Bali property market in 2025: prices from $80,000 and rental yields up to 16%

Dmitry Tsvetkov

Teamlead

While many global property markets face uncertainty and shrinking yields, Bali continues to deliver what investors want: 8–16% annual rental returns supported by record tourism. In 2024 alone, 6.3 million visitors came to the island, from digital nomads to wellness travelers and luxury holidaymakers.

Between 2021 and 2024, property prices in Bali jumped 51% per square meter, driven by steady occupancy, new infrastructure, and pro-investment policies — growth built on fundamentals, not speculation.

The opportunity is real — but so are the risks. Legal loopholes, construction delays, and inflated promises can all undermine results. This guide shows how foreigners can buy property safely, highlights the areas and property types with the strongest growth and returns, and outlines the due diligence steps that turn opportunities into successful investments.

$80,000+

Entry price

8–16% per year

Rental yields

Up to 20%

Property price growth

Why invest in Bali real estate: 5 key benefits

Bali’s property market is often described as one of the most promising hotspots in Southeast Asia, and for good reason. While glossy ads sometimes exaggerate the numbers, the island does offer real investment opportunities for those who invest wisely. Here are five key benefits that make Bali's property sector attractive to international buyers.

1. Strong rental yields. Well-managed villas and apartments in prime areas like Seminyak and Canggu can bring 10–14% net rental income, with top performers reaching up to 16%. Short-term rentals tend to be the most profitable, while long-term leases provide more stable income.

2. Year-round demand. Unlike many resort markets, Bali attracts visitors in every season. In 2024, the island welcomed 6.3 million international tourists, with average occupancy rates around 80%. Prime locations can reach 85–90%, ensuring that rental properties rarely sit empty.

3. Strong capital growth. Real estate investors who buy during presale often see property prices rise by 10–20% per year during construction, translating into a total increase in property values of 30–50% by completion. Even after delivery, completed properties usually grow at a steady 5–10% annually.

4. Accessible entry points. The real estate market is not limited to million-dollar villas. Bali offers smaller units like studio apartments and condo-villas starting at around $80,000, often with developer payment plans that require only 30% upfront. This makes the luxury lifestyle accessible to a wider range of investors.

5. Expanding infrastructure. Infrastructure development is one of the strongest drivers of property value growth in Bali. By 2028, several large-scale projects are set to transform the island:

New international airport in north Bali with capacity for up to 50 million passengers a year

Metro system connecting key districts

Modern sports complex in Bangli

Cultural hub in Klungkung

Toll road linking Gilimanuk and Mengwi

These projects will boost mobility, tourism, and local economies, creating higher demand for rental properties in nearby areas and shaping the property market trends for coming years.

Bali’s real estate market does not guarantee success for everyone, but with the right strategy and professional guidance from experienced real estate agents, investors can achieve strong returns and reliable income. For a deeper look at the opportunities and risks, see the article that explores market reality versus marketing claims.

Handpicked Bali properties for smart investors

Legal ways foreigners can own property in Bali

Foreigners cannot buy freehold land in Bali — that right is reserved for Indonesian citizens. But this does not mean you are shut out of the market. Indonesia’s property law offers several legal structures that allow foreign investment and enable international buyers to buy, use, rent, and even pass property on to heirs

Leasehold — Hak Sewa

This is the most common and flexible path for foreign buyers. You lease land from an Indonesian owner for 25–30 years, often with options to extend up to 80 years.

Leasehold gives you the right to build, live in, rent out, or resell the property. The key is the contract: since leasehold is not registered in the national land registry, every clause must be clear about extensions, inheritance, and resale.

Right to use — Hak Pakai

Available to foreigners with a residence permit such as KITAS or KITAP, Hak Pakai is a stronger form of ownership. It is registered in your name at Indonesia’s National Land Agency, giving you a land certificate recognized by the state.

You can live in the property, transfer it to heirs, and resell it to another eligible foreigner. However, it can only be used for residential purposes, and you can hold just one Hak Pakai property at a time.

