How to Buy Real Estate in Dubai in 2026: Prices, Fees, and a Step-by-Step Buying Process

Андрей Негинский

Основатель Neginski, инвестиционный эксперт рынка недвижимости

Neginski clients often buy in Dubai for two reasons: to live there and to earn rental or resale income. This guide explains how the market works and what to consider before purchasing.

At a Glance

Foreigners can buy freehold property in Dubai, and there is generally no mandatory holding period before resale. It can be used to preserve capital, generate income and qualify for residency.

Prices for high-liquidity units (easy to rent and resell) typically start from around $180,000. Transaction costs are up to 5%. Typical gross yield ranges are often quoted at 6.5–9% per year for long-term rentals and up to ~12% for short-term rentals, depending on the unit, fees, occupancy and management. Buying can be done remotely, and many off-plan projects offer developer payment plans (often marketed as ‘0% interest’) up to handover.

To make sure the investment achieves the intended result, choose your strategy upfront: rent out the property, resell or buy it to live in. Then evaluate the right areas and calculate all additional costs. The deal is registered through the Dubai Land Department (DLD). From selecting a property to registering ownership, the entire process can be completed online through a clear, regulated workflow.

Who Should Buy Property in Dubai

You can use Dubai real estate to preserve capital, support a relocation or generate passive income. Before choosing a property, be clear about your goal — it will shape both your returns and your quality of life.

Long-term rental investors

A reliable way to preserve capital and earn income in a stable currency.

Pros: a comfortable entry point from $180,000, transparent market, no local tax on rental income in Dubai (your home-country tax rules may still apply). Rent increases are typically guided by Dubai’s RERA Rental Index, which sets reference ranges by area and property type.

Cons: returns are lower than with short-term rentals.

Risks: vacancy periods if the asking rent is set too high.

Rental yield: 6.5–9% per year.

Short-term rental investors

A strategy for investors who accept volatility in exchange for higher returns.

Pros: yield is higher than with long-term rental. Daily operations can be delegated to a property management company — you receive reports and profit.

Cons: short-term rentals are not allowed in every residential building. You may need to register a contract with a management company, or obtain the required holiday-home permit or licence (and register the unit) with Dubai’s tourism authority; platforms like Airbnb are distribution channels, not the licensing body.

Risks: high competition, seasonal swings, frequent repairs and wear-and-tear.

Rental yield: 7–12% per year.

Resale investors

This approach suits experienced buyers. The strategy involves reselling an off-plan property via assignment (subject to the developer’s rules, payment milestones and transfer fees), either before handover or after completion, depending on the expected return and acceptable level of risk.

Pros: requires minimal involvement, mainly signing the contract at purchase and again at resale.

Cons: potential construction delays and a limited pool of buyers at the exit stage.

Risks: the unit may be hard to resell. To improve your chances, assess the developer’s reputation, payment schedule, location, infrastructure and demand.

Capital growth: 7–10% annually.

Business owners and commercial property investors

Relevant if you plan to move your company to the UAE. This can provide status, tax advantages and long-term stability. It’s important to choose premises that match your licensing setup (mainland vs free zone). For example, DIFC and DMCC are popular business jurisdictions with their own rules and cost structures, for example, DMCC and DIFC. You can also rent the property out to other companies.

Pros: leases are typically signed for 2–3 years, which lowers vacancy risk and provides more stable income.

Cons: the entry budget is higher than for residential property, from $730,000. Apartments can be used both for investment and living, while offices are primarily an income asset.

Risks: weak demand if you choose the wrong location. Corporate HQs tend to concentrate in DIFC, Business Bay and Downtown, where Class A office vacancy is ~5%.

Rental yield: from 9% per year.

Families for relocation

Dubai offers a high standard of living, safety and education. Buying a home can also support residency visa plans, while ongoing ownership costs are often comparable to other large global cities, once you factor in service charges and utilities.

For a family move, it makes sense to choose areas with strong infrastructure, including schools, hospitals, parks and shops. Neginski analysts can help you find the right location based on your needs.

Dmitry Vladimirov

Head of the Care Department

In 2025, Dubai’s population passed 4 million people, and the forecast for 2040 is 7.8 million. The city is building the world’s largest airport terminal at Al Maktoum International (DWC), designed to handle up to 260 million passengers a year. A new 30 km metro line is in development, set to reduce citywide travel times to just 20 minutes.

These factors drive steady property price growth and improve everyday living. That’s why buying an apartment here means more than just owning a home — it’s a step into a rapidly developing city with lasting value.

