Investing in Thai property: 5 proven strategies for 5–15% annual returns

Grigory Kosych

Teamlead

Thailand's property market is booming, especially in Phuket, where property prices can rise up to 15% annually and the return on investment from rentals ranges from 5 to 12%. Foreign investors have diverse opportunities — from fast capital gains to stable passive incomes, or a combination of both.

This comprehensive guide to buying property in Thailand outlines key investment strategies, expected returns, potential risks, and helps you choose the best approach tailored to your financial goals with expert guidance.

5–8% per year

Long-term rental yield

7–12% per year

Short-term rental yield

Up to 15%

Annual price appreciation

10 reasons to invest in Thai real estate

1. Consistent capital appreciation. Major resort markets such as Phuket have recorded average condo and villa price growth of 5–8% per year, supported by limited coastal land and strong demand from foreign buyers. Pattaya and Hua Hin are also trending upward.

When you buy property at the construction stage, appreciation can reach 15% annually until completion, making it a particularly good investment.

2. High net rental yields. A high return on investment is achievable through rentals. Short-term holiday rentals in prime projects in Phuket can deliver property investors 7 to 12% annual yields after fees. Long-term rentals — popular in hubs like Bangkok and Chiang Mai — tend to generate more moderate but steady income with lower turnover, providing greater stability over time.

3. Robust tourism industry rebound. Tourist arrivals passed 35 million in 2024 and are expected to exceed the pre-COVID record of nearly 40 million by 2026, sustaining the high demand for rental properties and mixed-use hospitality projects.

4. Multiple long-stay visa programs. Thailand Privilege Visa, the 10-year Long-Term Resident Visa, and the new Destination Thailand Visa give investors easier long-term residency routes and tax advantages, which increase holding periods and resale liquidity.

5. Investor-friendly tax regime. No capital gains tax on a sale in Thailand for individuals, and transaction costs under 6.3% keep entry and exit friction low. Annual property taxes remain modest — 0.02% for residential use and 0.3% for commercial use — making ownership cost-efficient.

6. Competitive entry prices. Beach-area new-build condominiums start from about $120,000, while luxury pool villas from $500,000 remain more affordable than comparable assets in Bali or Dubai, yet command similar nightly rental rates.

7. Expanding infrastructure. New projects such as Phuket’s planned light rail, the Eastern Economic Corridor high-speed rail, and airports in Phang-Nga and Pattaya are improving accessibility and driving land values higher.

8. Strong developer guarantees. Many resort developers focused on investment properties provide guaranteed-yield programs and rental-pool systems, reducing downside risk for those investing in Thailand property.

9. Growing digital-nomad base. A mix of reliable internet, co-working hubs, moderate living costs starting from $1,500 per month, and the Destination Thailand Visa attract long-stay remote workers who prefer furnished rentals over hotels.

10. Favorable climate & lifestyle. Year-round warm weather, international schools, world-class healthcare, and Thailand’s renowned food and leisure scene continue to underpin steady relocation and retirement demand.

Need help finding the right property?

We vet every developer for track record, financial strength, and buyer feedback so only secure, high‑potential options make the cut.

Overview of property investment strategies in Thailand

When it comes to investing in Thai real estate, there isn’t just one way to succeed. Some buyers look for quick profits, others want steady rental income, and many prefer a mix of both. The right choice depends on how long you plan to hold the property, how much risk you’re comfortable with, and how actively you want to be involved.

Buy-to-sell strategy

This is a short-term play. Investors reserve units during the early sales phase at lower prices and then sell their contract before the project is finished. Because developers usually raise prices in stages as construction progresses, early buyers can benefit from this uplift. The upfront costs are relatively low, but success depends on strong market demand.

Hold-and-rent strategy

This is a traditional model: you purchase a property and rent it out to generate ongoing income. The approach is flexible: you can choose short-term holiday rentals in tourist areas or long-term leases for expats and families.

Short-term vs. long-term. Short-term holiday rentals can earn higher returns, especially in popular resort zones, but they require active management. Long-term leases bring more stability and less turnover, though the yields are usually lower.

Self-managing vs. outsourcing the work. Running rentals yourself saves on fees but demands time and local know-how. Hiring a property manager reduces your effort, as they handle guests, marketing, and maintenance, though they take a share of the income.

