Investing in Overseas Property: Which Strategy to Choose in 2026

In 2026, many overseas property markets make investing relatively straightforward: developers offer instalment plans, some locations show strong capital growth and the buying process can be clear and predictable. In this guide, we explain how to choose the right strategy and what alternatives exist beyond buying a unit directly.

Andrey Neginskiy

Real estate expert, CEO of Neginski

At a Glance

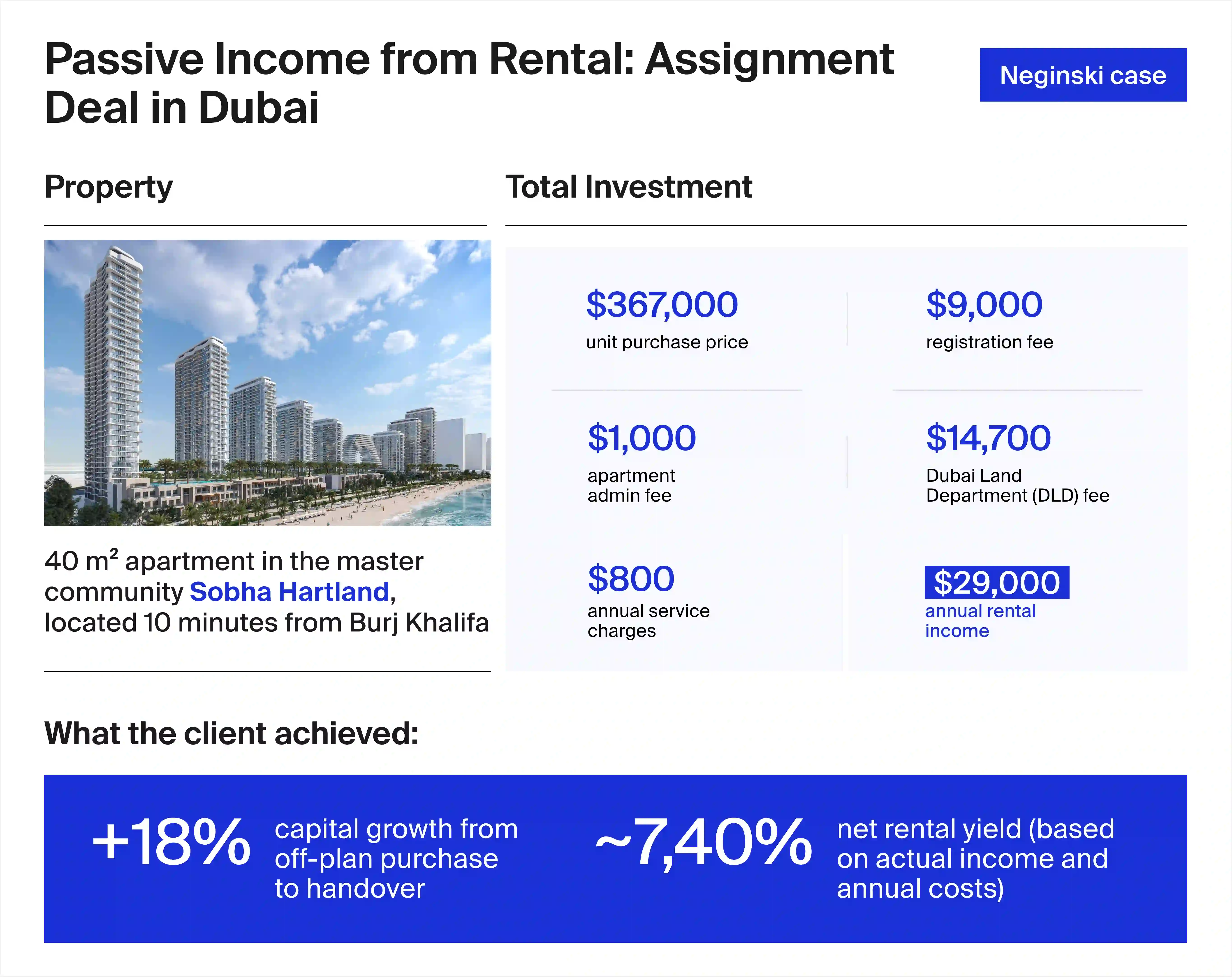

Your strategy depends on your goal: capital protection, passive income (often alongside portfolio diversification) or personal use. Based on Neginski’s five years of market experience and internal analytics, Dubai and Phuket may offer forecast rental yields of up to 12% a year. In some cases, capital growth by handover can reach up to 100%. These markets can also offer exposure to stronger currencies for capital preservation.

