, and pay reliably for it. When you look at it this way, the rules become clearer — and far more predictable.

Ksenya Kadesnikova

Investment-Focused Market Analyst

Tenants in this segment aren’t looking for novelty. They want three things:

Location that saves time on commuting — with access to schools, parks, malls, and walkable areas

Home that feels functional and safe

Lease they can renew without surprises

The properties that best meet these needs stay occupied. The ones that don’t — even if newer or “nicer” — sit empty or force frequent rent cuts.

What types of property actually work

1–2 bedroom apartments dominate demand. They’re the preferred format for the city’s most stable tenant profiles — salaried professionals, young couples, and mobile expats. They’re easy to rent, and even easier to re-rent.

Townhouses are gaining ground. Particularly in communities like Arabian Ranches, Damac Hills or Dubai Hills, where families seek space and safety without the price of a full villa. Townhouses with three bedrooms, small gardens, and good connectivity stay occupied for years.

Compact, efficient layouts outperform large ones. A 65 m² one-bedroom with smart zoning, a balcony, and storage will rent faster than a 110 m² open-plan “loft” with no functional space. Efficiency isn’t about square metres — it’s about usability.

Mid-floor units in mid-rise buildings tend to hit the sweet spot: good views, manageable service charges, and practical daily living. High floors often come with long elevator waits and higher AC bills — not a plus for value-driven tenants.

What to avoid? Large-format apartments of 3+ bedrooms in business districts almost always underdeliver. Their size appeals to families, but the area doesn’t. Their location suits executives, but not their housing style. This mismatch drives chronic vacancy.

Top areas for long-term rental investment

| Area | Why it works | Average net yield | Entry price | Typical tenant |

|---|---|---|---|---|

|

Dubai Hills Estate |

Master-planned, parks, schools, strong family appeal |

6.5–8% |

$465,000 |

Mid- to upper-income families |

|

Jumeirah Village Circle (JVC) |

High-yield mid-market hub with growing infrastructure |

7.5–9% |

$200,000 |

Singles, couples, first-time expats |

|

Jumeirah Village Triangle (JVT) |

Quiet, residential area — 90% ready, with a large mall and top-rated schools |

7.5–9% |

$200,000 |

Singles, couples, families with kids, first-time expats |

|

Dubai Creek Harbour |

Emerging community, waterfront, retail, upcoming metro station and Creek Tower with a large mall |

6–7.5% |

$505,000 |

Families, long-term mid- to upper-income expats |

|

Expo City |

Metro access, post-Expo investments, public sector growth, fully developed infrastructure, and a car-free city core with high safety standards |

7–8.5% |

$490,000 |

Early movers, government employees |

|

Dubai Sports City |

Affordable, schools nearby, highway access |

7–8% |

$175,000 |

Budget-conscious families, expats |

Why long-term rental strategy quietly outperforms

1. Structural demand. Dubai’s population is growing — and not just through tourists or speculators. Professionals relocate for work. Families move for safety, infrastructure, and schooling. These people sign annual leases and look for stable homes. In well-planned areas with parks, transport, and education, long-term demand is not just “strong” — it’s systemic.

2. Clean margins. There’s no income tax on rent. That means your gross yield is effectively your net — after service charges and basic upkeep. This creates clarity and predictability rare in other major cities. You know what you’re earning, you can plan and scale.

3. Repeatable returns. When structured properly, this strategy starts at 6.5–9% net annually — but what makes it stand out is that returns aren’t static. In Dubai, rental yields have shown a consistent upward trend, driven by a growing expat population.

For anyone planning to invest in Dubai for reliable, long-term income — without constant switching or hands-on oversight — this strategy offers stability, scalability, and strong fundamentals. As rents rise, ROI grows passively, compounding your gains over time.

Strategy 2: Short-term rental — high cash flow with up to 12% ROI

Dubai’s short-term rental market isn’t just profitable — it’s designed to work. The city attracts guests all year round, has strong infrastructure, and makes it easy for visitors to book and stay. Here, properties with the right look and location rent out quickly — not because they’re the cheapest, but because they spark interest and feel worth the price.

For investors, this means one thing: yield is not a function of square meters. It’s a function of attention, mood, and perceived value — all compressed into a booking window of 5 to 20 seconds. The unit that wins isn’t always the best. It’s the one that books first.