Guaranteed-yield vs. rental-pool. Some developers offer fixed returns for the first few years, which gives predictability to your investment in Thailand. Alternatively, rental pools combine the income from similar units and share it among owners, so payouts reflect real occupancy levels.

Hybrid approaches

Many investors choose a middle ground, combining elements of both strategies to balance income and growth:

Rent-then-sell — Rent the property for a few seasons to prove its income potential, then sell it at a premium to buyers looking for a turnkey investment.

Dual-mode letting — Maximize returns by using platforms like Airbnb during peak tourist months and switching to longer 6-month leases in the off-season. This keeps cash flow more consistent across the year.

Thailand offers something for every type of investor. Whether you want fast gains, reliable rental income, or a flexible mix of both, there’s a strategy that can fit your goals. And when we talk about Thailand, we primarily mean Phuket — the country’s most attractive and dynamic real estate market from an investment perspective.

Curated property selection in Phuket

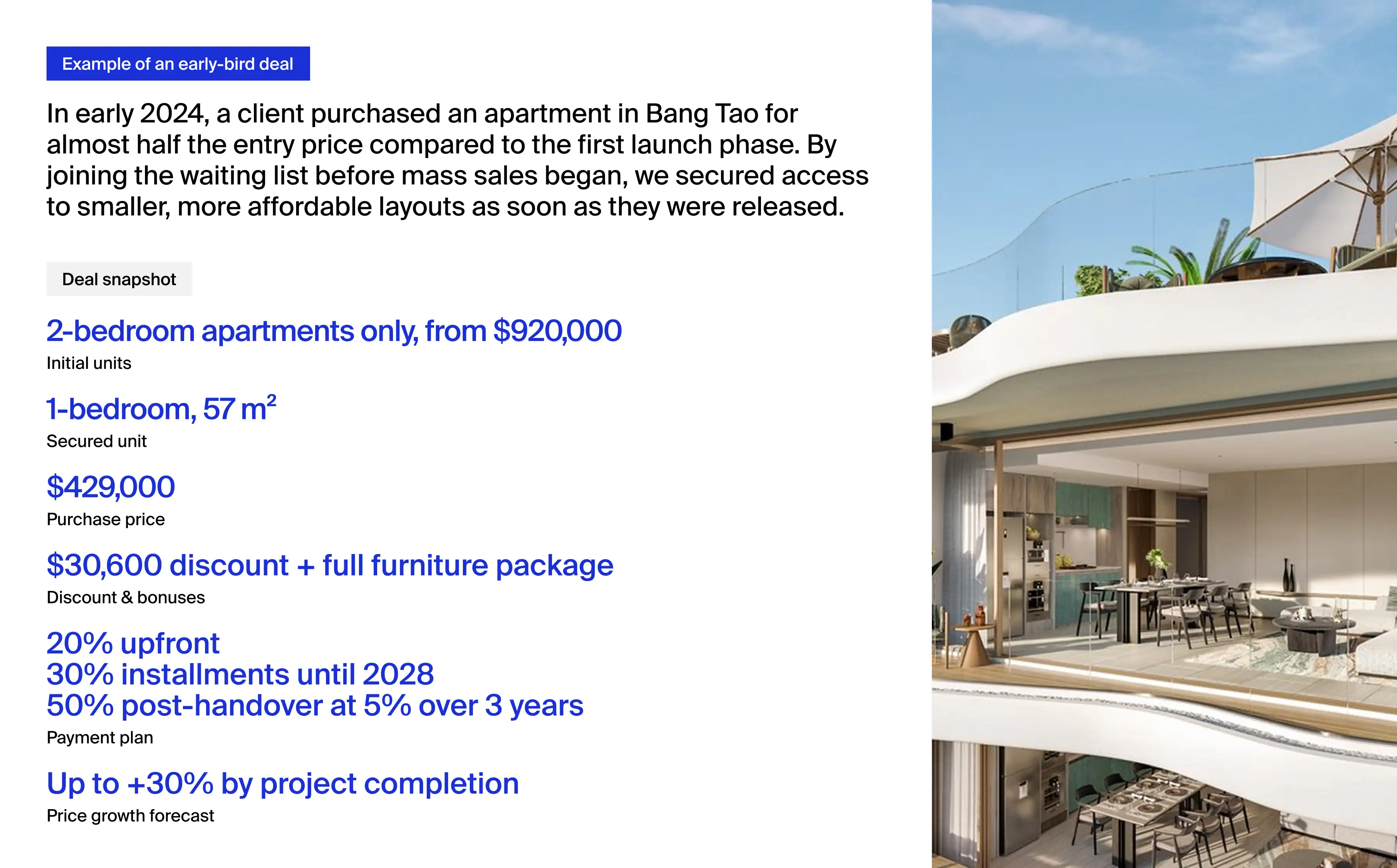

Strategy 1. Buy-to-sell — capital growth

This real estate investment investment approach — often called "flipping" — is all about buying early and selling at a profit as the property gains value during construction. Here's how it works:

Buy early. Investors reserve a unit at the very beginning of sales — usually before construction starts — when prices are at their lowest.