Most investors make money either from rental income or from resale income. There are also alternatives: REITs (real estate investment trusts), closed-end investment funds and property crowdfunding. Your result depends on the market, the location, the project, the purchase route and the stage at which you buy.

Pros and Cons of Investing in Overseas Property

There is no universal approach that works equally well in every country. Returns and risks depend on the jurisdiction, the property type, the construction stage and who will manage the rental operation. Below are the key advantages and constraints to check before you choose a strategy and a specific project.

Main advantages of investing in overseas property:

1. A low entry point. For example, in Phuket, business-class units in popular areas with developed infrastructure start from $90,000. In Dubai, prices start from $180,000. An investor can sometimes find options below this price from reliable developers if they join off-market launches and follow updates to Neginski’s catalogues.

2. Several rental models to match your goal. If you want more predictability from rentals, Phuket developers may offer a rental pool programme or a guaranteed returns programme (terms depend on the project). If you want to run short-term rental yourself, Dubai allows it in certain buildings with the right registration and a DTCM licence. You can source guests via platforms such as Airbnb, which may reduce your reliance on a property management company.

3. Straightforward paperwork. For an instalment plan purchase in Dubai, you typically need a passport and proof of income. In Phuket, a passport is usually enough. Proof of income is not required if you pay the full amount in one payment.

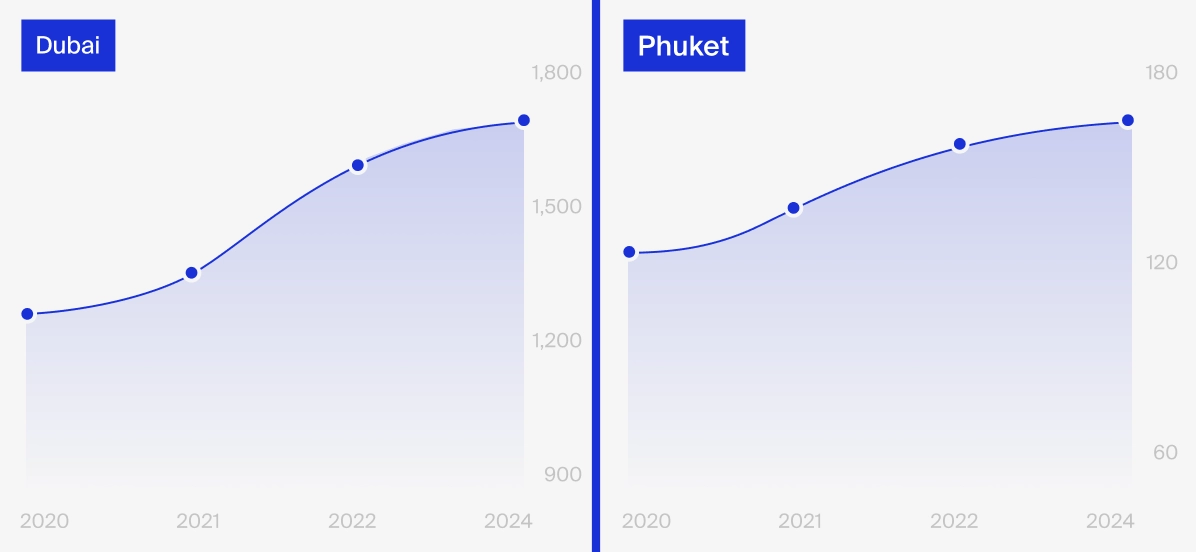

4. High liquidity in some markets. For example, in Dubai, the market exceeded 270,000 transactions in 2025 with a total value of AED 917,000,000,000. Against that backdrop, Dubai property can grow in price by up to 35% by handover for apartments and up to 100% for penthouses. In Phuket, price growth by handover can reach up to 40% in off-plan apartments, penthouses and villas, based on Neginski’s internal analytics.

