Investing in Dubai Real Estate in 2026: Pros, Cons and Market Outlook

Neginski analysts select property in Dubai to match clients’ goals: personal use, passive income or capital protection. In this article, we explain the pros and cons of Dubai’s market and its growth potential.

Andrey Neginskiy

Real estate expert, CEO of Neginski

At a Glance

Dubai is one of the most liquid property markets in the UAE and internationally. It attracts investors thanks to steady price growth, strong rental demand and active resales on the secondary market. Dubai property can provide passive income, protect capital from inflation or serve as a comfortable home for personal use.

The main advantages of the market are high liquidity and a wide choice of properties, no income tax and transaction safety thanks to payments via escrow accounts.

The disadvantages include limited ability to set rent freely, mortgage challenges and market saturation that can push prices down. These risks can be reduced if you choose the right project with a licenced broker or an analyst and calculate your strategy, income and costs before you buy.

A safe, transparent property

deal in Dubai with full support

Clear steps: documents, payments, risks,

and common pitfalls

Why Investors Consider Dubai Property for Investment

In 2025, Neginski analysts selected Dubai property for clients with a total value of more than $180.6M. The number of residential and commercial deals in the emirate grows every year. Here is why.

Why demand for investment property in Dubai is rising:

1. Transaction reliability. In Dubai, property transactions are supervised by the real estate regulator RERA. Before construction starts, the authority audits the developer and then opens an escrow account for the project. Funds are released to the developer in tranches as construction progresses. The developer receives the full amount only after handover.

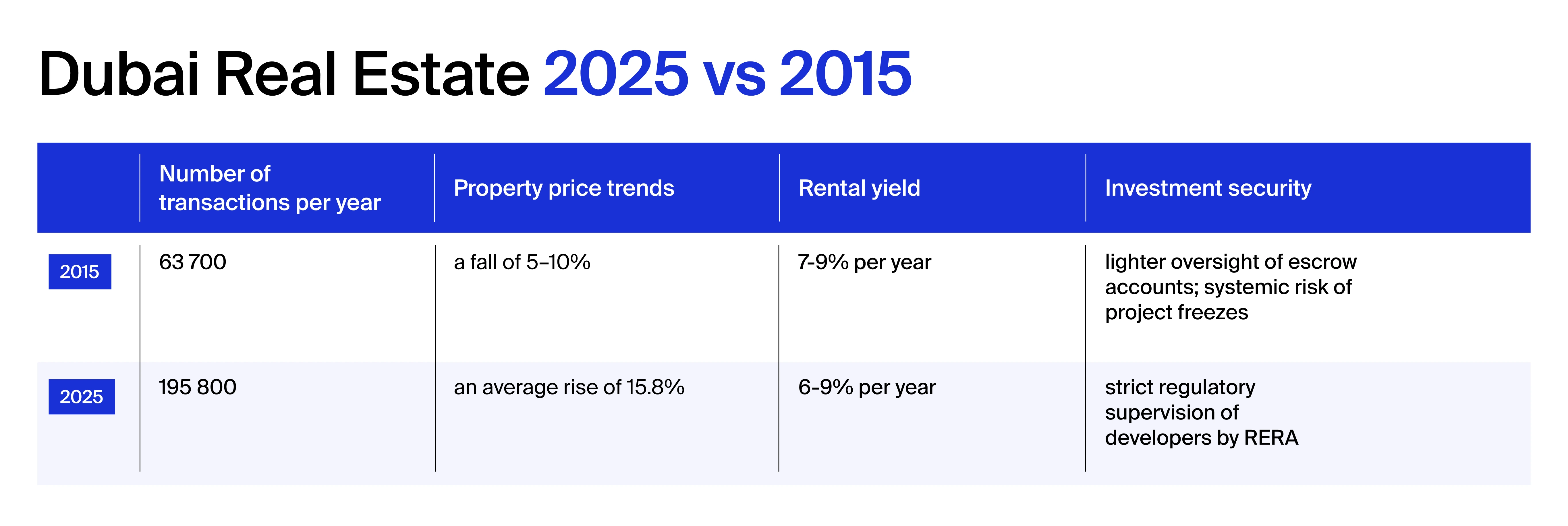

2. Market development. Ten years ago, the emirate was only starting to attract tourists and developers who at that time did not have strong market reputations. A lot has changed since then. We compare the two periods in the card below.