Pay in stages. Instead of paying the full price upfront, buyers follow the developer’s payment plan, which is typically spread out over 1–3 years.

Wait for prices to rise. As construction progresses, the value of the unit increases. Developers raise prices, and demand for near-complete or finished properties grows.

Sell before or at completion. The investor sells the property or the contract to another buyer — often without ever taking possession or renting it out — and earns a profit from the price difference.

Most resales happen in the final stages of the project or when the developer has no available units left. In the first year after purchase, only a few investors manage to exit the deal.

3 ways to resell the property

Depending on the timing and market conditions, there are three main resale strategies.

1. Assignment resale — during construction. The investor sells the contract to a new buyer while the building is still under construction — usually 12–18 months after purchase. This is allowed after making the first payment and before the property is officially registered. The new buyer continues the payment plan already in place.

2. Handover resale — just before completion. The unit is sold right before handover, with the final payment being the responsibility of the new buyer. This option works well when there’s strong demand for ready-to-move-in homes.

3. Post-completion resale — after completion. The finished property is sold — often to an end-user — usually 1.5 to 2.5 years after the original purchase. This option often brings the highest return, especially if the property was bought early at a lower price.

Grigory Kosych

Teamlead

How can investors avoid missing out on first-tier prices?

In Phuket’s highly competitive market, the first price tier often sells out within hours. At Neginski, our role is to secure that early access for investors. We do this through exclusive partnerships with leading developers, giving our clients invitations to VIP launches and pre-release selections where the best-priced units are available.

Equally important is preparation: we align each client’s investment goals with the right projects in advance, ensure documents and financial guarantees are ready, and monitor the market closely so they can act immediately when opportunities arise.

Grigory Kosych

Teamlead

Profitability: prices rise for up to 15% per year

The buy-to-sell strategy offers strong returns, especially when investors enter early in the sales cycle. In Phuket, property values in new developments typically grow by 20–40% over the construction period, with an average annual price increase of 10–15%. In top-performing projects, total growth can reach 50–100%, though such cases are less common.

When reselling a unit after just 1–2 initial payments, investors can achieve 50%+ annual return on invested capital, due to the low entry cost and price growth during development. Transaction-related fees usually do not reduce net profit, as covered by the buyer.

Risks & considerations

Construction delays. Projects can be held up by issues like permits, financing, or shortages of materials and workers. A delay pushes back resale opportunities and may slow down expected returns.

Market fluctuations. Property values do not always rise in a straight line. An economic slowdown or a wave of new supply can flatten prices or even drive them down, cutting into profits or causing losses.

Developer problems. If a developer runs into financial trouble or delivers poor-quality construction, it can be hard to resell the unit. In the worst case, investors may face extra costs, legal disputes, or a partial loss of capital.

These risks make it essential to check the developer’s track record, choose strong locations, and understand the broader market cycle before investing in Thailand's property market.

Want early access to top investment deals?

We’re among the first to know about hottest presales to help clients secure the best units before public launch.

Strategy 2. Long-term rental — predictable income

With this approach, a townhouse, villa, or condo in Thailand is rented out to a single tenant for a year or longer. Typical tenants in Phuket are expats, families, or digital nomads who value the island’s high quality of life.

Unlike short-term holiday rentals, long-term leases mean fewer tenant changes, less wear and tear, and far less day-to-day management. For owners, it’s a way to secure steady monthly income without constant advertising or guest turnover.

5–8% per year: What profitability depends on

Long-term rentals in Phuket usually generate 5–8% annual returns, depending on the property and location. Several factors shape profitability in this competitive property market:

Location — Homes near beaches, international schools, or popular expat neighborhoods achieve higher rental demand.

Property type — Condos and townhouses are easier to manage and generally deliver stronger yields than luxury villas, which can have high upkeep costs.