Ksenya Kadesnikova

Investment-Focused Market Analyst

Unlike most global cities, Dubai doesn’t have a dead season. Summer here isn’t a lull — it’s a shift: discounted hotels, shopping festivals, and air-conditioned leisure. Meanwhile, digital nomads, remote workers, consultants, and new expats move through the city every month. Result: occupancy stays high, while rates flex around demand instead of collapsing under it.

And because income tax on rentals is zero, net yield equals gross yield minus operating costs. That’s rare. Most global markets eat 20–40% of rental income in taxes before you see a return. In Dubai, the spread between promise and performance is narrower.

Ksenya Kadesnikova

Investment-Focused Market Analyst

Formats that maximize ROI

Studios and 1-bed apartments. Easy to manage, quick to turn, always in demand. Offer the cleanest operating model for individual investors.

Branded residences and serviced apartments. Unlock hotel-grade services and higher nightly rates. Book better, resell faster, manage easier.

View-first units. If the first photo doesn’t inspire, nothing else matters. Marina skyline, sea horizon, Burj Khalifa silhouette — these pay for themselves in click-throughs.

Best districts for short-term rentals

| District | Strategic advantages | Average net yield | Entry price | Target guest type |

|---|---|---|---|---|

|

Dubai Marina |

Waterfront, dining, nightlife, yacht charters |

8–11% |

$380,000 |

Couples, bloggers, leisure tourists, and relocators |

|

Downtown Dubai |

Burj Khalifa, malls, event density |

7–10% |

$490,000 |

Affluent travelers, business guests |

|

Business Bay |

Central, metro, flexible stays, commercial adjacency |

7–9% |

$300,000 |

Consultants, digital nomads, event travelers |

|

Jumeirah Lake Towers (JLT) |

Walkable, metro-connected, alternative to Marina |

7–8.5% |

$300,000 |

Short-stay tourists, budget-conscious guests |

|

Dubai Islands |

Beachfront, branded hospitality, resort potential |

8–12% |

$460,000 |

Lifestyle travelers, premium leisure guests |

Where short-term rental strategies might fail and how to avoid it

New investors often copy long-term logic: cheap units, decent layout, hope for the best. But short-term guests are not tenants. They don’t plan. They scroll, they filter, they click what pops. They want a feeling. The product isn’t shelter — it’s fantasy. The best-performing units understand this — and are optimized around five levers of emotional conversion.

1. Visibility = viability. Most guests will never read your listing. You have one frame to stop the scroll: skyline view, curated design, lighting, and layout that reads instantly as “aspirational.” This is why units in projects by Ellington, Imtiaz, or branded residences outperform — they’re engineered for platforms like Airbnb and Booking.com. They’re not just functional — they’re photogenic.

The right image works better as the first photo for short-term rentals: it evokes emotion, feels more inviting and intimate, and helps guests imagine themselves relaxing there

2. Location is not distance — it’s perception. Being “10 minutes away” doesn’t matter if the guest can’t see the action. Tourists want to be inside the city’s story. That means visible landmarks, walkable surroundings, and instant orientation. A block too far from Dubai Mall, Bluewaters, or Marina Walk, and your listing drops 30% in clicks and 40% in occupancy. Guests don’t zoom in on maps, they just move on.

3. Water and brand are instant trust signals. Units with sea views or branded operators book faster at higher rates. Not because they’re objectively better — but because they signal consistency. For guests choosing under time pressure, this removes doubt. Projects on Dubai Islands, Rashid Yachts & Marina, or under hotel management aren’t just beautiful — they’re reliable. And reliability drives willingness to pay.

4. Amenities shape emotion — not just experience. Rooftop pool. Spa. Co-working zone. Lobby café. These aren’t luxuries — they’re conversion mechanisms. Guests don’t buy square footage. They buy how it feels to arrive. Buildings that offer resort-like infrastructure produce better reviews, higher nightly rates, and repeat bookings. The effect compounds. Emotional value becomes financial value.

5. Access reduces friction. If your guest needs a car, you’ve already lost 30% of the market. Metro proximity, airport access, or short ride times to Downtown are non-negotiable. Even in peak summer, guests will choose Business Bay, JLT, or Downtown over newer areas that require logistics. Convenience isn’t a feature — it’s an eliminator.

