How to Buy Real Estate in Dubai on a 0% Instalment Plan in 2026: Terms and Potential Risks

Foreigners can buy property in Dubai using a developer payment plan marketed as 0% interest. This article breaks down how it works on the primary market: terms, documents and the key steps of a deal.

Andrey Neginskiy

Real estate expert, CEO of Neginski

At a Glance

Dubai developers offer instalment plans for up to 5 years. It is often easier to proceed than a mortgage and does not require residency. The down payment is typically from 20%, but you should also budget for the DLD fee (4%) and an admin fee so your upfront costs are realistic.

An instalment plan can work as an investment tool for capital preservation, passive income or relocation planning. Primary-market deals have safeguards: payments for off-plan property typically go to the project escrow account, and the developer receives funds in stages as construction progresses.

The most common mistakes are miscalculating the true cost of ownership and buying without an exit strategy. The process from shortlisting to registration with DLD is transparent and can be done online. An instalment plan is not a way to buy with no money. It is a tool to spread payments intelligently.

Buy property in Dubai remotely

Video tours. Clear terms. A step-by-step plan.

End-to-end online

Instalment Plan In Dubai: Why It is Not a Loan

Based on Neginski’s internal analytics over five years in the market, around 70% of foreign buyers in Dubai use a developer payment plan. This option is available only on the primary market and usually lasts up to 5 years, depending on the project.

An instalment plan is not a loan. It is a developer payment plan, not bank financing. The only bank product available to foreigners is a mortgage.

What makes an instalment plan different from a mortgage:

1. Simpler terms. For an instalment plan you usually need a passport copy and a document confirming your income. A mortgage in Dubai is typically available to UAE residents aged 21 to 65 with proof of an official monthly salary of at least $2,200 for the past three months.

2. Rate and term. An instalment plan is commonly marketed as 0% for up to 4 years before handover and up to 3 years after. A mortgage is typically 3.7–5% per year for up to 25 years, depending on the borrower’s age.

At the same time the down payment for a mortgage and for a primary-market instalment plan is similar: from 20%. For a mortgage, residents may need to cover up to 50% via the developer payment plan, with the remaining 50% financed by the bank and repaid later under the mortgage terms.

Types of Developer Payment Plans in Dubai

In some projects a buyer can agree an individual schedule with the developer. For example, you may be able to move one instalment to another quarter or delay the final tranche by a few weeks.

Foreigners in Dubai typically see two formats:

1. Payments during construction. Tranches are tied to milestones: foundations, structure and so on. In some projects 50% or 70% is due only at handover.

2. Post-handover instalments. Part of the price is paid after construction is completed. Unlike a mortgage, interest is not charged, so there is no interest overpayment. This can reduce cash pressure, but post-handover plans are relatively rare and units with them are often priced higher than those with payments only up to handover.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Neginski case: a client made $31,600 in 11 months after paying only 30% of the unit price

In December 2022 an investor approached us with a goal: resale income with minimal upfront outlay. Neginski analyst Arina shortlisted a liquid project with a suitable payment schedule.

The client bought a 38 m² studio in Iman Grove in Dubai Hills for $229,000. Under the instalment plan he paid only 30% of the price, plus the DLD fee (4%) and an admin fee of $1,000. Total upfront outlay was $78,860.

In November 2023 a buyer from the Neginski client base was found for the unit. He purchased it via an assignment for $113,000. The obligation to pay the remaining instalments transferred to the new buyer. Net profit after a 2% agent fee was $31,600, which is 40% on the invested capital.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Who Instalment Plans Work For

An instalment plan is especially convenient for three buyer profiles. Here is how it usually maps to goals.

For capital preservation investors

Dubai is a stable market with growing demand. In Q3 2025, apartment sales in new developments hit a historic record of 59,430 transactions, according to DXB.

An instalment plan lets you lock today’s price on a liquid unit and spread payments over several years without taking a large amount out of circulation at once. The paid-in capital is also less exposed to inflation and devaluation dynamics, compared to holding cash.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Neginski сase: capital protection from inflation with premium property in Dubai and up to 25% growth potential

In 2025, a married couple approached the agency with a goal: protect capital from inflation through Dubai real estate. The plan was to buy two units scheduled for completion within two years and resell them a year after handover.