Tenants and occupancy — Reliable, long-term tenants keep vacancy rates low and reduce costs.

Management — Professional property managers help maintain the property, handle tenants, keep rental income consistent, and ensure compliance with Thai property laws.

Market trends — Phuket’s ongoing demand from residents and expatriates supports steady rental interest, though returns are typically lower than with short-term holiday rentals.

Risks & considerations

Three key risks of the long-term rental strategy in Phuket are:

Vacancy risk — Empty periods between tenants reduce income.

Tenant issues — Late payments, disputes, or evictions can disrupt cash flow.

Maintenance costs — Ongoing repairs and management fees can cut into profits, especially if major work is required.

These risks highlight the need for careful tenant screening, professional property management, and financial planning to sustain profitability in long-term rentals in Phuket. Want to better understand what to watch out for? See our full article: Top 10 property investment risks in Thailand and how to avoid them.

Strategy 3. Short-term rental — higher yields

This approach is about renting out apartments or villas to tourists and business travelers for short stays — from just a few nights to a few weeks. In Phuket, demand is driven by international visitors and the growing number of digital nomads who come for weeks or months at a time.

Unlike long-term leases, short-term rentals involve frequent guest turnover. That means more effort with marketing, cleaning, and property management — often handled by agencies or on-site operators. The advantage is flexibility: you can adjust nightly rates to capture higher demand during the peak tourist season or special events.

Grigory Kosych

Teamlead

Foreigners are legally allowed to rent out their property in Thailand on a long-term basis without a work permit. However, short-term rentals — such as daily or weekly stays — are considered a commercial activity and require a valid work permit.

To stay fully compliant, foreign owners can work with a licensed property management company, which handles short-term rentals legally on their behalf. Projected returns already take into account management fees, so investors see net income figures.

Grigory Kosych

Teamlead

7–12% per year: What profitability depends on

Short-term rentals can be among the most profitable strategies in Phuket, usually bringing in 7–12% annual returns. Your success depends on several factors:

Location — Properties near beaches like Bang Tao, Layan, and Nai Yang rent faster and at higher rates.

Seasonality and occupancy — Income peaks from November to April when tourism is strongest.

Property quality — Modern interiors, pools, or sea views attract more guests and better reviews.

Marketing reach — Listings on platforms like Airbnb and Booking.com plus solid digital promotion reduce vacancy.

Management costs — Cleaning, repairs, and guest services eat into returns but are crucial for repeat bookings.

Together, these factors determine how much stable income an owner can realistically achieve from short-term rentals.

Risks & considerations

Active management. More guests mean more wear and tear, frequent cleaning, and ongoing marketing. Without professional help, it can be a heavy workload.

Occupancy swings. Even with steady tourism, seasonal dips or unexpected travel restrictions can cut bookings.

Higher expenses. Frequent guest use accelerates furniture and appliance replacement.

Regulations. Short-term letting is more regulated than long-term leases. Operating without the right setup may create compliance risks.