Right to build — Hak Guna Bangunan

This option is for those who set up a foreign-owned company — PT PMA. The company — not you personally — owns the land and buildings, making this suitable for commercial real estate ventures and larger real estate investment projects.

Hak Guna Bangunan allows you to develop villas, apartments, or commercial projects, and hold them for up to 80 years with extensions. It comes with higher requirements, such as a minimum capital of IDR 10 billion, or about $608,000, and full tax compliance, but it is the only legal way for foreigners to run property as a business in Bali.

Each ownership model has its own strengths and limitations. The best choice depends on your goals — whether you want a holiday home, a long-term residence, or a property investment business. With the right legal structure, owning property in Bali is not only possible but secure.

Need help finding the right property?

We vet every developer for track record, financial strength, and buyer feedback so only secure, high‑potential options make the cut.

Property types investors choose in 2025

By 2025, Bali’s property market offers investors more choice than ever before. What was once a niche destination for adventurous buyers has matured into a structured market with clear segments and strategies.

From affordable apartments to multi-million-dollar estates, each property type serves a different profile of investor — whether the goal is steady rental income, fast appreciation, or a mix of lifestyle and profit.

Villas: still the number one choice

Villas remain the most popular option for investors in Bali, with prices ranging from $200,000 to $500,000 for 2–3 bedroom homes to more than $1 million for large estates with prime ocean views. They are especially attractive for families, remote workers, and tourists who want privacy and the true “Bali vibe.”

Rental income is supported by strong daily rates: $150–200 on average, rising to $500 for luxury properties and up to $3,000 a night in premium locations.

Dmitry Tsvetkov

Teamlead

Condo-villas are Balinese innovation. They are small standalone homes, usually 30–50 square meters, priced from $80,000, which combine villa-style privacy with shared resort amenities such as pools, gyms, and restaurants.

This hybrid format appeals to travelers who want independence without giving up hotel-like services. Occupancy rates of 75–85% and professional management make condo-villas one of the most attractive entry-level investment options in Bali’s luxury segment.

Dmitry Tsvetkov

Teamlead

Apartments: affordable and resilient

Apartments, typically priced from $80,000 to $200,000, have shifted from being budget options to highly attractive assets, especially for the growing digital nomad community. While they bring in lower nightly rates than villas — on average $90–100 — their lower purchase and maintenance costs make returns strong.

Apartments in areas like Canggu, Umalas, and Ubud attract steady demand because they offer what tenants want most: reliable internet, coworking spaces, cafes, SPAs, and a vibrant social life.

Hotel units and branded residences: passive income made easy

Hotel units are the most accessible option in Bali’s resort complexes, with entry prices starting at around $90,000. Owners receive a fixed daily income, usually $40–60 net per day, without taking part in the rental process.

Everything — from bookings and guest services to maintenance — is managed by the hotel operator. The trade-off is that you cannot influence rental pricing or overall profitability, making this a hands-off but limited model.

Branded residences, priced between $200,000 and $500,000 and up to $1 million for premium projects, are aimed at investors who want reliable income combined with the reputation of international hospitality brands. These properties often come with guaranteed annual yields of 6–10% and provide access to resort-style amenities.

While management fees reduce margins compared to self-managed villas, the stability of income and strong resale value supported by global hotel marketing make them one of the most secure long-term investments.

Price ranges in Bali property market 2025: comparison

| Property type | Typical prices | Property features |

|---|---|---|

|

Studios and condo-villas, 21+ m² |

$80,000+ |

Compact units or small standalone homes with resort amenities |

|

Hotel units |

$90,000+ |

Hassle-free resort ownership with rentals managed by the hotel |

|

1-bedroom apartments, 40+ m² |

$100,000+ |

Suited for solo travelers or couples |

|

2-bedroom apartments, 60+ m² |

$140,000+ |

Popular with small families and long-stay tourists |

|

3-bedroom apartments, 90+ m² |

$220,000+ |

Larger layouts for families and shared living |

|

Villas with 2–3 bedrooms, 60+ m² |

$200,000 – $500,000 |

Family villas in popular districts, flexible for rentals |

|

Luxury villas with 3–4 bedrooms, 90+ m² |

$500,000 – $1,000,000 |

Premium properties near beaches or with ocean views |

|

Beach houses and branded residences |

$500,000 – $1,000,000 |

High-end homes in resort zones |

|

Exclusive estates with 5+ bedrooms |

$1,000,000+ |

Spacious residences with unique views and limited supply |

Best areas to buy property in Bali

Bali is not a single real estate market but a collection of very different districts, each with its own character, community, and investment profile. Some areas are driven by luxury tourism, others by digital nomads and wellness seekers, and some appeal most to families looking for a long-term base.