5. Strong rental income potential. Thanks to tourist demand, rental yield in Dubai can reach up to 9% a year for long-term rental and up to 12% for short-term rental. In Phuket, it can reach up to 8% and 12% respectively. This is above average in some mature markets. For example, average annual yields in the US and the UK are quoted at around 3-4% per year.

How to Earn Passive Income in Hard

Currency from Overseas Real Estate

Find projects with proven rental demand, clear running costs

and fully managed rentals

Constraints of overseas property markets:

1. Mortgages can be hard to arrange. You may need resident status, sometimes proof of local income over two years and a local guarantor. Down payments can start from 50%. Terms are often capped at 15 years, with rates up to 12% a year in Thailand and up to 10% in the UAE. In many cases, a developer instalment plan can be more practical. It is often marketed as ‘0% interest’, and some developers offer post-handover payment plans with instalments for up to three years after handover.

2. Unfamiliar legal frameworks. For example, Thailand does not use escrow accounts in the same way as some other markets, and payments are typically made directly to the developer. Foreigners also cannot own land in Thailand as freehold, only the building structure. This creates legal and operational risks. To reduce them, you need proper due diligence on the project and the developer.

3. Seasonality. In resort markets, short-term rental income depends heavily on the time of year. For example, Phuket often sees heavy rains from June to September, which can reduce tourist arrivals, hotel occupancy and rental income. To mitigate this, choose a unit with an analyst who knows the market. They can help you pick a unit and a location where off-season tourist demand is supported by resident and expat demand.

Four Main Goals for Investing in Overseas Property

Before you choose a strategy, define your goal. Your goal dictates how you deploy capital. Below are four common goals.

Capital protection against inflation

How it works: the investor buys an asset priced in a currency pegged to the US dollar, while the asset itself may grow in value faster than US inflation.

In the UAE, 1 USD = 3.67 AED and inflation is 0.72%. This exchange rate has remained broadly stable for more than 30 years. In Thailand, 1 USD = 31.47 THB and inflation is 0.66%.

Why overseas property is attractive in these conditions:

1. The property can rise in value as the area develops. This can support capital growth even after the project is completed. It can make sense to look at areas covered by Dubai’s official development plan and Phuket’s modernisation plans.

2. You can grow capital faster by investing early in construction. Prices often move most between the foundation stage and handover. If you exit right after handover, you may return your capital with growth broadly in line with the local new-build market.

3. You lock in the property price at today’s exchange rate. This can be more predictable than keeping funds in a bank deposit.

For example, if an investor in the US puts $10,000 into a bank account at 6% per year, they will have $10,600 after one year. But when they withdraw the money, it may buy less because of inflation. The return is fixed in nominal terms, but the real value of the money has fallen.

If the same investor puts $10,000 into Dubai property, and prices in that area rise by 10% over the year, his capital increases to $11,000. The value is held in a physical asset, which may better preserve real value than cash. That is why this route may be more effective for capital preservation.

Passive income

There are two main ways to earn from property: rental income or resale income. The choice depends on how much risk you accept and how quickly you want results. Resale can produce a faster outcome, but the final number depends on market prices at exit. Rental income can be more stable, but it usually takes longer to reach payback.

Utility bills were paid by the tenant. For the owner, the main recurring cost was the annual service charge

Personal use

Overseas property can be bought for personal use too: relocation, winter stays or as a fallback option — a backup home for your family.

Before buying for personal use, it helps to prioritise:

whether you can get resident status through a property purchase;

whether a mortgage is possible and at what rate;

the quality of local education (if you relocate with children);

any investor privileges attached to the purchase.

For example, in Thailand, buying property is not automatically tied to residency. However, some developers support visa arrangements under specific purchase conditions and may offer perks such as a one-year golf club membership.

In the UAE, there are three property-linked residency visa routes. Terms depend on the programme. We cover details here.

Portfolio diversification

This is common for experienced investors who already own property in his home market or invest in other assets such as equities. Overseas property can reduce the risk of capital loss and smooth overall portfolio volatility.

The point of diversification is to avoid a situation where a drawdown in one market or currency wipes out returns across the portfolio, and where property holding costs force an early exit.