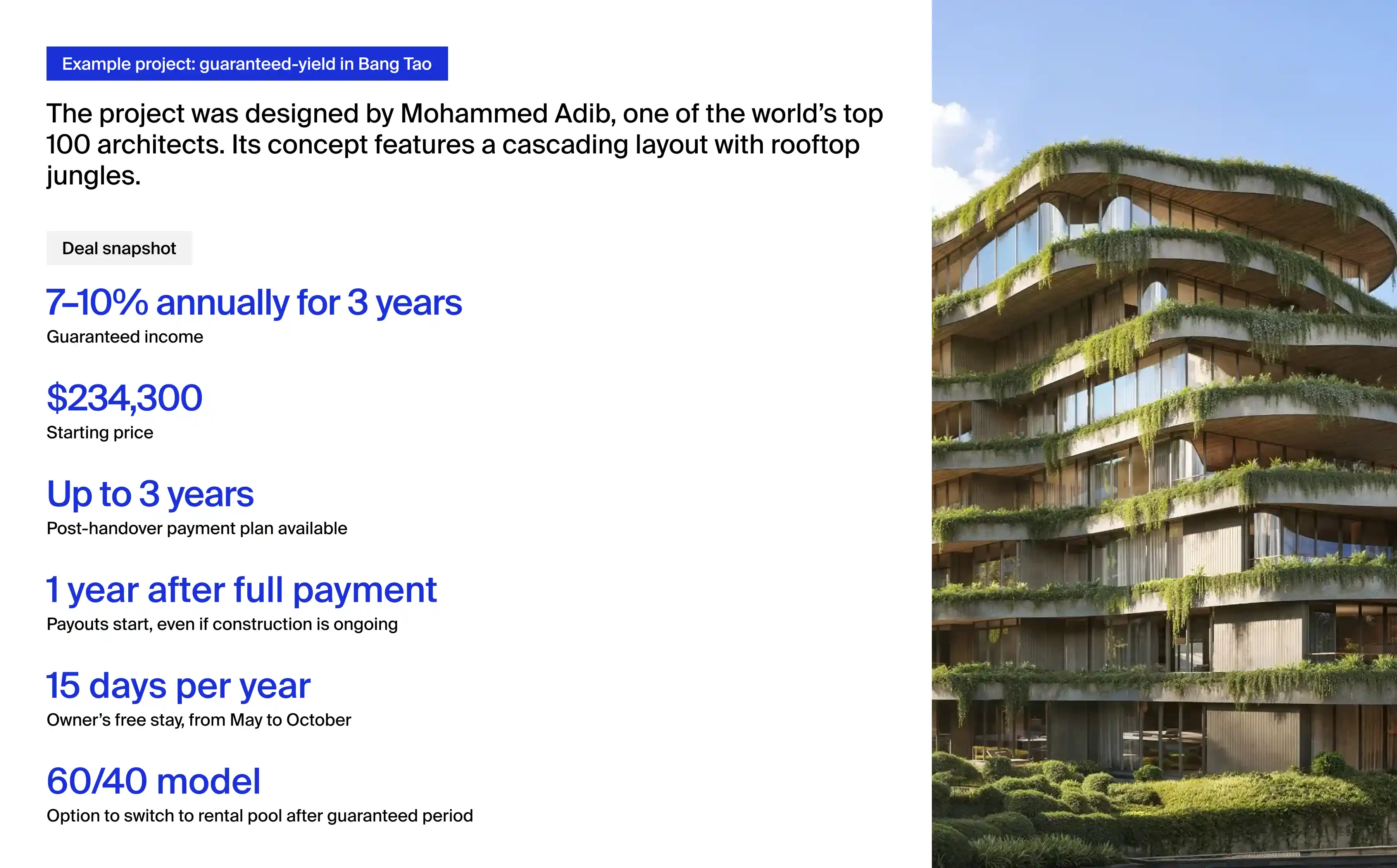

Strategy 4. Guaranteed yield — fixed returns

The guaranteed-yield model allows international investors to receive a fixed return annually for 2–5 years. After buying a property, the investor signs a rental management agreement: the property, typically a condominium, is operated as part of a hotel, and the developer pays a guaranteed income regardless of occupancy.

Most programs also include a personal use benefit of 14–30 days per year.

Once the guaranteed period ends, the investor can either sell the property at a profit — often 30–50% higher than the initial purchase price if bought at pre-sale — or switch to a rental pool program for variable but potentially higher returns.

Profitability: 5% to 7% per year

Guaranteed income is advertised at 5–7% annually, but net yield is usually 1–1.5% lower after accounting for:

Common Fee, that is the building maintenance fee

Taxes of 5–15%, depending on how payouts are structured

One-time costs such as a furniture package, sinking fund, or transfer fee

Even with these deductions, the investor enjoys predictable, hands-off cash flow, plus potential capital appreciation when reselling the unit after the program ends.

Risks & considerations

Fixed upside. Returns are capped, so investors won’t benefit if the property performs above expectations.

Limited property types. Only condominiums with a hotel license qualify, and units must be delivered fully furnished to match the project’s design.

Resale constraints. Liquidity can be limited during the guaranteed-income period, as buyers are unlikely to purchase a unit while the guarantee is in force, which can delay exit timing and reduce pricing flexibility.

Know your returns before you invest

We’ll assess your goals and opportunities and run the numbers.

Strategy 5. Rental pool — shared returns, reduced risk

A rental pool redefines traditional property ownership. It is a shared system where owners in a resort-style complex combine their units for rental. Instead of managing your own apartment, your unit is rented out as part of a larger group — like hotel rooms — and income is distributed among all participants.

This model, a cornerstone of Thailand property investment in resort areas, is common in Phuket’s branded residences and serviced apartments. A professional management company handles everything: bookings, pricing, guest services, and maintenance. You simply receive your share of the income, without any day-to-day involvement.