Choosing the right location is the single most important factor for rental yields, resale potential, and lifestyle fit.

Canggu has become Bali’s trendiest surf town, famous for beach clubs, co-working spaces, and a lively social scene. Villas dominate the market, with prices ranging from $2,500 to $3,500 per m², climbing to $6,000 per m² in prime areas and up to $8,000 per m² for top beachfront locations.

Seminyak is Bali’s style capital, where designer boutiques, fine dining, and luxury resorts meet golden sands. Property here is among the island’s most expensive, with prices generally between $4,500 and $6,500 per m², and up to $10,000 per m² in the most exclusive beachfront spots.

The Bukit Peninsula, home to Uluwatu, Nusa Dua, and Jimbaran, combines dramatic ocean views with surf culture and luxury resorts. Prices typically fall between $2,500 and $5,000 per m², making it more affordable than Seminyak while still offering excellent growth potential.

Ubud, Bali’s cultural and spiritual center, attracts wellness travelers, digital nomads, and families. Property here averages $2,500 to $4,000 per m², lower than coastal districts but supported by steady demand and strong rental performance.

Nuanu is a new eco-focused community near Tanah Lot that blends art, sustainability, and technology. Property prices currently range from $2,800 to $4,500 per m², offering investors the chance to enter early into a large-scale development.

Other promising areas include Seseh and Cemagi for tranquil coastal living, Umalas for family-friendly homes close to schools, Kuta for budget-friendly tourism properties, and Sanur for laid-back seaside living.

Best new developments on the island

Step-by-step guide to buying property in Bali as a foreigner

At Neginski, we follow a clear five-step system designed to make the buying process simple, transparent, and safe for international clients. On the primary market our services come at no extra cost — developers cover our fees from their marketing budgets.

1. Define your goal. We start by clarifying your objective: passive income, relocation, capital preservation, or growth. Based on this, we recommend the right strategy and budget.

2. Filter the options. Only 24% of projects on the market pass our due diligence. We eliminate risky or low-quality developments and present only secure opportunities.

3. View the property. You can tour properties in person if you visit Bali, or we can arrange detailed video viewings for remote buyers. We also explain ownership structures, management options, and calculate projected rental yields.

4. Verify all documents. Our team checks ownership rights, building permits, and the developer’s track record. We request full legal checks from independent notaries and confirm that the project complies with Indonesian law.

5. Secure the deal. Once you’ve chosen, we negotiate payment terms, instalment plans, and possible discounts with the developer. We also reserve the unit and ensure all agreements are properly documented.

Dmitry Tsvetkov

Teamlead

Around 80% of our clients invest in Bali property fully remotely. We handle everything from property selection and reservation to negotiating terms with developers, signing contracts, and registering transactions with state authorities.

Dmitry Tsvetkov

Teamlead

Financing options in Bali: instalment plans and alternatives

Traditional bank mortgages aren't available for foreign buyers in Bali, but that hasn't deterred international investors. Instead, the market has evolved around developer financing plans and creative payment structures that make property purchases accessible without conventional loans.

Why traditional mortgages aren't an option

Indonesian banks don't offer home loans to foreign individuals. Mortgage financing remains exclusively available to Indonesian citizens or companies registered locally. This means foreign buyers must rely entirely on cash purchases or alternative financing arrangements.

However, this limitation is largely offset by Bali's competitive property prices and the generous payment terms most developers provide specifically for international clients.