In Dubai’s short-term market, performance isn’t random — it’s designed. The right property, in the right building, with the right finish and framing, can outperform a less optimized unit by 50–70% annually on the same square footage.

This is not passive income, it’s operational revenue wrapped in hospitality. For those who want high cash flow, global demand, and 12-month liquidity, this is one of the most precise and scalable strategies on the market.

What to buy in Dubai: curated property selection

Strategy 3: Off-plan resale — capital growth through smart timing

For investors who prioritize capital accumulation over rental yield, Dubai’s off-plan resale model offers one of the most scalable and asymmetric strategies in the market. Capital appreciation of 20–35% between purchase and resale aren’t outliers — they’re engineered outcomes in projects where entry logic and exit demand align.

Off-plan investments offer early access at launch-stage pricing, often with staggered payment plans. That means your capital is only partially deployed while the asset appreciates through each construction milestone.

Ksenya Kadesnikova

Investment-Focused Market Analyst

This only works if your unit speaks directly to the next buyer’s logic — not yours. Most failed resales occur not because the market underperforms, but because the asset has no end user at exit.

Ksenya Kadesnikova

Investment-Focused Market Analyst

Many investors lean on big names, assuming a project from a “top-tier” developer guarantees resale. It doesn’t. Buyers don’t purchase a name — they purchase location, product-market fit, view security, and perceived scarcity. A branded tower surrounded by ten other launches will still dilute resale value if supply overwhelms absorption.

The core error investors make is buying what’s marketed, not what actually sells at exit. Flashy payment plans. Interior visuals. Branded lobbies. These sell the first buyer — not the second. The resale buyer wants something else: instant usability, fixed views, metro access, and emotional clarity. If investors don’t model for that demand, their margin vanishes in fees and price cuts.

Want early access to top investment deals?

We’re among the first to know about Dubai’s hottest presales — and we help clients secure the best units before public launch. Book a consultation to explore high-yield opportunities.

What drives strong resale premiums

Location scarcity. Projects in physically constrained areas — such as islands or prime waterfront plots — command higher resale values due to natural land limits and long-term demand.

True rarity of product. Mid-rise branded buildings on the first shoreline, limited unit counts, phased releases — all create a sense of exclusivity. When buyers know there’s nothing else like it, pricing power grows.

Transit proximity. Metro access elevates appeal among end users, which strengthens long-term demand and supports premium resale pricing.

Lifestyle infrastructure. Projects with lagoons, marinas, wellness zones, or co-branded hotel services are perceived as more than just homes — they build emotional urgency and ecosystem value.

Checklist for exit-oriented buying

Time your liquidity, not just your entry. Ask: when will I be able to resell — legally, practically, and competitively? The resale window often opens well before handover, but momentum peaks close to completion.

Audit the view risk. If the lagoon or marina isn’t yet built, check zoning. Ask for height maps. Don’t assume brochures reflect final visibility.

Understand delivery congestion. If your tower completes alongside six others in the same block, your unit becomes a commodity. Scarcity disappears — and so does pricing power.

Model real friction. Factor in all exit costs: NOC, agency commission, admin fees, price suppression from nearby stock. On average, this reduces real ROI by 5–7%.

Know your buyer before buying. Who are they? What will they pay for? If the only buyer is another investor with your same logic, it will be difficult to build margin.

Best districts for off-plan resale

| District | Resale catalysts | Price growth at completion | Entry price | Exit strategy |

|---|---|---|---|---|

|

Dubai Islands |

Sea views, masterplan limits future supply |

Up to 35% |

$460,000 |

Post-handover to end-users seeking lifestyle |

|

Maritime City |

Marina adjacency, skyline growth, urban rarity |

Up to 30% |

$580,000 |

Mid-to-late cycle flip on lifestyle value |

|

Mina Rashid |

Cruise port prestige + branding, phased build-out |

Up to 30% |

$545,000 |

Sell into post-launch end-user market |

|

Expo City |

Infrastructure catch-up, metro, legacy positioning |

Up to 30% |

$490,000 |

Exit as core transport links activate |

|

Al Jaddaf |

Central undervaluation, greenery, inner-city feel |

Up to 25% |

$380,000 |

Handover resale as area reaches maturity |

|

Business Bay (select pockets) |

Downtown spillover, branded launches |

Up to 25% |

$300,000 |

Early resale or branded asset at keys |

|

Downtown (select pockets) |

Iconic anchors, buyer prestige |

Up to 30% |

$490,000 |

End-user flip at completion |

|

Dubai Marina (select pockets) |

Branded towers near waterfront, resale liquidity |

Up to 30% |

$380,000 |

Pre-handover resale to lifestyle buyers |

Strategy 4: Hybrid use — flexible format for personal use and rental income

Not every buyer wants to be an investor. And not every investor wants to give up personal use. The hybrid model exists for those in between: people who value autonomy — over where they stay, when they earn, and how they use their assets.