How to diversify with overseas property:

decide what share of your capital you can hold in overseas property without needing a quick sale (often 10–30% if relocation is not your goal);

use an instalment plan so you do not pull all allocated capital out of the portfolio at once;

keep a reserve to cover 6–12 months of mandatory payments (instalments, service charges, potential vacancy). This can be up to 6% of the unit price;

diversify not only by country, but also by strategy: for example, one unit for rentals, another for capital growth and resale.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Neginski analysts can match property to any goal. Over 30% of clients come back for a second purchase as part of diversification, or recommend us to friends.

We select assets based on facts and numbers: only 24% of offers pass our risk management.

Our team is not just an estate agent. They are analysts with degrees from leading universities. They know their markets from the inside because they live in the regions they advise on.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Core Strategies for Overseas Property Investment

A strategy is a predefined plan for how you will earn from a unit and when you plan to exit the asset. Below are the common strategies. Results depend on the market and the project, so it is better to confirm forecasts with an analyst.

Renting out the property

You can earn passive income from rentals in different ways. Long-term rental is usually more stable and lower-risk, but yields are often lower. Short-term rental can be higher-yield, but costs and workload are higher. Here are the key scenarios.

Short-term rental — self-managed. Short-term rental can be one of the higher-yield options.

Yield depends on:

location;

rental rates;

unit features;

on-site amenities;

additional costs.

In Neginski clients’ experience, self-managing often means lower occupancy than a property management company can deliver. Even with experience, owners may only book up to 15 nights a month.

Self-managed short-term rental requires being in the country and constant work with guests and listings, so it is not fully passive.

Typical expenses include:

utilities;

service charges;

cleaning;

toiletries and consumables;

repairs due to wear-and-tear.

Also, not every country allows short-term rental. In many cases, you need a hotel or short-term rental licence, and it is only permitted in certain buildings.

Short-term rental — via a property management company. With this model, an investor can aim for occupancy of around 24 days out of 30 a month. Branded residences (for example, Wyndham or Accor) can help. Large hotel operators have global customer databases, which can increase bookings and, as a result, rental income.

The property management company covers operations: guest sourcing, check-in and check-out, reporting and payouts. A management fee can be up to 30% of revenue.

In Phuket, this model may come in two formats (depending on the project): rental pool* or guaranteed returns**.

* rental pool — a rental model where units are pooled into one “hotel-style” inventory and profits are split between owners pro rata.

** guaranteed returns — a programme where the developer or management company fixes the payout level and pays it annually regardless of actual occupancy (terms, caps and conditions matter).

Long-term rental — self-managed or via a management company. The right option depends on where you are based.

Long-term contracts are often signed for 11 months and frequently renewed (for example, when tenants are a family settled in the area). In this case, the owner’s involvement may be limited to viewings and signing, which can be handled via an agent.

If you want to reduce the risk of frequent tenant changes and vacancy, you can delegate long-term rental to a property management company for 20–30% of the contract value.

Waiting to buy could be costing

you money

Let's calculate the potential loss, with examples

from Dubai and Phuket

Resale

You can earn resale income on the primary market or the secondary market. Below are four common approaches.

Primary market. You can resell an off-plan unit via assignment during construction, sell after handover or exit 1–5 years after completion. Depending on the destination, overseas property can grow by 25–50% by handover, and in rarer assets up to 100%. After that, this guide uses a working assumption of around 10% a year on average, but outcomes depend on the market cycle and the specific location.

What to keep in mind:

The biggest upside is often at the earliest stage — before the foundation is laid. Prices can be up to 50% lower than after handover. But assignment deals require deeper due diligence, so risk management matters most here;

The unit price can still rise after handover, but the pace depends on the location and unit characteristics. For example, one-bedroom units with views tend to be in higher demand. But if a new building is planned in front of yours, you may lose the view and part of the value. Analyse the wider development plan before you buy;

Holding beyond five years is not always efficient, unless the location has limited new supply. Over a five-year horizon, competing supply can appear nearby at a more attractive price, which can force you to sell below your cost basis.

Secondary market. A common approach is flipping. An investor buys a worn unit at a lower price, refurbishes it and sells at a premium.

This can produce 15–60% of invested capital, but risks are real: a good refurbishment does not help if the unit is in an illiquid location and buyers do not show up.

We cover Dubai and Phuket investment approaches in more detail in this article.

Neginski’s client care team in Dubai helps clients choose a unit and resell it on the secondary market

Alternative investment routes

You do not need to own a unit to invest in property.

