Foreigners buying property in Bali: legal options, risks and steps in 2025

Igor Borovsky

Head of Analytics Department

As a foreigner, you can’t own land in Bali outright — but that doesn’t mean you can’t legally own real estate, rent it out, or resell it for a profit. Indonesia offers several clear legal pathways for foreign ownership — and if you choose the right one, you can control property in Bali for up to 80 years, fully protected by contract or title.

This guide breaks down how it works: from leasehold and residential titles to corporate ownership.

3 forms

Of property ownership for foreigners

$80,000+

Entry price

8–16%

Annual rental yields

Can foreigners buy property in Bali?

Foreigners cannot own land in Bali in freehold, or under Hak Milik, — that right is reserved for Indonesian citizens. However, this restriction doesn’t mean foreigners are excluded from the Indonesian property market. Indonesia’s property law offers alternative land use rights that allow non-citizens to legally control, profit from, and inherit property — for periods of up to 80 years.

In practice, foreigners acquire the right to use, lease, or build on land, not the land itself. These rights are formalized through legal structures that are long-term, renewable, and — if structured properly — fully transferable. Choosing the right model is key to owning property in Bali legally and securely.

Leasehold — Hak Sewa. This is the most accessible route for foreigners entering the buying process. You lease land from an Indonesian owner and gain the right to build, live in, rent out, or resell the lease to another party. No residence permit is required.

Hak Sewa is flexible and straightforward, but it comes with one major limitation: the lease agreement is not registered in the national land registry (BPN). Instead, your rights are secured by a notarized contract. This makes legal review essential — every clause matters, especially those concerning extensions, resale terms, and what happens if the landowner sells or passes away.

Right to Use — Hak Pakai. This title is available to foreigners who hold a residence permit. Unlike Hak Sewa, Hak Pakai is registered in your name at BPN, giving stronger legal protection under Indonesian property law. It allows you to live in the property, pass it on to heirs, or transfer it to another eligible resident.

However, it’s subject to restrictions: you can hold only one Hak Pakai property at a time, and the land must be used for residential purposes only.

Right to build — Hak Guna Bangunan. This title is designed for foreign-owned companies. It grants long-term rights to build and use property for income-generating purposes — like villas, apartments, or commercial complexes.

Under Hak Guna Bangunan, the land is owned by the company, and the company is owned by you. However, this structure comes with higher entry requirements:

You must establish a company with a minimum capital of IDR 10 billion.

The company must meet all investment and tax compliance obligations.

The property must be used for commercial or rental purposes.

Freehold — Hak Milik. This is full land ownership, comparable to owning property in Europe or the US. However, only Indonesian citizens can hold a freehold title. Even local companies can’t qualify unless 100% Indonesian-owned.