Dmitry Vladimirov

Head of the Care Department

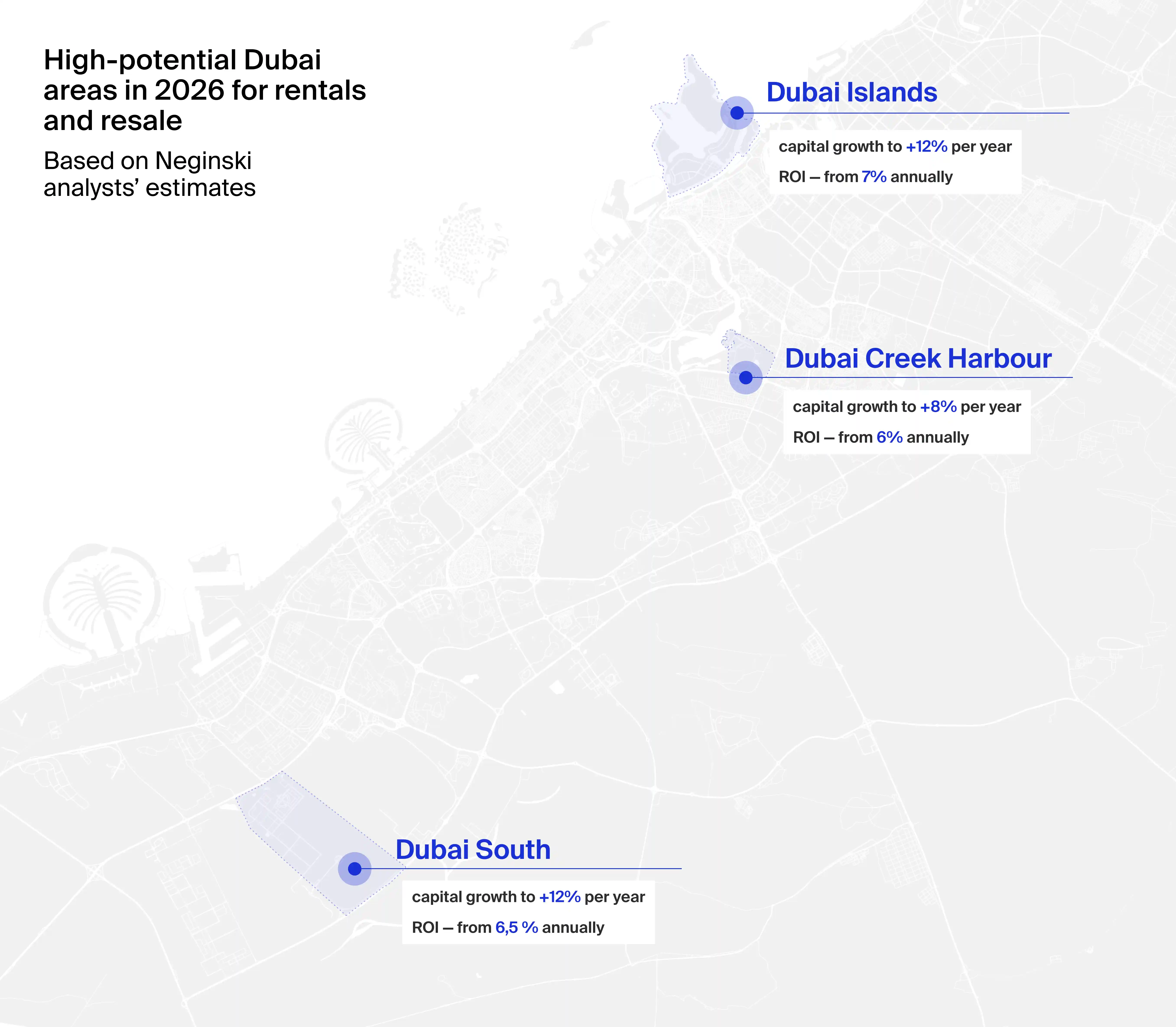

Dubai Areas for Maximum Investment Returns

The right location depends on your goals. For investors, Neginski analysts have selected three of the most high-potential areas for rentals and resale.

Dubai South

The largest master development by Dubai South Properties. Based on Neginski’s internal analytics, the number of transactions in the area increased by 158.6% in the first half of 2025 compared to the same period in 2024. Prices in the location have been growing by up to 12% annually, while gross yields are often estimated from ~6.5% per year (depending on the unit and management model).

Key drivers of demand, price growth and rental yields:

Clear development strategy through 2040. The area is actively developing, with new residential districts, business centres, golf courses, hotels and a major shopping centre under construction. They will attract tourists and expats, driving property values up.

Expansion of Al Maktoum International Airport. Dubai’s long-term aviation strategy prioritises Al Maktoum International (DWC) as a major growth hub, with capacity expected to shift over time from DXB. A new terminal designed for 260 million passengers per year is under construction. Airport staff and related professionals will rent and buy apartments nearby, boosting demand in Dubai South.