Dubai’s key investment areas are already established. New clusters are developing (Dubai Islands, Maritime City) and the market has already validated demand for this format

3. Strong rental demand. From January to November 2025, Dubai welcomed 17,550,000 tourists, and in 2025 the population exceeded 4 million people, showing annual growth of 6.14%. These factors support demand and push up rates in both short-term and long-term rentals.

4. Rapid growth in property prices. During the pandemic, the market slowed down, but by 2021 it recovered and has shown steady growth for four years. Over this period, prices rose by 70%. Market trends suggest potential for further long-term growth.

Who Dubai Property Investment Suits

Over six years in the market, we have analysed the strategies of more than 1,000 clients. 40% come back for a repeat deal or recommend us to others.

For passive income investors

This means buying property to rent out or resell.

In Dubai, estimated rental yield typically ranges from 6.5% to 12% per year, depending on the rental model. Resale profit depends on the stage at which you bought. If you buy at early construction stages, price appreciation may range from 35% to 100%. Completed property price growth averages 7–10% per year.

For an investment to generate income, you need to consider not only the purchase price, but also costs during ownership and costs when selling on the secondary market.

We have prepared two tables with costs for each income strategy.

Costs when renting out a property in Dubai

| Cost item | How often to pay | How much |

|---|---|---|

|

Service charges |

Once a year |

From $2 to $21 per m² and above |

|

Utilities |

Monthly |

Depends on the unit size, meter readings and season. For example, a one-bedroom apartment can be around $300 |

|

Property management fees |

Monthly, quarterly or yearly, depending on the contract |

5–10% of income for long-term rentals and 15–25% for short-term rentals |

|

Ejari tenancy contract registration |

Each time you sign a long-term tenancy contract |

From AED 180 to AED 220 ($49–$60) |

You should also budget for furnishing, because the unit price typically includes only basic fitted elements: built-in wardrobes, bathrooms, kitchen units.

If you rent out through a management company, the investor is paid after their fees and other charges are deducted, meaning the investor receives net profit straight away.

Costs when reselling a property in Dubai

| Cost item | When paid | How much |

|---|---|---|

|

Agent fee |

When you sign a contract with the buyer |

2–5% of the property price |

|

Developer NOC (No Objection Certificate) fee |

On resale, paid to the developer |

$140–$1,360, depending on the developer |

|

Apartment admin fee |

When buying property |

$1,000–$1,500, depending on the developer |

|

Dubai Land Department (DLD) fee |

When buying property |

4% of the property price |

In Dubai, the investor does not pay tax on resale income, which makes the emirate one of the most attractive property markets.

For capital protection investors

This means buying property to lock capital into a physical asset that does not lose real value over time, unlike cash whose nominal value can be eroded by inflation.

At the same time, if the investor later wants to cash out, the unit must be in demand on the secondary market so it can be sold quickly.

How to achieve that?

Answer: choose a property in a growing area. Location = 90% of investment success. If you know your investment horizon, review the Dubai development plan and choose a property in the areas that the plan prioritises.