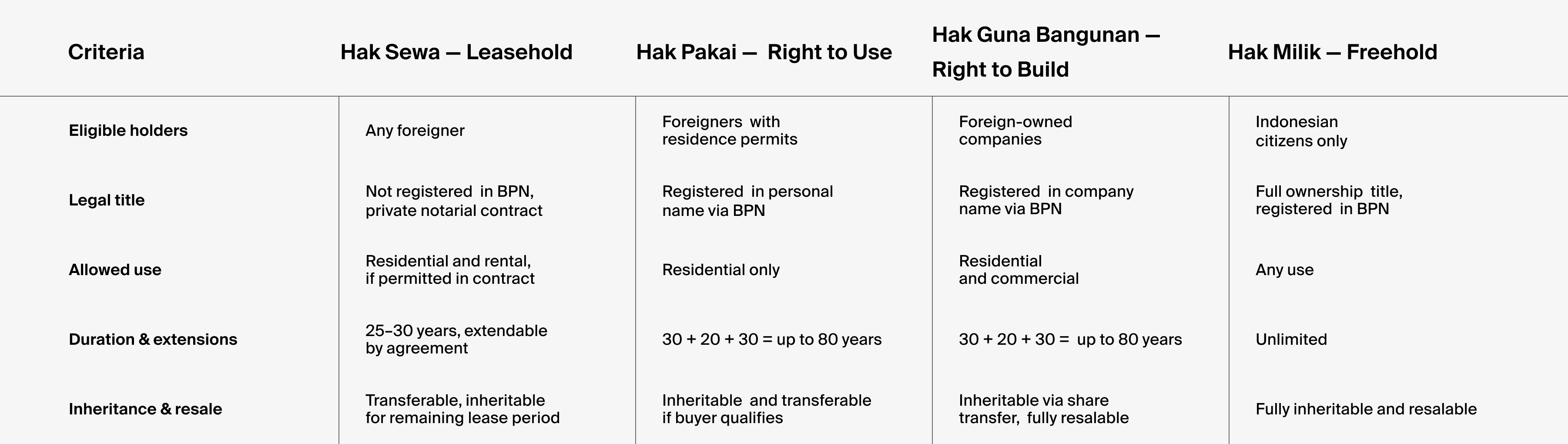

Comparison of property ownership options in Bali

Choosing the right structure is not just about legality — it’s about strategy. Each model comes with its own balance of flexibility, tax exposure, control, and resale potential.

The wrong structure can limit the buyer’s ability to rent out the property, renew their rights, or pass it on to heirs. The right one — chosen with guidance from real estate experts and aligned with visa status, income plan, and exit strategy — protects the investment over the long term.

Need help finding the right property?

We remove the guesswork from property investment by vetting each developer for track record, financial stability and buyer feedback — offering only secure, high-potential options.

Hak Sewa: leasehold property ownership for foreigners in Bali

For foreigners who want to buy property in Bali without setting up a company or obtaining residency, Hak Sewa — the Right to Lease — is the most flexible and accessible model. It gives you the right to use, build on, rent, and resell property for up to 80 years. You don’t own the land, but you control the asset — and that’s what matters.

That said, leasehold in Indonesia operates outside the national land registry. Your entire protection comes down to one document: a private contract. Which means this isn’t just a real estate purchase — it’s a legal structure you build from scratch. And it needs to be airtight.

Buyers’ rights. Hak Sewa gives you broad rights, but the fine print decides everything. At minimum, it allows you to:

Build or renovate a home

Live on the property yourself

Rent it out — long-term or short-term — if local regulations and your contract allow

Resell the lease or assign it to another buyer

Pass the remaining term to your heirs

These rights sound simple, but in practice, they hinge on contract clarity. Want to sublet? It needs to be stated. Planning short-term rentals? You’ll need a local management company with a license. Even extensions and renovations can be blocked without proper language in the lease.

Terms & extensions. Most leasehold deals start at 30 years. You’ll often hear promises of 80 years total — typically structured as 30 + 20 + 30. But here’s the catch: only the first term is guaranteed. Everything after that is optional — and relies on the landowner agreeing when the time comes.

To safeguard your position:

Demand written terms for extension: deadlines, pricing, payment triggers.

Add succession clauses to maintain continuity if the land changes hands.

Work with a real estate agent and a PPAT notary who understands how to close loopholes before they open.

The right contract won’t just protect your investment — it will define whether you have leverage when it’s time to extend, exit, or defend your rights.

Lower entry cost. Since you’re leasing — not buying — the land, the capital required is lower than freehold equivalents in other countries.

You also avoid the legal costs, capital requirements, and bureaucracy that come with registering a company. That makes leasehold one of the most cost-effective paths into Bali’s appreciating market — especially for lifestyle buyers and investors looking to enter quickly.

Risks & due diligence. Hak Sewa is not recorded in BPN — Indonesia’s national land registry. The buyer won’t receive a land certificate. The only protection is the private contract they sign.

To mitigate that risk, your due diligence needs to go beyond paperwork:

Confirm that the land title is clean, registered, and held by the signatory.

Check that zoning aligns with your intended use.

Ensure a valid building permit exists — or that you can apply for one.

Is leasehold the right choice for you? Leasehold is the right model if you:

Don’t have a residence permit

Want to avoid the cost and complexity of setting up a company

Plan to live in, rent out, or resell the property within 10–15 years

Prefer flexibility and low entry barriers over permanent land control

In short: if you treat Hak Sewa as a legal framework — one that you actively structure and control — it becomes a powerful way to access Bali’s property market without overcommitting capital or locking yourself into corporate infrastructure.

Investment property in Bali

How to buy Bali property in leasehold: step-by-step guide for foreigners

Buying property in Bali is often faster and more straightforward than most foreign investors expect — especially when purchasing off-plan or under construction, which is the most common route for our clients.