Improving transport connections. Between 2026 and 2030, a new metro line and the Etihad Rail line will pass through the district, linking Dubai with other emirates. This will further drive up property values and demand in the area.

Dubai South is linked to the rest of Dubai and the UAE by the Sheikh Mohammed Bin Zayed Road and Emirates Road highways

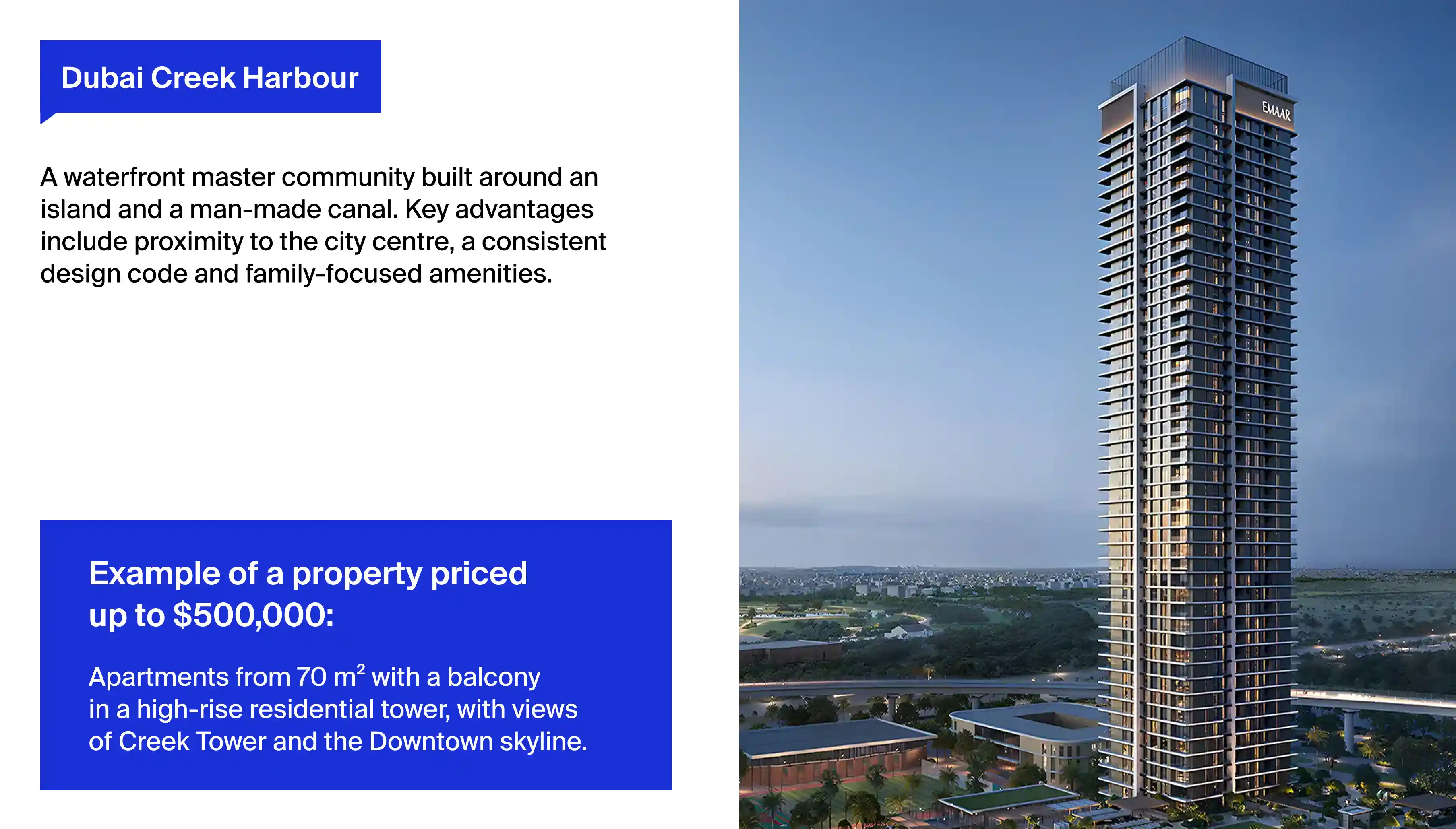

Dubai Creek Harbour (DCH)

A growing waterfront community with a promenade and views of Downtown. Prices in the area are rising by up to 8% per year, and return on investment (ROI) starts from 6% per year.

Key drivers of demand, price growth and rental yields:

Master-planned community by Emaar. A government-linked developer with 28 years of history and a strong reputation is shaping the entire district in a single architectural concept. This reduces investment risk and ensures strong liquidity and stable pricing.

Waterfront location. According to Neginski analysts, it leads to 30–50% higher occupancy and rental rates up to 25% above those in inland areas. Waterfront units often command a premium in occupancy and nightly/monthly rates compared to inland stock, depending on view, building quality and access.