Developer instalment plans: the standard approach

Most new developments in Bali come with built-in payment plans designed specifically for foreign buyers. These arrangements are straightforward, require no credit checks or collateral, and typically follow this structure:

30% down payment upon signing the purchase agreement

Remaining 70% spread over 12–24 months in equal installments

0% interest in most cases

Post-completion payment options available on select projects, sometimes allowing buyers to use rental income to finish payments

The beauty of these plans lies in their flexibility. Developers are often willing to negotiate terms, particularly during pre-construction sales phases. This gives buyers valuable time to organize funds, handle currency conversions, or liquidate other assets before completing their purchase.

Know your returns before you invest

We’ll assess your goals and opportunities and run the numbers.

Taxes on Bali real estate: what buyers need to know

Bali is known as one of the most accessible property markets for foreign buyers, but ownership also comes with a layer of taxes and fees. These costs are not excessive by global standards, yet they do affect your actual return.

What you pay when buying

Every transaction involves upfront costs, although in many new developments these are already included in the advertised price. Typical fees are:

Notary fee — 1% of the purchase value, covering legal review, contract drafting, and registration.

Value-added tax — 11% when buying new property directly from a developer. This is often included in presale pricing, but always check.

Luxury goods sales tax — 20% on properties above $1.9 million, applied only to brand-new, high-value acquisitions.

Regular charges after purchase

Once you own the property, taxes shift to annual obligations:

Annual property tax — 0.5% of the government-assessed value, usually modest compared to market value.

Luxury property tax — 10 to 20% per year, applied to high-end villas depending on size, zoning, and use.

Lease renewal payments — for leasehold properties, a new payment is required after 25–30 years. This is not technically a tax, but it is a major expense that functions much the same.

How rental income is taxed

Rental income taxation depends on how the property is managed:

10% tax if a licensed management company operates the property with the necessary tourism permits.

20% tax if you rent it out directly as a foreigner without a registered entity or local partner.

Short-term rentals — daily or weekly — also incur 11% VAT, but only if the property is formally run as a licensed tourism business. In those cases, the VAT is usually included in the operator’s pricing. Long-term rentals are exempt from VAT but remain subject to income tax.

Dmitry Tsvetkov

Teamlead

Operating expenses — such as management fees, cleaning, maintenance, and booking platform commissions — typically reduce gross rental income by 45–50%. Even after these costs and taxes, well-managed properties in Bali still achieve net yields of 10–16% annually, making them competitive with leading global markets.

Dmitry Tsvetkov

Teamlead

Risks in Bali property investment and how to avoid them

Bali’s real estate market is full of opportunities, but it is not without risks. Investors can achieve strong returns and enjoy the lifestyle benefits the island offers, but success depends on careful checks, good legal support, and realistic expectations. Here are the main risks to be aware of — and how to protect yourself.

Land and zoning issues

Not all land in Bali can legally be used for housing or rentals. Indonesian law divides land into zones: green for conservation, yellow for residential, and pink for commercial. Building on land that is not zoned for your intended use can result in fines, demolition orders, or forced closures.

How to stay safe:

Ask a licensed notary to verify land use before committing to a deal.

Do not rely on verbal promises from sellers or agents.

Always review the land certificate and zoning documents.

Weak leasehold agreements

Most foreigners buy on leasehold terms, but contracts vary in quality. Poorly written leases may not clearly state renewal conditions, inheritance rights, or resale options, making the property harder to keep or sell later.

How to stay safe:

Make sure the lease includes clear renewal conditions in writing.

Add clauses covering inheritance and resale rights.

Use notarized, bilingual contracts reviewed by a qualified lawyer.

Avoid handshake agreements or informal paperwork.

Developer and construction risks

Buying off-plan can be attractive, but it comes with risks such as construction delays, poor quality, unexpected costs, or even abandoned projects.

How to stay safe:

Research the developer’s track record and visit past projects.

Speak with previous buyers for references.

Favor developers who finance part of the project themselves, not just with deposits.

Check that building permits and land titles are secured.

Use staged payment schedules linked to construction milestones.

Climate-related construction problems

Bali’s tropical climate — with heavy rain, high humidity, and seismic activity — can expose flaws in construction. Poor materials or design often lead to mold, leaks, and rapid wear and tear.