Over 80% of transactions are completed remotely, with buyers selecting units on the primary market and finalizing the deal without ever setting foot on the island.

At Neginski, we handle every stage of the journey — from your first inquiry to handing over the keys and completing legal registration — ensuring the process is seamless, transparent, and secure. Here's how the leasehold purchase process typically works, step by step.

1. Property selection

The process begins with a curated shortlist. We match you with units that align with your budget, investment goals, and preferred ownership format. Viewings are conducted via video calls, and our analysts assist in negotiating not just the price, but also payment terms, inclusions, and upgrade options — often directly with the developer.

2. Reservation and legal review

Once you’ve chosen a unit, you place a fully refundable deposit — typically $1,000 to $5,000 — to reserve it. This gives our legal team time to review the purchase agreement, which outlines the price, payment milestones, handover terms, and lease duration.

This legal audit phase takes up to 2 weeks, and is critical for clarifying your rights, identifying hidden costs, and ensuring the lease structure is clean and enforceable.

3. Contract signing and first instalment

After approval, the deal moves to signing. The leasehold purchase agreement is signed remotely, with no need for a physical presence. Your first payment is also made at this stage. Most developers offer 0% financing, so you can spread the total amount over time without paying extra for flexibility.

4. Construction and staged payments

As construction progresses, payments are made in stages. A typical structure involves paying 30–50% upfront, with the remaining 50–70% split across 3–4 instalments during the construction period.

The exact schedule depends on the project phase and developer policy. Each milestone is confirmed by progress reports and site updates.

5. Handover and registration

Once construction is completed and the final quality check is passed, your property is handed over and the lease is formally registered by a notary. This legal registration, although not part of the national land registry (BPN), serves as the enforceable proof of your leasehold rights. The registration fee is typically around 1% of the declared value.

Hak Pakai: property ownership for buyers with a residence permit

For long-term residents of Bali, Hak Pakai offers a legal structure, under which a property registered in foreign buyer’s own name — and legally recognized by the Indonesian state. While foreigners can’t own land outright, this Right to Use comes close, offering full residential control for up to 80 years, with formal land title issued by the National Land Agency.

Requirements for the buyer. Hak Pakai is available only to foreigners who hold a valid long-term residence permit, such as:

KITAS — temporary stay permit

KITAP — permanent stay permit

The most popular option for property buyers is Investor KITAS, which connects your real estate ownership to an investment purpose — whether you run a business or hold shares in a local company.

Tourist and business visas don’t qualify. Hak Pakai is structurally tied to the buyer’s immigration status. If their permit lapses, they risk losing access — not permanently, but functionally — until it’s renewed or reassigned. The law allows a grace period, but this isn’t a loophole to rely on. If you’re serious about holding property in Bali, your immigration strategy must be part of your ownership plan.

Buyers’ rights. Hak Pakai grants the right to:

Own one residential property, registered in your name at BPN

Control land up to 2,000 m², or up to 5,000 m² with special approval

Use the property for residential purposes only — no hotels, hostels, or coworking spaces

You can purchase a villa, house, or apartment, provided it’s in a residential zone and has a valid building permit (IMB or PBG). That said, zoning matters: properties in mixed-use or commercial areas may not qualify.

Igor Borovsky

Head of Analytics Department

You can rent the property out long-term, if declared properly. But short-term rentals like Airbnb are not permitted. That limitation is important: Hak Pakai is not a loophole for running a rental business; it’s a tool for legal residential ownership.

Igor Borovsky

Head of Analytics Department

You can also resell — but not to just anyone. Hak Pakai property can be sold or transferred, but only to another foreigner who also holds KITAS or KITAP. The transaction must be approved by the National Land Agency, and the buyer must meet the same eligibility criteria. It’s not a casual resale market — but that’s what keeps it clean. This structure isn’t flooded with speculators; it’s made for people who know they want to stay.

Terms and extensions. Hak Pakai is granted in three consecutive terms:

30 years initially

20-year extension

30-year second extension

That gives you up to 80 years of legal use — but each renewal is an application process, not a default. To renew, you must show proof of residency status, tax compliance, and a formal request, submitted within the right time window. Planning ahead isn’t optional — it’s how you protect your right to continue living in or using the property without disruption.

Risks & due diligence. Hak Pakai is one of the most secure titles available to foreigners, but several risks still require careful management:

If the property owner loses or does not renew residency, their use of the property is frozen until resolved.