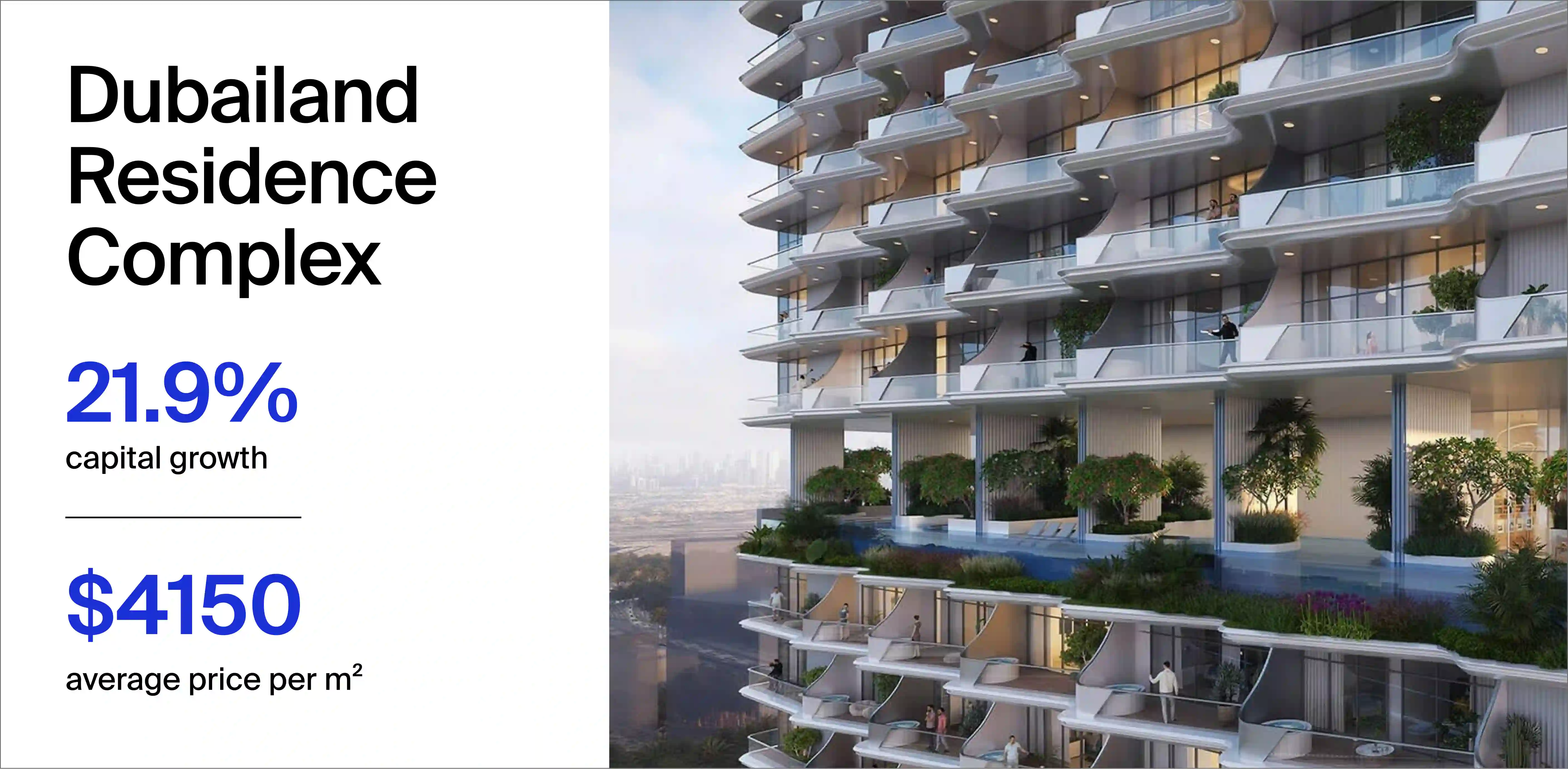

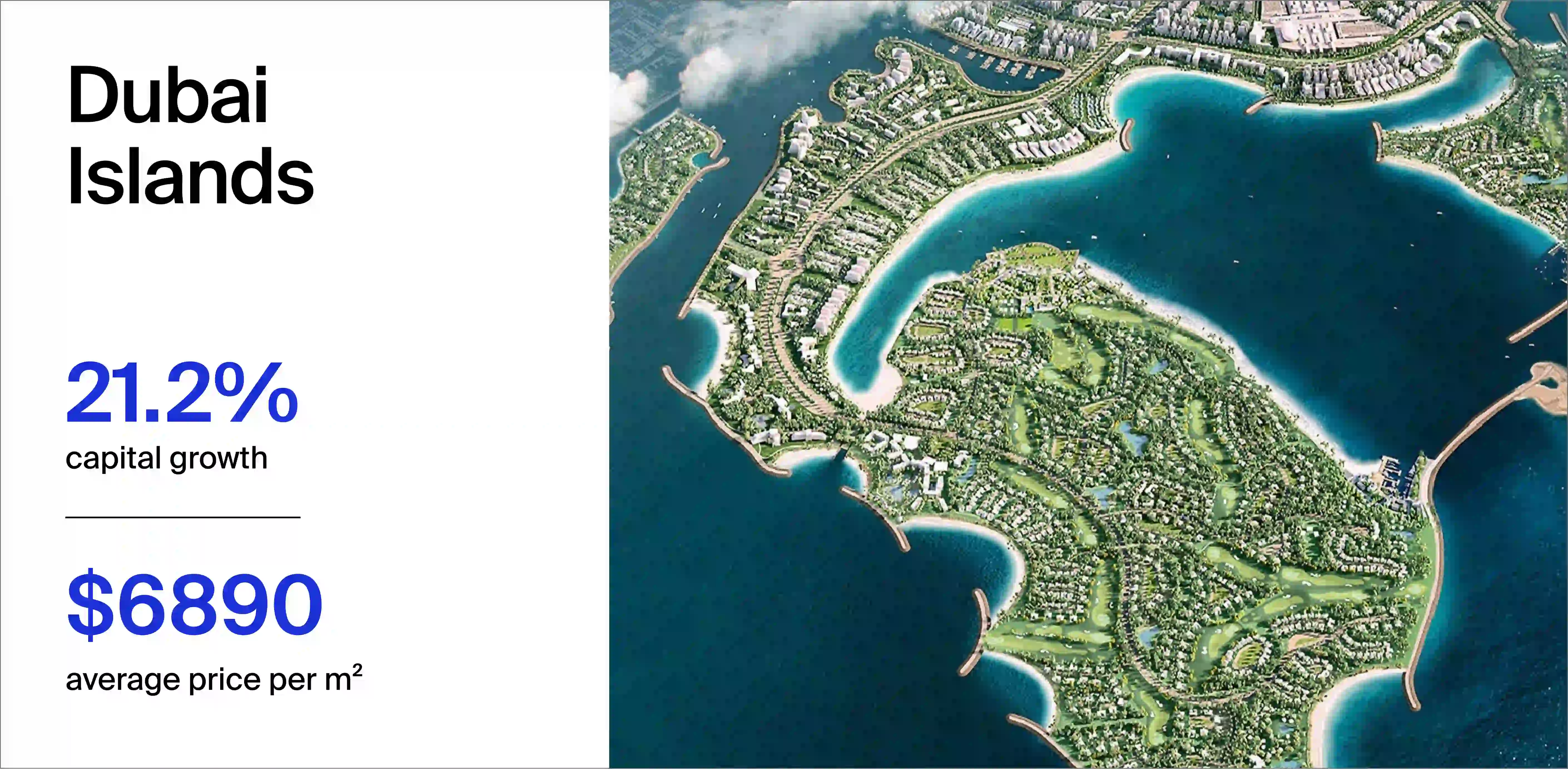

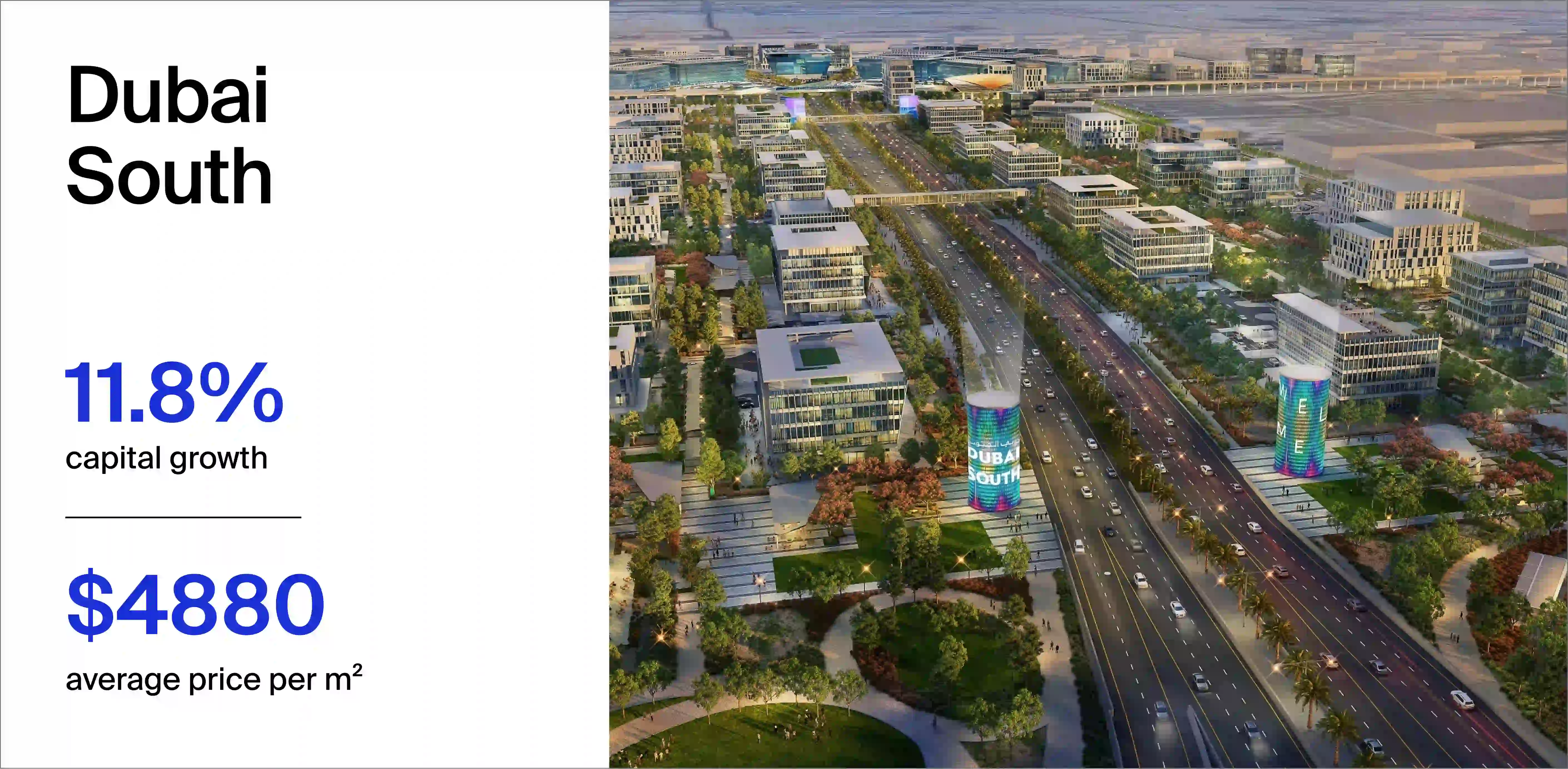

For example, in 2025, due to area upgrades under the plan, the highest capital appreciation was seen in Dubailand Residence Complex, Dubai Islands and Dubai South. In the cards below, we explain what changed in each area and calculate the total growth based on Neginski analytics.

Property in Dubailand Residence Complex starts from $160,000. The area has access to the city’s main motorways. Strong demand from students and employees of Dubai International Academic City

Dubai Islands is an upscale green waterfront community at an early stage. Prices and secondary-market demand grow due to limited beachfront supply and a clear development strategy

Dubai South is a large masterplan project. Forecasts suggest that by 2032 population inflow will reach ~1 million people. The reasons are growth in jobs linked to the expansion of Al Maktoum International Airport (DWC) and the construction of Etihad Rail connecting other emirates

For relocators and personal use

Dubai offers a high standard of living, safety and education. Also, buying a home in the emirate can allow an investor and their family to obtain a residence visa, which can help with opening a bank account, getting health insurance and running a business.

There are three visa types linked to buying property:

a 2-year residence visa for investments from $205,000;

a 5-year retirement visa for investments from $272,000;

a 10-year Golden Visa for investments from $545,000.

The third option costs more but offers the most privileges, for example the owner has no restrictions on time spent outside the UAE. When applying for a Golden Visa, it may be enough to have paid 20% of the property price, depending on the property status and the applicant’s profile.

More details on buying property to obtain a visa for you and your family are available in this article.

Pros of Investing in Dubai Property

Emirates News WAM reports that from January to March 2025 the UAE registered 94,719 property transactions. 58,039 of them were in Dubai, around 61.3% of all UAE deals. Below are the reasons investors choose this market.