These instruments can generate returns without direct ownership:

1. REITs — real estate investment trusts. The fund buys property with investors’ money, rents it out or sells at a profit. Investors receive their share pro rata.

2. Closed-end investment funds — pooled funds investing in assets or securities for 3 to 15 years. After the term ends, the fund is wound up and investors receive their share of the profit.

3. Crowdfunding — multiple investors co-finance a project. A sponsor runs the deals and an online platform connects the sponsor to investors. When the project makes a profit, each investor receives a return based on their stake.

How to Choose an Overseas Property Strategy

The best strategy depends on your goals, your resources and your tolerance for risk. Assess the market, compare property types and model the numbers.

How to choose a strategy that matches your profile:

1. Define your goal.

Passive income — renting out or reselling

Capital protection — longer hold, with rentals as a parallel cashflow

Hybrid — for example, rent for a few years and sell later

2. Set your budget, payment route and management model.

Budget affects location and property class

Payment route — mortgage, instalments or 100% payment

Your time — if you can manage rentals yourself, returns can be higher. If not, include management fees in your model

3. Choose a market with suitable conditions.

Phuket — if your budget is lower and you want more predictability on rental income at the start, for example via a rental pool or guaranteed returns (where available). Market guide;

Dubai — if you are ready to invest more for potentially higher returns. Market guide.

4. Choose a property type.

| Type | Best for | Notes |

|---|---|---|

|

Off-plan |

Capital protection, rentals, resale |

Cheaper at entry, but you wait to start earning |

|

Secondary |

Rentals, resale, personal use |

Faster deal, you can rent out immediately |

|

Commercial |

Rentals |

More expensive and requires deeper market knowledge |

5. Define your investment horizon.

Fast deal — flipping;

1–5 years — resale or rentals;

5+ years — capital protection and rentals.

How Beginners Can Start Investing in Overseas Property

You can buy the property in person or remotely. For a strong outcome, you need market analysis, a liquid unit and legal due diligence. Below is a step-by-step process.

Step 1. Define your goal and strategy

At the start, most goals fall into three buckets: capital protection, passive income and personal use. We recommend choosing one as the main goal.

A Neginski analyst can map the strategy to your goal, timeline and budget.

Step 2. Choose a market and a unit

Your choice depends on budget and risk tolerance. For example, Dubai starts from $180,000. Liquidity is high, but the entry point is higher. Phuket starts from $90,000, and some developers offer guaranteed returns programmes, but rates can be below market yield.

If you do not want to do it alone, Neginski analysts can help. We have two branches and six overseas offices. We can source property in the location that best fits your goals and budget. With vetted partners and proper checks, these markets can be structured safely.

Step 3. Reserve the unit

In Dubai, you typically start with an EOI (Expression of Interest): a refundable deposit that confirms intent but does not secure a specific unit. To reserve a particular unit, you then pay a booking fee. It is usually non-refundable, but it is credited towards the purchase price.

In Phuket, instead of an EOI, buyers typically pay a 2–5% deposit. Payment can be made via bank transfer to the developer or in cash. If the buyer cancels, the deposit is usually not refunded.

Step 4. Sign the SPA and make payments

The SPA (Sales and Purchase Agreement) sets out the unit specifications and key deal terms. It protects the buyer from changes to the unit during construction. It is issued after full payment or after the first instalment under an instalment plan or a mortgage. Mortgages are harder: they often require resident status.

For instalment plans, the down payment can be 10–40% depending on the project and the market. After that, payments follow a schedule tied to construction milestones.

Step 5. Register the deal

In Dubai, before registration you pay a registration fee of 2–4% of the price. Then you register the purchase with the Dubai Land Department (DLD). Within 1–4 weeks, you receive an Oqood certificate by email for an off-plan unit.

In Phuket, registration is completed via Thailand’s Land Department. The investor also pays state fees and taxes from 1.1% to 6.3% depending on the ownership structure.

Step 6. Wait for handover and collect the Title Deed

After completion and acceptance, you receive the ownership document: in Dubai, the Title Deed. In Phuket, this is the Chanote for a villa purchase, and the Condominium Unit Title Deed for an apartment in a condominium project.