If they violate zoning or operate commercially without licensing, they risk enforcement.

If they don’t include inheritance planning, their heirs could face legal delays or forced resale.

To mitigate all of the above:

Work with a licensed PPAT notary and an immigration consultant

Verify zoning and building permits before purchase

Include clear succession clauses in the agreement

Consider joint ownership with a spouse or family member who also holds residency

When is Hak Pakai the right strategy? This model is best suited for:

Long-term residents, retirees, and digital nomads

Buyers who want a residential home, not a commercial asset

Families looking to secure property rights across generations

Individuals who prioritize title registration and full legal recognition

Hak Pakai isn’t built for speculation or short-term gain. But for those seeking stability, legacy, and legal clarity, it delivers peace of mind — and a true sense of ownership — in a country where direct land ownership is otherwise off-limits.

Hak Guna Bangunan: building property via a foreign-owned company

For foreign investors who want to do more than just own a villa in Bali — those who want to build, operate, and scale real estate as a business — Hak Guna Bangunan is the model that makes it possible. It’s the only legal structure that allows full commercial use of land by a foreigner, via a PT PMA — a foreign-owned Indonesian company.

You don’t own the land personally, your company does. But when that company is fully under your control, Hak Guna Bangunan gives you everything that matters: legal security, operational freedom, and commercial scalability. If set up properly, it’s the most powerful property structure available to non-Indonesians.

Buyers’ rights. Hak Guna Bangunan gives your business the right to:

Buy land and buildings in the company’s name

Develop and operate income-generating properties

Hold property for up to 80 years with long-term security

Rent, sell, or transfer ownership through asset or share sale

Partner with licensed management companies to legally operate rentals, even daily ones

Requirements for the buyer. To acquire Hak Guna Bangunan land, a foreign investor must first establish a Perseroan Terbatas Penanaman Modal Asing, or PT PMA — a foreign-owned limited liability company. The company must declare specific KBLI codes — Indonesian business classifications — aligned with its intended activities, such as:

68111 – Real estate owned or leased

55101 – Hotel and similar short-stay accommodation

68200 – Real estate services under contract

The minimum declared capital is IDR 10 billion, approximately $650,000. Of this, 25% must be deposited into a corporate bank account at the time of registration. While an audit is not required at setup, the company may be asked to present proof of capital during tax reviews or when applying for operational licenses.

Once your PT PMA is live, it must:

Register for a tax ID (NPWP)

Submit monthly tax filings — even with zero activity

Stay compliant with labor, reporting, and investment laws

Corporate structure is the price of full legal control. It’s also what makes Hak Guna Bangunan sustainable long term.

Terms & extensions. Hak Guna Bangunan is granted in three phases:

30 years initial

20-year extension

30-year second extension

Total: up to 80 years — but each step requires formal renewal, with updated business activity documentation, tax filings, and zoning confirmation.

Renewals are usually approved as long as your company is active and compliant. But land-use reforms or policy changes can impact outcomes.

Igor Borovsky

Head of Analytics Department

Why does zoning matter? You can’t just buy land anywhere. Hak Guna Bangunan is only permitted on land zoned for: pink — tourism, red — commercial, and orange — mixed use. Yellow zones — residential — are off-limits. If someone tries to use Hak Guna Bangunan in the wrong zone, they’ll face blocked permits, suspended activity, or forced transfer.

Before you buy, request a zoning certificate from the local planning office — and make sure it aligns with your intended use.

Igor Borovsky

Head of Analytics Department

Risks & Due Diligence. Hak Guna Bangunan is structurally strong. But like any corporate-based ownership, it comes with legal dependencies:

If the zoning is invalid, the company may be blocked from operating.

If the company is dissolved, the associated Hak Guna Bangunan rights are terminated.

If shares are sold improperly, control over the property may become legally disputable.

If succession is not planned in advance, heirs may face delays or complications in transferring ownership.

These risks are all manageable — but only if you plan ahead. Include heirs in your corporate structure. Document share ownership cleanly. Keep your licenses current. Run the company like an asset, not a formality.