Metro opening in 2029. A 30-kilometre line and a station 74 metres above ground will improve connectivity and cut travel times to central areas. This should support resale liquidity in Dubai Creek Harbour and strengthen rental demand among families and office workers.

Dubai Creek Harbour is an Emaar development, the company being one of the most prominent and well-established developers in the region

Dubai Islands

An archipelago of five man-made islands, one of the last undeveloped waterfront locations in Dubai. Prices here are growing by up to 12% per year, and rental yield starts from 7% per year.

Key drivers of demand, price growth and rental yields:

Limited waterfront supply. New supply is limited by the coastline which, according to Neginski analysts, can boost residential project values by up to 35% after handover.

Master-plan development. By 2030, the area is expected to include 86 hotels, an arts district, 9 yacht marinas, 2 golf courses and a shopping mall. New infrastructure should support steady growth in both property prices and rental rates.

60% of the area is green space. This reduces temperatures by around 5°C. Large green-space ratios can improve microclimate comfort and perceived livability — key factors for long-term demand — though exact effects vary by project design and implementation.

Strong transport access. Two bridges are planned to link the islands to the mainland and reduce travel time to Downtown Dubai to around 20 minutes. This is expected to support rental demand from expats.

Dubai Islands are individually named: Central, Marina, Shore, Golf, and Elite

Andrey Neginskiy

Real estate expert, CEO of Neginski

Your results depend on choosing the right location. We recommend considering:

1. Goal. The area should match your purpose. For living, focus on schools, parks and everyday amenities. For rentals, prioritise metro access, office hubs and key tourist routes.

2. Price. A low entry price in new areas often means weaker infrastructure, which can lead to more vacant periods. But early launches can be good value, so check how prices are set at the start of sales.

3. Future development. Dubai changes fast. An area that feels empty today can become a hotspot in two years. Look at both what exists now and what is planned next.