Senior Neginski analyst Maria shortlisted two view apartments, 75 m² each, with one bedroom, priced at $485,000 and $522,000. Each unit was fully finished: furniture from European brands, SMEG appliances, Grohe bathrooms. Location: Dubai Islands, where unit prices were lower than competitors and the instalment-plan down payment was 5% lower, which made the entry budget more comfortable.

Market analysis and project selection helped optimise the budget and secure better resale terms. Similar units in a nearby complex are already priced about 10% higher, and by handover the price growth can reach up to 25%, depending on market conditions.

Andrey Neginskiy

Real estate expert, CEO of Neginski

For passive income investors

For buyers who want to grow capital, an instalment plan can make an investment more efficient.

For resale income: you can pay 30% of the price and resell with a price increase of up to 35% or more before you pay the full amount. The remaining instalments under the developer payment plan transfer to the new buyer, if the developer’s rules allow assignment.

For rental income: a plan with post-handover instalments can let you cover part of the schedule with rental income.

Neginski case: a client saved 27% on monthly instalments

An investor came to us with the goal of earning passive income from rental property in Dubai while keeping purchase costs as low as possible. The key request was to find a unit where rental payments could cover a significant share of the developer payment plan instalments.

Neginski analyst Ekaterina selected a one-bedroom apartment in JVC in a completed development by Damac Properties for $310,000, with a two-year post-handover instalment plan.

Because the buyer lived in the emirate, the plan was to rent the unit out independently rather than through a property management company.

Payment details:

Down payment: 40% ($124,000);

The remaining 60% ($186,000): equal instalments over 24 months after handover;

Monthly instalment: ~$7,750;

Net annual income from short-term rental: $25,000;

Monthly rental income: ~$2,080.

Result: rental income covers ~27% of each monthly instalment ($2,080 against an instalment of $7,750). The investor's actual monthly financial burden is reduced to $5,670, while the asset itself generates passive income and appreciates over time.

For living & relocation

An instalment plan helps you plan a relocation: reserve a future home at today’s price and spread the costs evenly across the property itself, paperwork and setting up life in a new country. If you need to move in quickly, you can consider the resale unit with a mortgage or completed properties with post-handover instalments.

Neginski case: a three-year instalment plan saved $123,000 when relocating to Dubai

A family from Europe planned to relocate to Dubai in three years. The goal was to lock in today’s price and spread payments so there was enough budget left for relocation preparation and paperwork.

Sergey’s task as an analyst was to find a property in a family area with a long developer payment plan. The payment schedule had to match the relocation timeline. He selected a two-bedroom apartment in an off-plan project by Emaar in Dubai Hills Estate. Price: $615,000. A three-year instalment plan: a 25% down payment, the rest in equal instalments before and after handover.

The monthly instalment under the plan was $12,815 instead of a one-off payment. By the time of the relocation in 2025, prices for comparable lots had grown to $738,000. The family saved $123,000.

After paying the full amount, the investor received a Golden Visa for 10 years for himself and all family members. Residency was arranged in Dubai after completing the medical check.

At the same time, when buying a home to live in on the secondary market, remember one more cost item: an agent fee of 2%. This increases the size of your down payment, but depending on the project it may still be better value than buying on the primary market.

Get a Dubai new-build

shortlist for your strategy

Up to 5 options with strong resale potential

and trusted developers

How Much You Need for the Down Payment on a Dubai Installment Plan

The first payment usually means not only one of the instalments, but also additional property-related costs that are not included in the unit price.

Additional costs when buying property in Dubai:

DLD fee — 4%;

Apartment admin fee — $1,000–$1,500;

Agent fee (secondary market only) — 2%.

This is important to factor in both when planning your purchase budget and when calculating potential yield or resale income.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Example: first payment and fees when buying property in Dubai

$450,500 — unit price, 58 m², two-bedroom in Dubai Hills.

First instalment under the instalment plan (20%) — $81,090;

DLD fee (4%) — $18,020;

Apartment admin fee — $1,500.