You can collect the document in person or delegate it to our specialist. They can accept the property under a power of attorney and register all documents in your name.

Step 7. Resell or rent out

If you buy in Dubai through Neginski, you can delegate the process to our client care team. They handle everything from key collection to finding buyers or tenants and reporting. We cover day-to-day and legal tasks, so the investor can treat the income as passive.

What if you do it without Neginski?

For rentals, consider a property management company: it can help maximise occupancy and stabilise payouts. For resale, you need to estimate the market price, list the unit and complete the sale under local rules. You can also delegate this to a local agent. In many markets, secondary market agents charge around 2% of the sale price.

Buy an overseas apartment

remotely safely

A step-by-step guide to completing the purchase online:

documents, payments, and title registration

About the Author & the Company

Andrey Neginskiy

Real estate expert, CEO of Neginski

This article was prepared by the Neginski team — an international real estate agency with teams in the UAE, Moscow and Phuket. We support clients at every stage, from clarifying goals and selecting a project to completing the purchase and managing the property.

We work with 300+ developers, get early access to off-market launches, source rare listings and negotiate discounts. More than 30% of our clients come back for repeat purchases. Learn more about us.

Disclaimer

The information in this article is for general guidance only and does not constitute individual legal, investment or immigration advice. Property purchase terms, instalment plans, mortgage financing, rental and resale rules in UAE and Thailand depend on the specific project, developer, bank, property status and the buyer’s individual profile.

UAE laws and regulatory requirements may change. Before making any decisions, we recommend getting personalised advice and confirming the latest terms with the Dubai Land Department (DLD) and Thai Land Department, the developer, the bank or licenced advisors.

Sources

This article is based on publicly available data, Neginski’s analysis and the team’s hands-on experience.

Links:

Invest in Real Estate Abroad in 2026 | Neginski Real Estate

Buying Real Estate in Phuket for living and income | Neginski Real Estate

How to buy property in Dubai for life and investing | Neginski Real Estate

Dubai Residency Visa Through Property Purchase | Neginski Real Estate

FAQ

-

It can be worth it if your budget matches the market’s typical entry point and you understand the risks that come with property investing.

What outcomes can you realistically target:

capital growth from 25% to 100% on resale, depending on the market, location, project and the stage at which you buy;

rental yield up to 12% a year, depending on the rental model and the same property factors;

capital preservation in a stronger currency.

-

The most reliable strategy is the one that reduces two risks upfront: vacancy and the inability to exit quickly. This is why many investors choose capital protection: a longer hold, rentals as parallel cashflow and a clear management model (self-managed or via a property management company).

-

It depends on your time horizon:

if you want passive income over several years, renting out is often the fit. On a secondary unit it is faster: a shorter deal and you can rent immediately, but yield can be lower;

if you want a quicker result around handover, resale is often considered because buying early can be cheaper and the price can rise by handover.

-

entry point: Dubai from $180,000, Phuket from $90,000;

yields: Dubai is market-based, Phuket may offer guaranteed returns or a rental pool (depending on the project);

payments: Dubai often uses escrow mechanisms, Phuket payments typically go directly to the developer;

land ownership: Dubai offers freehold in designated areas, Phuket is typically leasehold for land (while condominiums have specific freehold structures within foreign ownership quotas);

goal logic: Phuket can fit lower budgets and investors who want more predictability on rental income at the start, Dubai can fit higher cheques and potentially higher returns.

-

low liquidity and a long exit, which is why location and project analysis matter;

legal risks: you need to verify ownership documents and the ownership structure;

seasonality: to reduce it, choose a location that is popular with tourists and expats.

-

Yes, the deal can be done online. In that case, a broker-analyst can manage the transaction and paperwork. The investor signs and pays, then documents are sent by email or delivered to the required address.

-

It depends on the price and liquidity of the unit. In Dubai and Phuket, an average payback period of 10–12 years at yields of 10–12% a year.

-

Neginski recommends working with an analyst: they help define the strategy and select a reliable unit for your budget.

If you do it without an analyst:

define your goal: passive income, capital protection or personal use;

define your budget and market;

choose a project: primary or secondary market, residential or commercial;

assess the location: tourist demand, proximity to business hubs, beaches and malls;

inspect the property with the developer’s representative;

agree terms and sign the contract;

wait for completion and collect the keys.