Some projects start with a rental pool, while others offer it after a guaranteed return period. The key benefit: even if your unit sits empty part of the time, you still earn from the performance of the whole property.

5% to 10% per year: What profitability depends on

Returns in Phuket rental pools typically range from 5 to 10% annually, depending on several key factors:

Rental split — Income is shared between the owner and the management company, typically in a 70/30 or 60/40 split, favoring the owner. These terms are defined in your contract.

Location and seasonality — Properties in tourist hotspots with year-round appeal tend to perform better.

Management quality — Strong operators keep occupancy high and adjust pricing to match demand.

Occupancy levels — Income varies month to month. You earn more in high season, less during quieter periods — but always share in the full building’s performance.

Brand strength and repeat guests — Projects with good reputations and loyal clientele often deliver higher long-term returns.

Unlike guaranteed-yield strategies, rental pool income is flexible — but that flexibility can work in your favor. In peak months, returns may exceed fixed-income models, while over time, a well-managed pool can deliver consistently strong performance.

Risks & considerations

Fluctuating income. There’s no fixed monthly payout. Your earnings change based on how well the whole property rents.

Lack of clarity. In some cases, the way rental income is calculated and divided isn’t fully transparent. A trustworthy developer or real estate agent should provide clear performance data. Make sure to review past performance and understand the terms before signing.

Dependence on management. Your results depend on how good the management company is. A strong operator will keep occupancy high and maintain quality. A weak one can drag down performance — even in a great location.

Limited personal use. If you want to stay in your unit, you usually have to book your dates in advance. Usage may be limited to a certain number of weeks per year, depending on the rental agreement.

Top projects with guaranteed yield and rental pool programs

How to choose the right investment strategy?

With multiple options on the table, the best strategy for property investment in Thailand is not about chasing the highest return but about matching the approach to your goals, risk profile, and lifestyle.

To make the right choice, focus on the factors below:

Investment goal. Decide whether your priority is to build a steady income stream or realize a one-time profit.

Risk tolerance. Be honest about your comfort with uncertainty.

Level of involvement. Choose the strategy based on the time and effort you’re ready to commit.

Time horizon. Think about how long you can keep money tied up.

Personal use. Think about whether you plan to enjoy the property yourself for vacations or part-time living.

Capital and financing. Finally, assess your available budget and payment preferences.

In short, the “right” strategy to invest in Thailand is the one that balances returns, risks, and involvement in a way that feels sustainable for you — and keeps your long-term objectives firmly in view.

Side-by side comparison of property investment options in Thailand

Choosing the right investment strategy in the Thai property market shouldn't be a guessing game. While each approach we've covered offers distinct advantages, comparing them directly reveals crucial trade-offs that can make or break your investment success. Buy-to-sell strategies promise the highest returns but demand perfect timing, while guaranteed yield programs offer peace of mind but cap your upside potential.

The tables below cut through the complexity, presenting hard data on returns, risks, effort requirements, and time commitments for each strategy. This side-by-side analysis helps you identify which approach matches your financial goals, available time, and tolerance for uncertainty.

Annual expected returns

| Strategy | Return level | Details |

|---|---|---|

|

Buy-to-sell |

High |

10–15% annual price growth in strong markets, and ROI can be much higher on cash invested |

|

Long-term rental |

Moderate |

5–8% yearly rental yield plus modest capital appreciation over time |

|

Short-term rental |

High |

7–12% annual net yield in tourist areas with potential for higher gross income in peak seasons |