Andrey Neginskiy

Real estate expert, CEO of Neginski

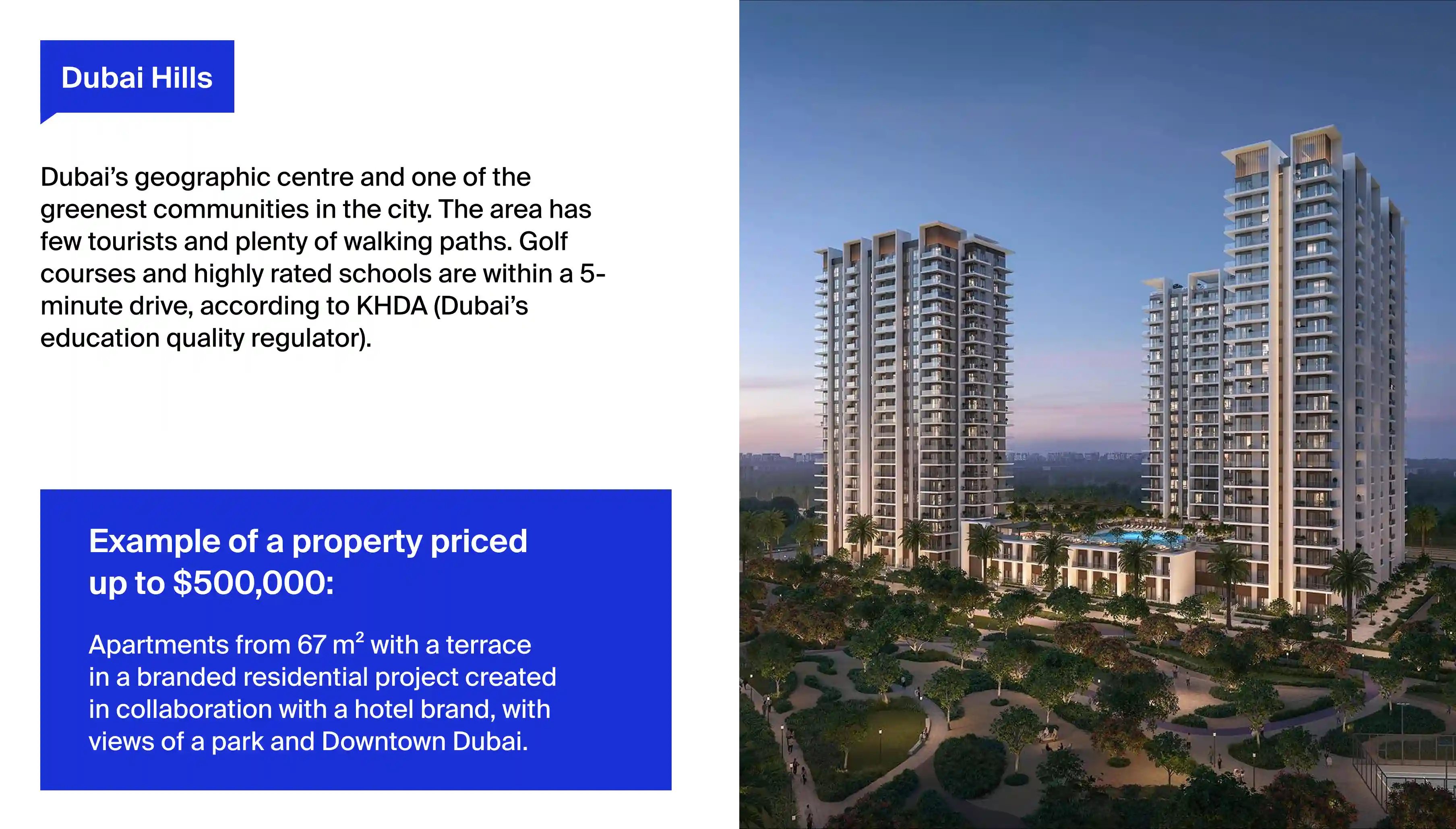

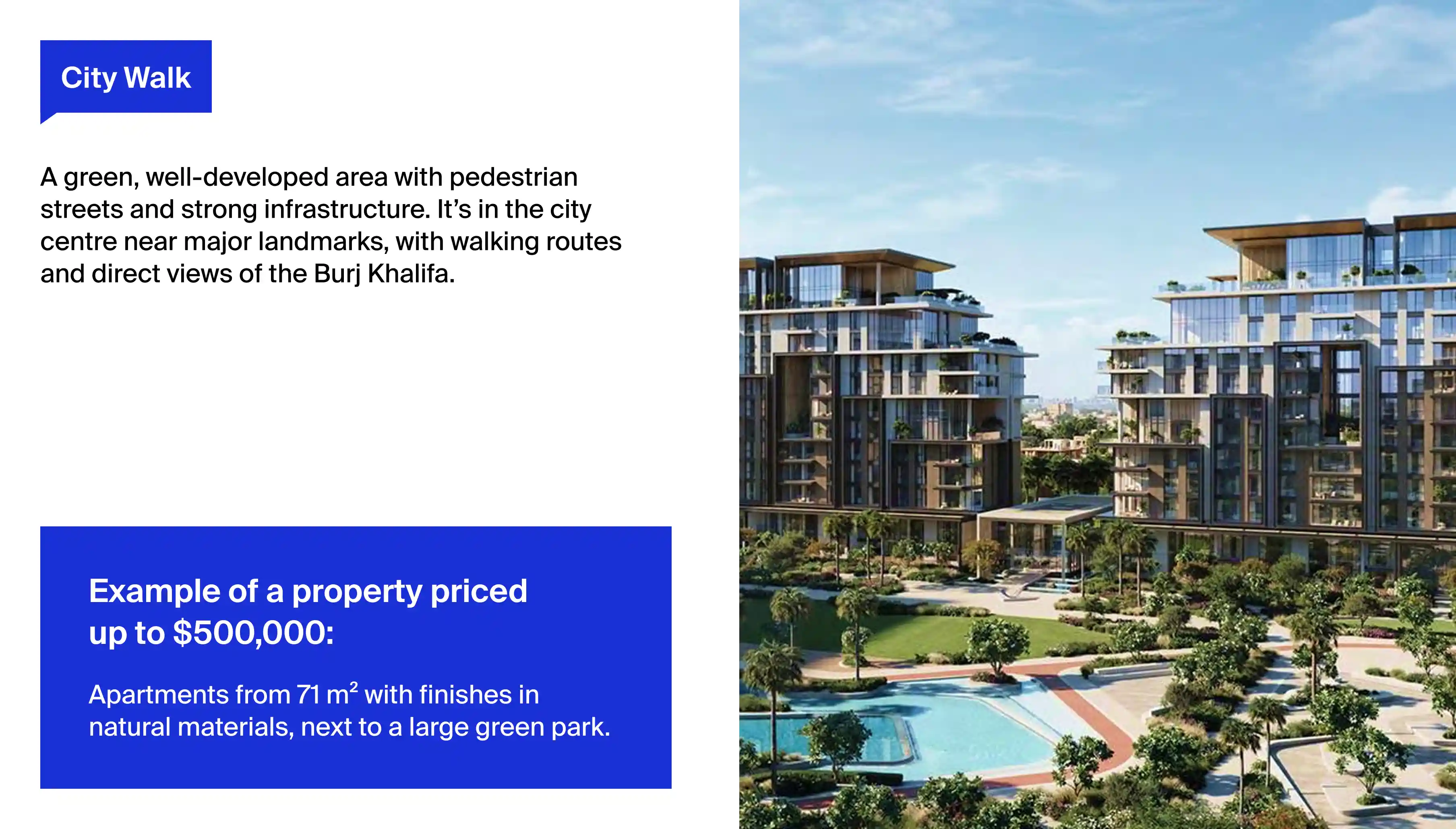

Dubai Areas for Living With Family

If you’re choosing a location to relocate with your family, take a look at the examples below. We’ve selected three optimal areas for living and projects priced up to $500,000 — close to the average budget level often seen in Dubai market statistics (Dubai Land Department).