Total: $100,610

Andrey Neginskiy

Real estate expert, CEO of Neginski

Is It Safe to Buy Property on an Instalment Plan in Dubai

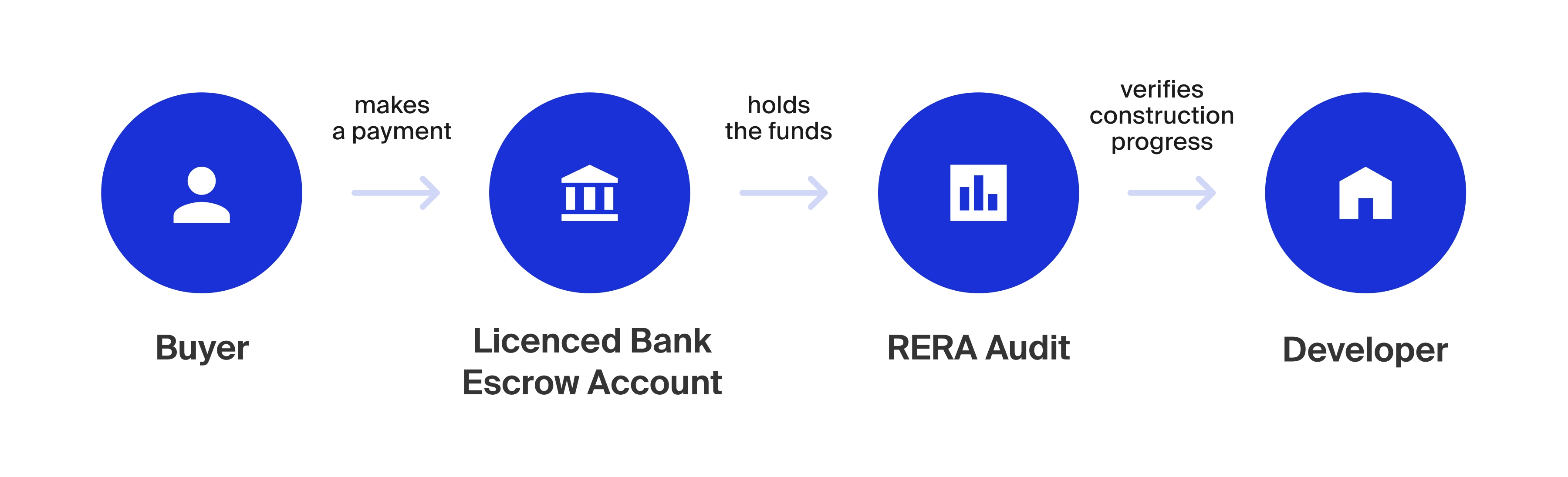

Property transactions in Dubai are regulated and have legal safeguards: developers typically receive funds through escrow accounts rather than directly. The real estate regulator RERA oversees each project and releases money in tranches as construction progresses. The developer receives the full amount only after handover, regardless of the payment plan.

In a worst-case scenario, if a developer freezes construction, the regulator may appoint a new developer to complete the project. If that is not possible, the regulator may initiate a process to return investors’ funds from the escrow account, subject to the project’s status and applicable procedures.

At Neginski, we check not only whether the escrow account is active, but also the movement of funds: how stable the financing is. As a result, our analysts filter out ~76% of projects at the very start due to long-construction risk.

Developer payment model when buying property in Dubai

How Foreigners Can Buy Property in Dubai on an Instalment Plan: Five Steps

You can buy a property either by visiting Dubai or remotely. With an online transaction, a Neginski analyst handles every stage: from agreeing terms with the developer to legal checks and key handover. The client receives documents after each stage is completed.

Step 1. Project shortlist

The analyst clarifies the purchase goal: capital preservation, relocation with family or rental income. This determines the area, property type and strategy. Based on the answers, the analyst prepares an initial shortlist of options.

Step 2. Review the property

A viewing via Zoom or an in-person meeting with the developer. At the sales office, you can see the showroom of the future property and ask questions directly to the representative.

Step 3. Pay the EOI or booking fee

High-potential developments in Dubai can sell out within the first hours of launch. To secure the most liquid lots, speed matters.

Access to the launch is provided by the EOI (Expression of Interest): a preliminary refundable deposit that confirms the investor’s interest, but does not reserve a specific unit.

To book a specific apartment, after paying the EOI you pay the booking fee. It is non-refundable, but it is credited towards the total price.

Step 4. First payment and receiving the SPA

At this stage, you pay the initial instalment under the instalment plan (10–20% of the property price), DLD fee (2–4%) and admin fee (up to $1,500).

The SPA (Sales and Purchase Agreement) is the contract that records the unit specifications. It sets out the unit’s key characteristics and the terms for any changes during construction. The SPA is issued after the first instalment is paid. With a remote transaction, a Neginski analyst receives the document on your behalf and sends it to you.