When is Hak Guna Bangunan the right model? Hak Guna Bangunan is primarily designed for those planning to develop real estate projects in Bali — not just buy and hold. It’s best suited for:

Developers building rental portfolios, villa compounds, or boutique hospitality projects

Investors who want to construct from the ground up — rather than buy off-plan units

Foreign operators scaling legally with long-term ownership and resale strategy

Businesses that require full operational control, permits, and licensing

It’s not a fit for individual buyers purchasing a personal residence, passive investors avoiding company setup, or short-term buyers looking for a quick flip.

Know your returns before you invest

We’ll assess your goals and opportunities and run the numbers.

Financing property in Bali: developer instalment plans for foreigners

Mortgages are off the table. Foreigners are not eligible for mortgage loans from Indonesian banks — even if they hold a KITAS or KITAP residence permit. Local lending is restricted to Indonesian citizens, and there is no equivalent to cross-border financing in the Bali real estate market.

As a result, all purchases must be made in cash or via developer financing. That may sound limiting, but Bali’s primary market offers a flexible workaround, specifically tailored for international buyers.

Nearly all new-build projects in Bali come with 0% instalment options, available directly through the developer. These aren’t loans, and no third-party bank is involved. Instead, the buyer pays in stages as construction progresses — with no interest applied.

The standard structure looks like this:

30–50% upfront as a booking deposit or down payment

The remaining 70–50% split into 3–4 scheduled instalments tied to construction milestones

Because these plans are interest-free, they’re especially attractive compared to traditional lending models in other countries. However, for higher-value purchases, developers may request documentation confirming the legal origin of funds, in line with Indonesia’s anti-money laundering laws.

Bali property with 0% installment

Bali property taxes and fees: what foreign buyers need to know

Bali’s property market is famously accessible to foreign buyers — but legal ownership comes with its own financial layer: taxes, transfer duties, and compliance costs. These aren't deal-breakers, but they do affect your real return — especially if your investment is structured poorly or sold prematurely.

Taxes in Bali are relatively moderate by global standards, but their application depends entirely on how you hold the asset, whether it's newly built or secondhand, and what you intend to do with it.

Taxes at the point of purchase

Every transaction — whether it's a leasehold or a corporate-titled HGB — involves upfront costs, though in most primary market deals these are already included in the unit price. Here are the typical fees:

Notary fee — 1% of the purchase value. Covers legal review, contract drafting, and registration. This applies across all deal types.

VAT — 11%. Applies when buying new property directly from a developer. Often advertised as “included” in presale pricing — but always confirm.

Luxury goods sales tax — 20%, triggered if the property exceeds USD 1.9 million. Applies only to brand-new, high-value acquisitions and is assessed at the point of transaction.

Ongoing costs during ownership

Once the property is under your control, taxes shift to annual obligations and long-term asset maintenance. Here’s what to expect:

Annual property tax (PBB) — 0.5% of the government-assessed value. This is usually modest compared to market value, but it applies universally — regardless of ownership structure.

Luxury property tax — 10–20%, applied annually to high-end assets depending on size, usage, and zoning. Mostly relevant for luxury villas in top-tier locations.

Lease renewal payments — for Hak Sewa properties, a renegotiated lease payment is required after 25–30 years. It’s not technically a tax, but functionally similar: it’s a major capital outlay that must be planned for in any long-term model.

Taxation on rental income

This is where ownership structure plays a critical role. Bali does not apply a uniform tax rate to rental income — instead, your obligations depend on who manages the property and how the rental is structured:

10% – If the property is operated by a licensed management company with the appropriate tourism permits.

20% – if you rent it out directly as a foreigner without a registered entity or local partner, and the income is treated as passive.

Short-term rentals, such as daily or weekly stays, also incur an additional 11% VAT — but only if the property is formally operated as a licensed tourism business. In such cases, this VAT is usually included in the pricing managed by your licensed operator and not charged separately to the owner. By contrast, long-term rentals are exempt from VAT but remain subject to income tax.

Beyond taxes, investors should account for operating expenses — including management fees, cleaning and maintenance, booking platform commissions — which can collectively reduce gross rental income by around 45%.

That said, even after taxes and costs, net returns in Bali remain in the 10–16% range, making rental property a strong performer relative to many global markets.

Why is the Bali property investment worth it — even without freehold?

The absence of freehold for foreigners in Bali is often misunderstood as a dealbreaker. It’s not. While Hak Milik — full land ownership — is legally restricted to Indonesian citizens, the real question is not what title you can’t hold, but what you can build with the ones you can.