Property Types in Dubai: Key Differences

Properties are typically divided into residential and commercial. The right choice depends on your goal: preserve capital, earn rental income in a stable, USD-pegged currency (AED) or create a fallback option for your family.

Residential property

There are two main ways to use residential property in Dubai: for personal living when relocating and for generating income. We’ve split this category into two groups to make it easier to decide what fits your strategy.

Apartments, studios, duplexes and hotel units. These are versatile formats for passive income. They are commonly rented long-term by digital nomads and office employees, which supports stable occupancy. They are also in demand among tourists for short-term stays. With the right unit selection, short-term rentals can deliver higher returns than long-term leasing.

Two-bedroom-plus apartments, townhouses and villas. These work well for capital preservation and higher-ticket rentals. The main tenants are families with children who tend to stay longer and move less often. When choosing a property, access to schools, hospitals and shopping centres matters.

Compact units are easier to rent out and resell, but they are less comfortable for family living. Larger units can bring more stable income, but they are harder to resell due to the higher price point. We explain how to choose the right strategy in this article.

Commercial property

Commercial property includes offices, coworking spaces, retail units, warehouses and service premises. Offices are in high demand in business hubs such as DIFC, Business Bay and JLT. Retail space is most in demand in residential communities and tourist areas.

Commercial real estate typically has higher ROI and higher prices than residential property. Tenants usually sign 3–5-year leases and often renew them. Companies, like families with children, do not want to move every few months. They invest in fit-outs, adapt their workflows to the location and stay for the long term.

How to Buy Real Estate in Dubai: Three Legal Ways

In Dubai, real estate transactions are protected by law. For off-plan purchases, buyers payments are typically made into regulated escrow accounts rather than directly to the developer. Each project is monitored by the real estate regulator, which releases funds in stages as construction progresses. The developer receives the full amount only after the project is completed.

You can buy property in Dubai in three ways:

1. Full payment. This option is most common for completed properties and for resales before the project is completed. It usually means simpler paperwork and a faster start to rental income.

2. Instalment plan. The most popular and financially efficient payment method on the market. Developer payment plans often run until handover, commonly 2.5–4 years, with down payments frequently starting from ~20%. Some projects allow more flexible schedules (for example, larger payments closer to handover).

You can also resell an off-plan property before completion after paying 30–50% of its value. The remaining balance is transferred to the next buyer.

3. Mortgage. Available for secondary-market purchases or as the final payment stage before handover (40–50% of the property value). Interest rates range from 3.7% to 5% per year. Mortgages are most widely available and competitively priced for UAE residents; some banks may offer limited options to non-residents, with stricter terms.

The Real Cost of Owning Property in Dubai

To calculate returns correctly at the purchase stage or review and improve an existing portfolio, you need to account for all costs.

| Cost item | How it is calculated | How much to pay | When it is paid | Who it is paid to | Notes |

|---|---|---|---|---|---|

|

Agent fee |

% of the purchase price |

2–5% |

At booking or when signing the SPA |

To the agency or broker |

0% when buying off-plan with Neginski |

|

Dubai Land Department (DLD) fee |

% of the purchase price |

4% |

At booking |

To the Dubai Land Department (DLD) |

For commercial property purchases, 5% VAT also applies |

|

Service charges |

A fixed rate per m²сумма за м² |

Roughly $2–$21+ per m² per year |

Once a year |

To the building or community management company |

Some developers waive the fee for 1–3 years (free service charge) |

|

Utilities |

A fixed amount for each utility line item |

As a rough reference, a one-bedroom can be around $200–$400/month, depending on usage. |

Monthly |

To the utility provider |

Paid by the tenant for long-term rentals and by the owner for short-term rentals |

|

Apartment admin fee |

A fixed fee |

$1,000–$1,500, depending on the developer |

At booking |

To the developer |

Mandatory fee |

|

Developer No Objection Certificate (NOC) fee |

A fixed fee |

$140–$1,360 |

At contract signing |

To the developer |

Paid only when buying on the secondary market |

When you buy directly from a developer, the main extra costs are the 4% Dubai Land Department (DLD) fee and an administrative charge. In total, these costs are usually no more than 5% of the purchase price, so include them in your budget planning.

Freehold vs Leasehold: Ownership Differences

Dubai’s real estate market is divided into zones with different ownership types: freehold and leasehold.