In its essence, this is a strategy about control. You own a property that welcomes you — when you need it — and works for you — when you don’t. It’s not passive income. It’s programmable utility: a unit that responds to your life cycle, not the other way around.

Why this model is gaining ground

Many people today don’t fit the binary profile of “homeowner” or “landlord.” They split time between geographies. They work remotely. They winter in Dubai, but summer elsewhere. They want a lock-up-and-leave base — but they also want cash flow. In that context, the hybrid model isn’t just convenient. It’s optimal.

It offers:

Seasonal residence without sunk cost

Income generation without full commitment to yield

Visa access without the pressure of full-time use

Exit flexibility — you’re not locked into either model

Ksenya Kadesnikova

Investment-Focused Market Analyst

A real hybrid unit must satisfy two types of users with opposing logic: you, who want comfort, privacy, and familiarity, and your guests, who expect clarity, speed, and service.

The layout must make sense to both. The finishes must hold up under use, and the amenities must appeal emotionally to a guest.

Ksenya Kadesnikova

Investment-Focused Market Analyst

Where hybrid actually works

A hybrid strategy depends less on property class and more on urban logic. You need neighborhoods where:

Short-stay demand is resilient year-round

Services — metro, groceries, medical — are walkable

Guest profiles are transient, but quality-oriented

And, critically — you’d genuinely want to stay there yourself

Best locations include:

Dubai Marina & JLT — Tourist-magnet meets resident logic. Beach, metro, malls, and mixed inventory.

Downtown & Business Bay — Strong nightly rates, walkable access to culture and commerce.

Dubai Islands — Coastal lifestyle, expanding infrastructure, and hotel-adjacent dynamics.

Palm Jumeirah (select) — Premium cachet, branded services, but flexibility varies by tower.

Dubai Creek Harbour — Serene, scenic, structured, and ideal for long-weekend guests and owners alike.

Know your returns before you invest

We’ll assess your goals and opportunities and run the numbers.

Strategy 5: Family living — long-term comfort and future value

When the purchase is driven by life plans, not speculation, the criteria change. You’re no longer looking for the best yield per square foot. You’re looking for consistency, safety, infrastructure that grows with your family, and an asset that doesn’t just hold value — it holds relevance.

Buying a home to live in — especially with children — shifts your perspective from financial tactics to long-range strategy. But here’s the advantage: in Dubai, family-oriented real estate doesn’t force you to choose between comfort and value growth. The right property does both.

The real selection filter: functional continuity

When we help families choose, the question isn’t just “Where will this child grow up?” It’s also:

Will the mall, clinic, or park be finished before your child is born?

Will their school be 10 minutes away, or 45?

Will the quiet street in front of your villa stay that way when nearby construction finishes?

Will your child feel safe walking home, biking to a friend, playing outdoors at 6pm?

In that context, not all “family areas” are equal. Some are branded as such. Others are built as such.

Family living in Dubai also offers three systemic advantages:

Residency tied to ownership. A property from $205,000 gives you a renewable 2-year visa; $545,000+ opens a 10-year golden visa with family sponsorship.

Tax transparency. No income tax, no annual property tax. Holding costs are known in advance.

Full freehold rights in designated areas. Families can own, inherit, and plan for the next generation without legal friction.

What defines real family-ready product

Integrated infrastructure — not promised, but present: schools, clinics, retail within the masterplan.

Traffic logic — no highways running through your block. Inner roads built for strollers, not speed.

Layout foresight — storage space, balconies, shaded areas, not just glass and show kitchens.

Community behavior — do people here live or invest? If villas are empty, pools unused, lights off at night — it’s not a family area, it’s a brochure.