Hak Sewa , Hak Pakai, and Hak Guna Bangunan form a complete legal framework that enables foreigners to buy, own, rent out, and resell property in Indonesia — for up to 80 years. These models aren’t loopholes. They’re designed systems — and when chosen correctly, they offer everything most investors actually need.

1. Affordable entry. Bali still offers one of the lowest capital entry points in the global resort property market. For $80,000 to $250,000, buyers can secure full-featured villas, apartments, or branded units with pools, management, and infrastructure — often in zones that are already tourist-proven or on the brink of breakout growth.

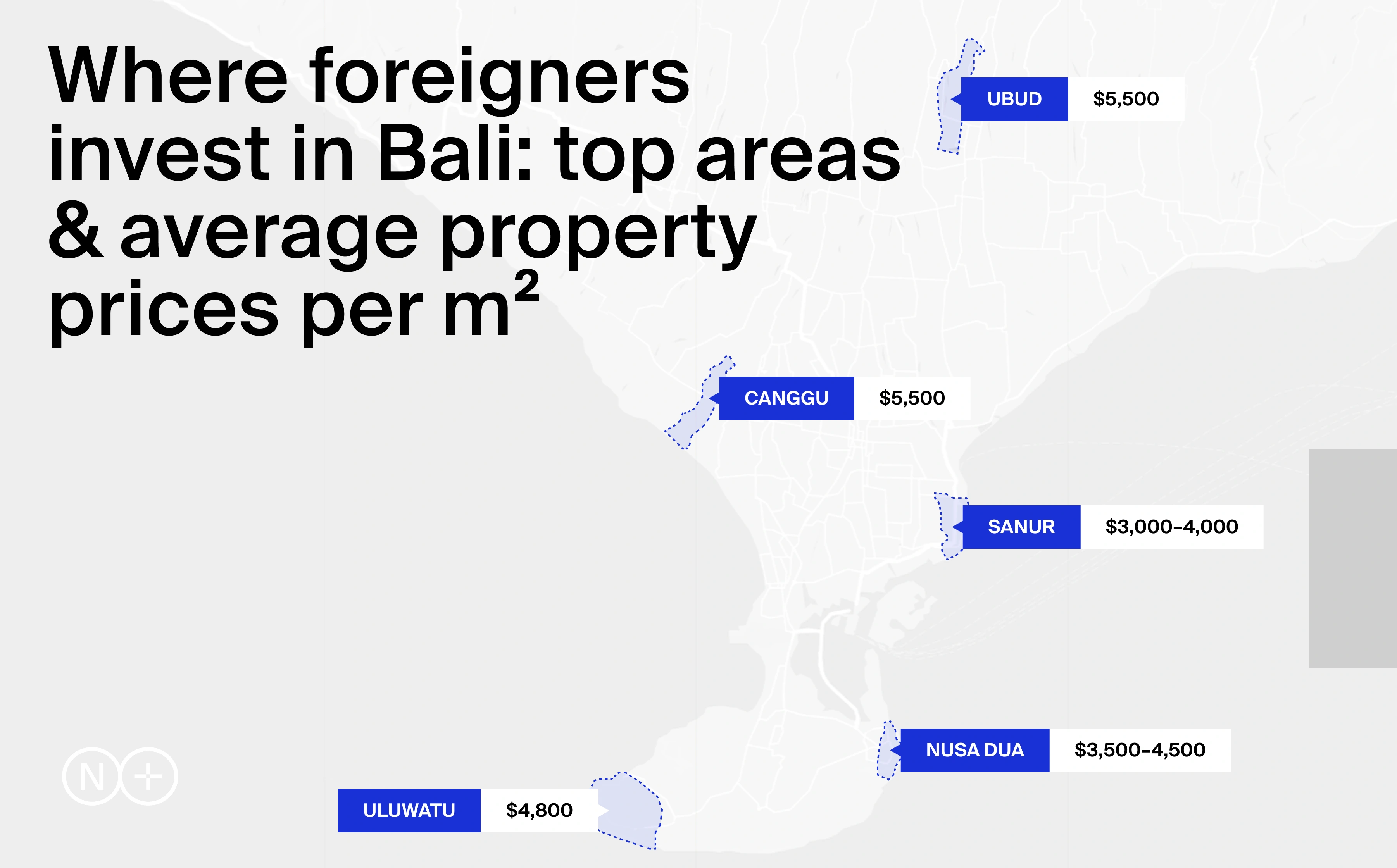

Prices per square meter in high-demand areas like Canggu, Umalas, Uluwatu, or North Sanur still average 30–50% lower than Phuket or Southern Europe. Developer terms such as 0% instalment plans, early-stage pricing, and post-handover payment schedules make acquisition flexible.