How to stay safe:

Hire an independent inspector during construction and before handover.

Choose projects with professional maintenance teams and proper budgets.

Look for earthquake-resistant designs and ventilation systems.

Prioritize developments built with materials suitable for tropical conditions.

Legal and tax compliance

Operating rental properties in Bali requires the right licenses, tax registration, and regular reporting. Failing to comply can result in fines or even closure of the property.

How to stay safe:

Work with a licensed property management company that handles compliance.

Use legal counsel to structure your investment correctly and register everything from the start.

Unrealistic return promises

Some developers and agents advertise “guaranteed” returns of 20% or more while downplaying taxes, furnishing costs, management fees, or vacancy risk.

How to stay safe:

Ask for detailed financial models that include all costs.

Compare with actual occupancy data from similar finished projects.

Use realistic benchmarks: 8–16% annual returns are typical for well-located properties.

Be cautious of “guaranteed income” offers that sound too good to be true.

The bottom line on the Bali property market in 2025

Bali’s real estate market rewards strategy, not luck. Treat the island as a set of distinct markets and match your goal to the right area and format:

South Bali for high short-term yields

Ubud and Nuanu for longer stays and steadier occupancy

Micro-locations near the beach and on quieter streets for stronger resale and pricing power

Property type matters just as much:

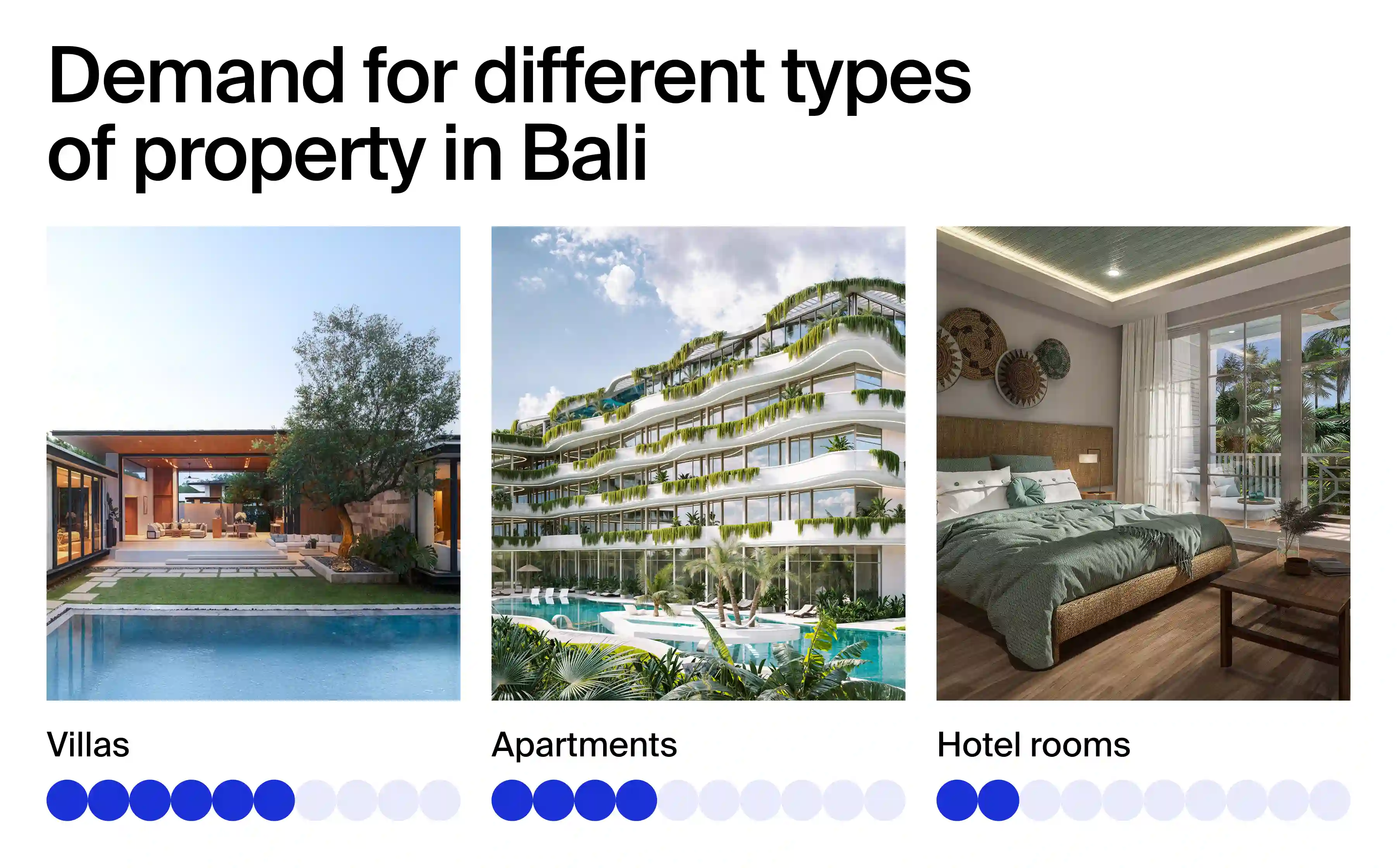

Villas lead demand

Apartments win on accessibility and year-round occupancy

Condo-villas offer an affordable villa feel

Branded residences trade a slice of upside for predictability

The playbook is simple: define your outcome, shortlist districts that fit it, pick the format that matches your budget and tenant, run conservative numbers, and only wire funds after legal due diligence comes back clean. With that discipline, Bali offers something rare today — solid yields of up to 16%, real end-user demand, and multiple entry points that let you build a portfolio step by step.

Want early access to top investment deals?

We’re among the first to know about hottest presales — and we help clients secure the best units before public launch.

FAQ

-