Step 5. Registration with Dubai Land Department and proof of ownership

Within 1–4 weeks after registration, the buyer receives the Oqood certificate by email, confirming rights to an off-plan property.

After construction is completed, regardless of the payment method, you receive the Title Deed and become the full owner.

A safe, transparent property

deal in Dubai with full support

Clear steps: documents, payments, risks,

and common pitfalls

Common Mistakes When Buying on an Instalment Plan in Dubai

An instalment plan is a tool for using capital efficiently, but planning mistakes can turn an investment into a loss. Below are the top three financial mistakes investors make when buying property on an instalment plan in Dubai.

Miscalculating costs

If you do not factor in every expense at the purchase stage, you can lose yield or fall outside your budget. In some cases, owners are forced to resell urgently. This is called a distressed sale.

How to avoid it: prepare a full cost estimate, speak with an analyst and confirm all potential expenses with the developer.

Investing with no strategy

If an investor buys without a clear plan for how and when to exit, they can lose potential income due to inefficient use of funds.

For example, if you plan to earn resale income, you can do it by paying only 30% of the unit price under the instalment plan. The remaining payments transfer to the next buyer and you realise profit before the project is completed.

How to avoid it: define the investment goal with an analyst and model the outcome across different income scenarios.

Buying above your budget

Some investors do the opposite: they buy property while only being able to pay part of the amount and assume they will exit the deal before all instalments are due.

Market demand can make it possible to resell before construction is completed. But if local demand is misjudged, the deal may not close in time. A long delay in instalment payments can lead to forfeit and even the loss of ownership rights.

How to avoid it: avoid high-risk deals and plan your budget.

About the Author & the Company

Andrey Neginskiy

Real estate expert, CEO of Neginski

This article was prepared by the Neginski team — an international real estate agency with teams in the UAE, Moscow and Phuket. We support clients at every stage, from clarifying goals and selecting a project to completing the purchase and managing the property.

We work with 300+ developers, get early access to off-market launches, source rare listings and negotiate discounts. More than 30% of our clients come back for repeat purchases. Learn more about us

Disclaimer

The information in this article is for general guidance only and does not constitute individual legal, investment or immigration advice. Property purchase terms, instalment plans, mortgage financing, rental rules and UAE residency visa options depend on the specific project, developer, bank, property status and the buyer’s individual profile.

UAE laws and regulatory requirements may change. Before making any decisions, we recommend getting personalised advice and confirming the latest terms with the Dubai Land Department (DLD), the developer, the bank or licenced advisers.

Sources

This article is based on publicly available data, Neginski’s analysis and the team’s hands-on experience.

Links:

Dubai Real Estate Market Q3 2025 Transactions Report

Law No. (8) of 2007 Concerning Escrow Accounts for Real Estate Development in the Emirate of Dubai

Real Estate Regulatory Administration

FAQ

-

Yes. An instalment plan is a developer programme, not a bank product. To proceed, you usually only need a copy of your passport and proof of income. UAE residency is not required.

-

‘0%’ is a marketing term: it usually refers to a developer payment plan marketed as 0% interest, where the price is split into several instalments with no interest added on top.

-

There are two categories of additional costs: at purchase and during ownership.

at purchase: DLD fee — 4% of the price, registration fee — up to $1,500;

during ownership: property management company services and connecting utilities — depends on the building’s tariffs.

-

This is a payment plan where up to 50% of the unit price is paid after handover. It reduces cash pressure, but units with post-handover instalments are priced higher.

-

It is safe if the project is registered with RERA and payments go to an escrow account. RERA oversees construction and the movement of funds. At Neginski, we also check the developer’s track record and the project’s reliability.

-

Yes. This is a resale via assignment. The investor’s profit is the difference between what has already been paid for the property and the resale proceeds. With an instalment plan, the obligation to pay the remaining instalments transfers to the new owner.

-

If a payment is overdue, the developer can apply penalties under the contract terms (for example, 10% of the overdue amount). With prolonged non-payment, the developer can terminate the contract unilaterally and keep all amounts paid.

-

Yes, but only if you are UAE resident. In this case, the investor pays 50% to the developer under the instalment plan, and the remaining 50% is financed by a bank mortgage after handover.

-

Usually, you only need a passport and proof of income (a bank statement or an employment certificate). Requirements may vary depending on the developer.

-

A mortgage can be better when you buy a ready home to move in quickly or when the developer payment plan is too short (less than 2 years), which creates a high monthly payment burden.