Freehold means full ownership of both the land and the property. Ownership is registered with the Dubai Land Department; for off-plan purchases, interim registration applies until handover. If financed, the bank will typically register a mortgage charge. This format allows you to resell the property and pass it on to heirs with no time limits. Most popular areas, including Dubai Marina, Business Bay, Downtown, JLT, JVC and Arjan, are freehold zones. Freehold is the main ownership format in Dubai, especially for new projects.

Leasehold is a long-term lease of the land and the property for 29–99 years. You can rent the property out, sell it or use it yourself. But if you resell, the new owner receives the property only for the remaining lease term. You generally transfer the remaining lease term on resale; the exit mechanics depend on the contract terms and local rules. Leasehold properties are less common and are usually found only in certain areas or specific developments.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Neginski case

Victor, an investor with deal experience in Bali, came to us to choose a property in Dubai. Earlier, he bought a villa in Canggu on a leasehold basis, with a 30-year land lease. Three years later, it became clear that resale was not as attractive as expected. The remaining lease term had shortened, so potential buyers either avoided the property or demanded a discount.

In Dubai, we offered him an alternative: an apartment in JVC on a freehold basis, with full ownership of the land and the unit, the ability to pass it on to heirs and the option to resell at any time. This became the key factor in his decision.

Freehold ownership is one of Dubai’s major advantages. In many other popular investment destinations, land is typically leased for 25–30 years. This reduces liquidity and makes exit strategies more difficult. Dubai, by contrast, offers clear terms, legal protection and full ownership rights, including for foreign buyers.

Andrey Neginskiy

Real estate expert, CEO of Neginski

UAE Residency Visa Through Property Purchase

UAE citizenship is not typically available through property purchase, but residency is available through several pathways: employment, investment, study, freelance status or family sponsorship. Residency visas can be issued for up to 10 years, depending on the route and eligibility.. The card that confirms your residency is called an Emirates ID. It is the main document you need in the UAE to open a bank account, rent an apartment long term and get a driving licence.

One of the most popular ways to secure residency in the UAE is by buying property. The visa duration depends on the size of the investment. Below, we explain the key requirements you need to meet.

Key points about Dubai residency visas through property purchase:

You can get a 2-year visa by buying property in Dubai worth at least 750,000 AED (~$205,000), or a 10-year Golden Visa with an investment from 2 million AED (~$545,000).

The property must be completed, fully paid and registered with the Dubai Land Department (DLD).

If you buy during construction, issuance may be delayed until the property is officially completed and handed over.

How to Buy Real Estate in Dubai Online: Step-by-Step Guide

You can buy a property in person or remotely. At Neginski, we run a risk check on developers and projects in advance. Only 24% of listings pass our screening.

Step 1. Meeting with an analyst

We clarify your goal: capital protection, relocation or rental income. This defines the area, property type and strategy. The analyst clarifies your preferences, answers questions and shares an initial shortlist of options.

Step 2. Project consultation

You view the unit via Zoom or meet the developer in person. At the sales office, you can see the showroom and ask questions directly.

Step 3. Paying the EOI or booking fee

High-demand launches can sell out quickly, so timing matters. An EOI (Expression of Interest) is a deposit used to signal interest and secure early access; refundability depends on the developer and the specific launch terms.

To reserve a specific unit, you pay a booking fee. It is non-refundable but credited toward the purchase price.

Step 4. First payment and fees

Down payment is usually 10–20% of the price. The DLD fee is typically 4% of the purchase price (additional admin/registration fees may apply depending on the deal)..

Step 5. Receiving the SPA

The SPA is the sales contract that confirms the unit’s specifications and key terms. It is issued after the first instalment. For remote purchases, a Neginski analyst receives the SPA on your behalf and forwards it for signing.

Step 6. Registration with the Dubai Land Department

Within 1–4 weeks, the buyer receives the Oqood certificate by email, confirming rights to the off-plan property.

Step 7. Receiving the ownership certificate

After construction is completed and the full amount is paid, the owner receives the Title Deed.

Neginski analysts manage every stage. We negotiate with the developer, review the contract and payment plan, flag hidden costs and coordinate the legal steps. The result is a clear, transparent process you can control from start to finish.

About the Author & the Company

This article was prepared by the Neginski team—an international real estate agency with teams in the UAE, Moscow and Phuket. We support clients at every stage, from clarifying goals and selecting a project to completing the purchase and managing the property.

We work with 300+ developers, get early access to off-market launches, source rare listings and negotiate discounts. More than 30% of our clients come back for repeat purchases. Learn more about us

Disclaimer

The information in this article is for general guidance only and does not constitute individual legal, investment or immigration advice. Property purchase terms, instalment plans, mortgage financing, rental rules and UAE residency visa options depend on the specific project, developer, bank, property status and the buyer’s individual profile.