Foreigners cannot directly own freehold land in Indonesia, but there are three fully legal options: long-term lease agreements, or Hak Sewa, the right-to-use title, or Hak Pakai, for those with a residence permit, and ownership through a foreign-owned company, or PT PMA, which allows commercial use. All three structures are recognized by Indonesian law and can provide secure rights for up to 80 years

-

The strongest demand in 2025 is concentrated in South Bali — particularly Canggu, Seminyak, Uluwatu, and Nusa Dua. Ubud and Sanur also remain popular for families and long-stay visitors, while new hubs like Nuanu are gaining attention thanks to infrastructure growth and sustainability projects

-

Villas are the top choice thanks to their privacy and rental appeal, apartments are attractive for their affordability and central locations, condo-villas offer an affordable villa-style experience with resort amenities, and branded residences appeal to investors who want fully managed, hands-off income.

-

Prices vary by size and location. Entry-level villas in less central areas start around $150,000. Mid-range villas in popular zones are typically $250,000–500,000. Premium beachfront or ocean-view estates often exceed $1 million. Price per square meter ranges from about $2,000 in emerging districts to $10,000 in prime beachfront areas.

-

Yes, Bali is one of the strongest global markets for rental yields, thanks to consistent year-round tourism. Properties can be rented long-term or short-term, with yields ranging from 8–16% net annually.

To rent out a property for less than 30 days, foreign owners must work with licensed management companies that handle compliance, guest services, and taxes.

-

At purchase, buyers typically pay a notary fee of 1%, VAT of 11% on new builds, and luxury tax of 20% on new properties above $1.9 million. Ongoing costs include 0.5% annual property tax, 10–20% luxury tax for high-end villas, and lease renewal payments after 25–30 years for leasehold. Rental income is taxed at 10% if managed by a licensed operator or 20% if rented out directly.

-

Traditional mortgages are not available to foreigners. Instead, most developers offer instalment plans: typically a 30% down payment, with the balance spread over 12–24 months interest-free. Some projects also allow post-handover payments, sometimes covered by rental income.

-

Yes, remote ownership is common and practical in Bali. Most foreign investors work with licensed property management companies that handle everything — from guest communication and bookings to maintenance and regulatory compliance — ensuring income without the need to be on the island.

.webp)

.webp)