2. Strong yields. Gross rental yields in Bali range between 8–16% annually, depending on unit type, location, and management structure. Unlike seasonal markets, Bali’s tourism runs year-round — powered by a mix of global holidaymakers, regional weekenders, and digital nomads on long-term stays.

Even in conservative scenarios, occupancy rarely falls below 60%. In core tourist corridors, that figure consistently exceeds 70%, especially with professional hospitality operators managing turnover, pricing, and guest services.

Whether run through a licensed management company or embedded in a branded residence program, cash flow in Bali is not a theoretical promise — it’s the primary reason many units are sold out before completion.

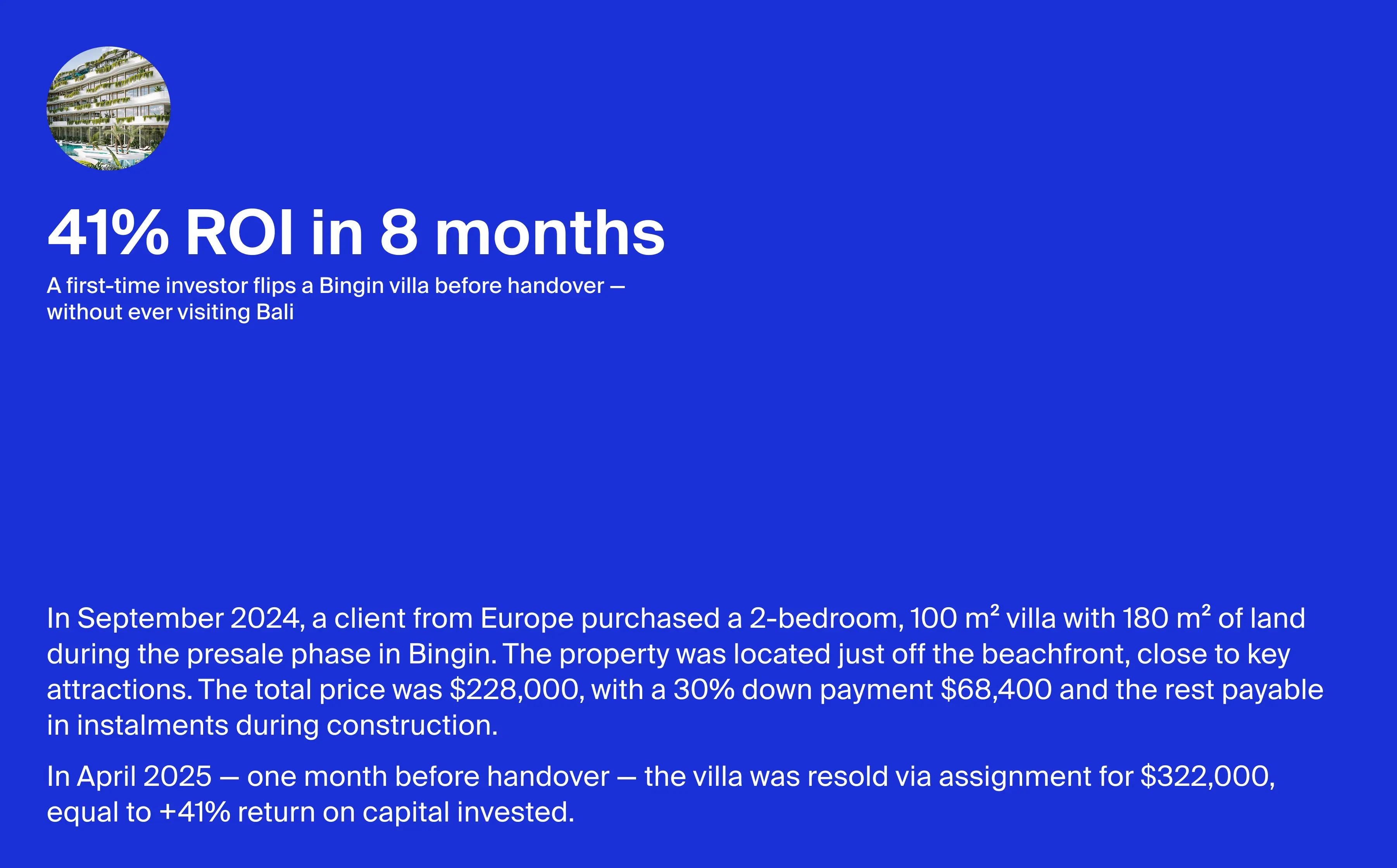

3. Appreciation — without needing to wait decades. Capital growth in Bali isn’t speculative — it’s built into the market structure. Projects launched at the presale stage routinely appreciate 10–20% per year by handover, especially in fast-developing areas where infrastructure and zoning upgrades lag just behind early investor activity.

Unlike saturated urban markets, Bali’s expansion is horizontal and decentralized. Growth radiates outward from existing hubs, creating new high-performing micro-markets — such as Pererenan, Nuanu, Kedungu, and North Ubud.

4. Lifestyle & liquidity. One of Bali’s unique advantages is that property here serves dual purpose. It’s a yield asset — but also a lifestyle asset. You’re not buying a share of a fund or an apartment you’ll never see. You’re buying a place you can actually live in, visit, host friends, work remotely from, or retire to.

For investors who value mobility, usability, and liquidity, Bali property offers a flexible toolset: use it seasonally, rent it out the rest of the year, exit profitably when market conditions are right. This versatility is hard to replicate in other foreign-ownership-restricted markets, where structures are either too rigid, too expensive, or too legally exposed.

Final thoughts: ownership is limited, opportunity is not

Foreigners can’t own land in Bali under freehold — but that’s not the point. With the right structure, legal strategy, and asset selection, foreign investors can access Bali’s property market fully, profitably, and within the bounds of Indonesian law.

Whether you’re entering through Hak Sewa for maximum flexibility, securing a Hak Pakai title for long-term residential use, or building through a foreign-owned company under Hak Guna Bangunan to operate legally as a business, there’s a path that fits your goals — and the law supports it. These options cover different types of property, from lifestyle villas to income-generating rentals.