|

Guaranteed yield |

Low–Moderate |

5–7% fixed annual return during guarantee period, often net 4–6% after fees |

|

Rental pool |

Moderate |

5–10% typical yearly return, can exceed fixed yields in strong markets |

Risk levels

| Strategy | Risk level | Details |

|---|---|---|

|

Buy-to-sell |

High |

Relies on rising market; risk of price stagnation, project delays |

|

Long-term rental |

Low–Moderate |

Stable income but vacancy or tenant issues possible |

|

Short-term rental |

Moderate |

Dependent on tourism and seasonality; more variable income |

|

Guaranteed yield |

Low |

Income is contractually guaranteed; main risk is operator default |

|

Rental pool |

Moderate |

Income fluctuates with occupancy; depends on management quality |

Effort required

| Strategy | Effort level | Details |

|---|---|---|

|

Buy-to-sell |

Moderate |

Upfront research and selling effort needed, but no tenant management |

|

Long-term rental |

Low–Moderate |

Minimal day-to-day involvement once tenant is in |

|

Short-term rental |

Moderate– High |

Active management required — or pay 20–30% to agency; frequent guest turnover |

|

Guaranteed yield |

Low |

Completely hands-off during guarantee — operator manages everything |

|

Rental pool |

Low |

Fully managed by operator; passive after joining pool |

Holding period

| Strategy | Horizon | Details |

|---|---|---|

|

Buy-to-sell |

Short-term |

1–3 years, usually exit before or at completion |

|

Long-term rental |

Long-term |

5+ years to realize both rental income and capital appreciation |

|

Short-term rental |

Flexible |

Can operate indefinitely; often reviewed every few years |

|

Guaranteed yield |

Short-to-Medium |

2–5 years, aligned with guarantee period |

|

Rental pool |

Medium-to-Long |

Taken together, these comparisons show that there is no single “best” strategy for investing in Thai property — only the approach that best fits your personal goals, risk profile, and level of engagement. By weighing returns against risks, effort, and holding period, you can match your investment plan to your own priorities, whether that means steady rental income, maximum capital growth, or a balance of both.

Wrapping up: Thailand investment essentials

Thailand's real estate sector presents compelling investment opportunities for foreigners seeking both capital appreciation and rental income. From buy-to-sell strategies delivering up to 15% annual price growth to rental pools offering steady 5–10% returns, each approach serves different investor profiles and financial goals.

The key to success lies not in chasing the highest advertised returns, but in matching your strategy to your circumstances. Conservative investors may find guaranteed yield programs attractive for their predictability, while those comfortable with higher involvement can capitalize on short-term rental yields of 7–12%. Meanwhile, the buy-to-sell approach rewards those who can act quickly on pre-sale opportunities.

Before you decide to invest in Thailand real estate:

Assess your risk tolerance and available capital honestly

Define your primary goal — quick profits, steady income, or capital preservation

Research developers thoroughly — track record matters more than promotional materials

Consider starting small with a single unit to test your chosen strategy

Build relationships with local property managers and legal advisors

The Thailand property market rewards informed, patient investors who understand both the opportunities and the risks. Whether you're drawn to the hands-off nature of guaranteed yields or the higher potential of active rental management, success comes from choosing the right strategy and executing it well.

FAQ

-

Entry prices vary widely. In Phuket, new-build condos near the beach start from about $120,000–150,000, while villas usually begin at $500,000. Developers often offer payment plans with only 20–30% upfront during construction, making it possible to start with less capital if you buy off-plan.

-

Short-term holiday rentals in tourist zones can generate 7–12% net annual yield, especially during high season. Long-term rentals aimed at expats and families typically return 5–8% per year, but with more stability and less turnover. The trade-off is higher effort and seasonality for short-term rentals versus predictability for long-term leases.

-

They are real but should be approached with caution. Developers in Phuket often offer 5–7% fixed annual returns for the first 2–5 years. The key is to verify the developer’s track record, financial stability, and contract terms. Reputable operators usually honor guarantees, but they cap your upside and restrict property use.

-

Focus on reputable developers with a history of on-time delivery, check that all permits are in place, and avoid projects that rely solely on pre-sales for financing. Diversify your strategy: if resale demand slows, be ready to hold and rent. Using a local legal advisor for contract review is also essential when buying property in Thailand.

-

On the west coast, Bang Tao, Nai Yang, and Kamala combine strong tourist demand with limited new land in Thailand, supporting both rental yields and capital growth. Nai Harn and Rawai are popular with expats and long-stay families, giving stable rental demand. Emerging areas near planned infrastructure, like Chalong, also show good long-term potential.

-

It depends on your goals, risk tolerance, and involvement level. If you want stable, hands-off income, look at guaranteed yield or long-term rental. For higher returns and flexibility, short-term rentals or rental pools may suit you. If you seek quick profits and can handle higher risk, buy-to-sell, or flipping, is an option.

-

Yes, many investors use hybrid approaches. For example, with a rent-then-sell strategy, you lease the property for a few years to prove its income potential and then resell it at a premium. Another option is dual-mode letting, where you focus on short-term rentals during the high season and switch to long-term leases in the low season. Combining strategies helps balance cash flow and capital appreciation.

.webp)

.webp)