Best districts for family living

| District | Why it works for families | Entry price |

|---|---|---|

|

Dubai Hills Estate |

Designed from scratch with family logic |

$465,000 |

|

Schools, hospitals, and malls integrated |

||

|

Central park spans 180k+ sqm |

||

|

Golf and cycling tracks support outdoor routines |

||

|

EMAAR-backed, with long-term liquidity |

||

|

Dubai Creek Harbour |

Quieter than Downtown, with skyline views and clean air |

$505,000 |

|

Stroller-ready sidewalks |

||

|

Upcoming schools and clinics make it a next-decade anchor for family life |

||

|

Jumeirah Village Circle (JVC) |

Compact, accessible, affordable — ideal for first-time family buyers |

$300,000 |

|

Low-rise clusters with parks, nurseries, and practical layouts |

||

|

Community is mature and active |

||

|

Jumeirah Village Triangle (JVT) |

90% completed, with ready infrastructure |

$200,000 |

|

Top-rated schools and nurseries within the district |

||

|

Green parks, quiet streets, and a strong residential feel |

||

|

Home to one of the city’s largest community malls |

||

|

Expo City |

Safe, car-free city center |

$490,000 |

|

Excellent metro access and walkable infrastructure |

||

|

Well-developed parks, schools, and clinics already in place |

||

|

Backed by government investment, ensuring long-term stability |

What’s also important is that these family homes outperform in the long run because they’re not designed to be sold. They’re designed to be lived in. But paradoxically, this makes them easier to resell when needed — to other families who value the same logic.

That’s the exit liquidity few investors think about: not yield chasers, but families entering the same stage you’re leaving. In a city with constant population inflow, these cycles repeat — and a well-chosen family home becomes a stable, appreciating asset with minimal turnover stress.

Final thoughts: Invest in what matches your strategy

The biggest advantage Dubai gives investors is not product variety — it’s strategic range. You can build income, grow capital, preserve wealth, relocate your family, or create optionality. But that same range becomes noise when there’s no internal filter.

While property prices often dominate investor conversations, they’re only one piece of the equation — context, timing, and strategy matter more than any headline number.

Success here doesn’t come from spotting the best deal. It comes from knowing why you’re in the market at all. Once that lens is clear, everything else sharpens. Neighborhoods fall into place. Product formats make sense. Risk becomes measurable. And — most importantly — you stop shopping and start selecting.

What actually makes an investment “best”? It’s not price per square meter, not view, not brand.

It’s this: Does the property solve a specific problem in your life or portfolio — better than other tools available? If the answer is yes, that’s your asset. If it’s “maybe,” keep looking.

Focus on the profits — we’ll take care of the rest

From paperwork and tenants to daily management, our Care Department handles every step of your property investment.

FAQ

-

You can start from $175,000 for a studio in emerging areas. For visa eligibility, the threshold is $205,000. Entry price varies by location, project stage, and rental potential. Properties in a prime location tend to start higher but offer stronger long-term value and demand.

-

For off-plan resale, the typical cycle is 24–36 months depending on the project timeline. For rental properties, you can start earning within weeks — but real net yield stabilizes after 6–12 months of operation.

-

In most cases, no — local mortgages are only available to UAE residents with documented local income. However, some developers offer post-handover payment plans that mimic financing without bank involvement.

-

Ownership costs in Dubai are relatively predictable. Annual service charges usually range from $8.7 to $87.1 per square meter. Monthly utilities for a standard apartment start at $80. If you rent out short-term, property management is optional and charged separately. There’s no income tax and no annual property tax, which keeps holding costs low by international standards.

-

It depends on your goal. Off-plan is better for capital growth and staged payments, but requires patience and market reading. Ready units are better for immediate rental income or family use — and offer more clarity on what you’re buying. Many of the best areas to invest in Dubai include a mix of both formats, giving investors flexibility based on their strategy.

-

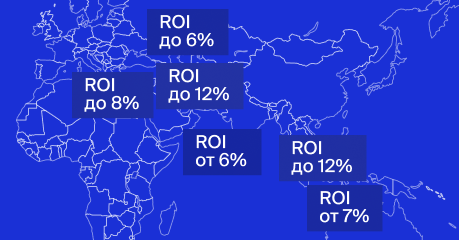

Dubai offers 6.5–12% net rental yields, 20–35% capital growth on off-plan resale, zero income tax, and strong demand driven by infrastructure expansion and population growth. With clear strategy and the right location, Dubai real estate investment remains one of the most attractive and scalable opportunities in 2025.