Bali is more than a lifestyle destination. It’s a dynamic property market with rising capital values, strong rental yields, and a maturing legal infrastructure that increasingly favors transparency and foreign participation. Prices remain accessible, returns are real, and the fundamentals — from tourism to infrastructure — continue to strengthen.

Want early access to top investment deals?

We’re among the first to know about Bali’s hottest presales — and we help clients secure the best units before public launch. Book a consultation to explore high-yield opportunities.

FAQ

-

Yes, foreigners can legally buy property in Bali, but not land in the traditional sense. Instead, they acquire long-term rights to use or build on land through leasehold contracts, Hak Pakai (right to use), or company ownership via PT PMA. These structures are fully legal and widely used by international buyers.

-

You don’t need Indonesian citizenship to buy a house in Bali. While you can’t own freehold land, you can purchase the right to use or lease a property through legally recognised frameworks designed specifically for foreigners. Many foreigners own villas, apartments and commercial units through these models.

-

Bali is considered one of the most profitable and accessible real estate markets in Southeast Asia. With strong rental yields of 8–16%, rising property values of up to 20% per year, and low entry costs, it offers an excellent balance of lifestyle and return. Many properties generate double-digit annual income and can pay back in as fast as in 6.5 years.

-

Yes, leasehold property is legally secure when properly structured. The lease agreement should be notarised and clearly define your rights, including use, rental, resale and inheritance. Leasehold is one of the most popular and tested models for foreigners in Bali — both for living and investment.

-

Prices vary widely depending on the area, size and quality. Entry-level properties start around $2,500 per square metre, while premium beachfront villas in areas like Canggu or Seminyak can reach $6,000–10,000 per square metre. On average, a two-bedroom villa in a high-demand location costs between $180,000 and $300,000.

-

Buying property in Bali does not automatically grant you residency. To live on the island long-term, you’ll need a valid visa — such as a KITAS for retirees, digital nomads, or investors. However, owning property makes it easier to settle in, especially if your visa type supports long-term stays and property use.

.webp)