UAE laws and regulatory requirements may change. Before making any decisions, we recommend getting personalised advice and confirming the latest terms with the Dubai Land Department (DLD), the developer, the bank or licenced advisors.

Sources

This article is based on publicly available data, Neginski’s analysis and the team’s hands-on experience.

Links:

Dubai's Population Growth: Crossing the 4 Million Mark

It has been revealed how Dubai will change by 2040

The UAE will spend $35 billion to build the world's largest air hub

A new metro line and a 74-meter-high station will be built in Dubai

Decree No. (43) of 2013 Determining Rent Increase for Real Property in the Emirate of Dubai

Law No. (8) of 2007 Concerning Escrow Accounts for Real Estate Development in the Emirate of Dubai

Mohammed bin Rashid approves designs of new passenger terminal at Al Maktoum International Airport

FAQ

-

People of any nationality can buy property in Dubai. A mortgage is most straightforward for UAE residents. Non-resident mortgages may be possible with select banks, but terms and eligibility are typically stricter.

Main mortgage requirements:

having a UAE residency visa

being employed in the UAE

minimum income is set by the bank on an individual basis and depends on the employer, length of employment and the borrower’s financial profile

down payment of at least 20% of the property price plus the bank’s fees

interest rates of 3.7–5% depending on the bank

-

Registration usually takes 3–5 business days. An NOC is required for resale. An NOC is a developer-issued confirmation that there are no outstanding debts:

without an NOC, you cannot register the deal with DLD

NOC processing time is 3–10 business days

the document is paid and costs from 500 to 5,000 AED ($136–$1,360)

-

Freehold means full ownership, while leasehold is a lease for a fixed term:

freehold can be sold, rented out and inherited

leasehold typically lasts 30–99 years depending on the property

leasehold may include restrictions on resale and inheritance

freehold areas are a priority for investment

-

A realistic range is $180,000–$250,000 per unit in popular areas such as JVC, Dubai Hills, Business Bay and Arjan:

the price depends on the project stage, early-stage units are cheaper

the budget should also include 5% for purchase costs

installment plans or a mortgage may be available

-

The number of fees differs between primary and secondary transactions. In both cases, the main payment is the DLD registration fee (4%).

Additional costs:

primary market: an admin fee up to $1,500

secondary market: 2–5% agent fee and an NOC up to $1,360

-

Service charges usually cover security, cleaning, elevators, common areas and sometimes air conditioning:

service charge levels depend on the project and building class and can range from 8 to 80+ AED/m² per year ($2 to $21+ per m²)

you can request the figures from the developer or management company or check Dubai Land Department data (Service Charge Index)

in new projects, the rate is often lower at first and increases after 1–2 years

-

Selling a ready property is usually simpler and cheaper. Off-plan resale comes with restrictions.

Off-plan specifics:

resale is possible only after meeting the SPA conditions, including a minimum paid percentage and obtaining the developer’s NOC

broker commission for assignment is 2–5%

some developers charge an additional fee on resale

-

Short-term rentals require registration and the relevant holiday-home permit/licence, and not every building/community allows it—always confirm building rules and management policies. You can rent out the unit yourself or through a licensed management company.

What to check when choosing a management company:

the company must have a license

management fee is typically 10–20% of revenue

check reputation, transparency, reporting and the contract terms

it is often safer to work with a management company recommended by the developer

-

Offices cost more to maintain, but returns can be higher:

profit is typically 6–8% per year on average

a license is required and sometimes a legal entity is needed

not all offices allow leasing without business registration

service charges are higher than for residential properties

-

Banks and developers may request documents for KYC, the mandatory buyer identification process:

they often ask for bank statements, tax returns or income certificates depending on the buyer’s tax residency country

for companies and self-employed buyers, source-of-funds checks are stricter and may include corporate documents, financial statements and UBO disclosure

if you buy with a mortgage, checks are especially strict

verification can take 3–10 business days

-

Yes, if the property value and status meet the requirements:

minimum value from 750,000 AED (about $205,000)

the property must be ready and registered with DLD

for joint ownership, conditions depend on the visa type:

for a 2-year residency visa, the total property value is considered

for a 10-year Golden Visa, each applicant must own a share worth at least 2 million AED (about $545,000)

the visa can be renewed as long as ownership is maintained

-

Reputation and documentation checks are essential:

ask for a list of completed projects

confirm the construction stage with DLD or with an analyst

read reviews and check Property Finder forums

review land ownership structure and handover timelines

-

Any yield estimate is a forecast, not a guarantee, except for projects that offer guaranteed returns.

long-term rentals: 6.5–9%

short-term rentals: up to 12%, but with higher risk and fluctuations

yield depends on the rental model, demand and how well the property is managed