Pros of investing in Dubai property:

1. No income tax. This applies to profit from reselling residential property or renting it out as an individual. For legal entities, a 9% corporate tax has applied since June 2023 on profits above AED 375,000 (~$102,000). So if rental income is generated as a company activity, tax may still apply.

Andrey Neginskiy

Real estate expert, CEO of Neginski

Important: there is no income tax if an investor rents out or resells residential property. But if they apply these strategies to a hotel room or commercial premises (a shop or an office), their income will be subject to VAT (Value Added Tax) at 5%. The logic is that in this case the investor is buying not just an apartment, but a business.

Andrey Neginskiy

Real estate expert, CEO of Neginski

2. Visa programmes when buying property. These allow you to obtain a 2-year residence visa, a 5-year retirement visa and a 10-year Golden Visa. Visa holders can live in the UAE long term with access to opening bank accounts, renting property, getting a driving licence and healthcare services.

3. Wide choice of properties. According to Supply Pipeline, around 70,000 units are expected to be completed in 2026. Dubai new builds are most often in the business and premium segments, with resident-focused amenities and finishes made from high-quality materials. Specifications and pricing vary widely depending on location and the buyer’s needs.

4. High returns on property investment. Neginski clients typically achieve 6.5–12% per year from rental income and +35% on resale. These results include costs and are achieved through careful selection aligned to the investor’s strategy. Only 24% of projects pass our risk screening.

Earn rental income in Dubai

hassle-free

Property selection, rental-ready setup, full management

and transparent reporting

Cons of Investing in Dubai Property

Dubai’s property market remains one of the most in-demand among the emirates, but it has drawbacks that can prevent you from reaching your financial goal. Below are the key constraints that affect investment outcomes.

Cons of Dubai’s property market:

1. RERA regulates rental rates. An investor cannot increase rent above the range set by the rental index. Rent can be increased by up to 20%, depending on how far the current rent is below the market level. This creates an upper limit for yield in Dubai.

Andrey Neginskiy

Real estate expert, CEO of Neginski

How does the rent increase process work?

1. The owner uses the RERA Dubai Rest app, which determines the allowed rent increase range for a specific property based on the area, the property type and the current rent;

2. If the current rent is below the market level (according to the index), the landlord can increase it (typically 5% to 20% if the gap to market is more than 40%);

3. The landlord must notify the tenant in writing (via the RERA website or a notary) at least 90 days before the contract ends.

Andrey Neginskiy

Real estate expert, CEO of Neginski

2. Mortgage challenges. A mortgage is typically issued only for a secondary-market purchase or for the final instalment in a developer payment plan before handover, which is 40–50% of the apartment price. The rate is 3.7–5% per year. It is available only to UAE residents, subject to conditions.

3. Risk of market oversupply. Dubai is seeing more new developers. If market activity becomes too high, the number of projects can exceed the number of investors. In that case, prices will adjust to the new balance.

Investment Property Formats in Dubai

The property type affects price, potential rental yield and resale profit. For detailed calculations for your chosen strategy, we recommend speaking to an analyst. Below are the key property types in Dubai.

Residential property

Apartments. The units are located in modern, usually high-rise complexes with on-site amenities such as pools, gyms, a tennis court, a spa and more.

Duplexes. Two-level homes within one unit. Most often these are apartments in residential complexes with an internal staircase, separating bedrooms and shared areas across levels.

Townhouses. Homes in a row, sharing walls with neighbouring units. Usually 2–3 storeys with a small plot or patio. Typically located in communities with internal roads and shared district infrastructure.

Villas. Detached houses on their own plot. They usually offer more privacy and space than townhouses and suit family living. Most are in gated or planned residential communities with amenities and maintained grounds.

Compact formats are easier to rent out and resell, but less convenient for family living. Larger units can provide stable income, but are harder to resell due to the higher ticket size. We explain how to choose the right strategy in the article.

Commercial property

Commercial property includes offices, hotel rooms, co-working spaces, retail units, warehouses and service premises. Offices are in demand in business clusters such as DIFC, Business Bay and JLT. Retail units perform in residential and tourist areas.

Commercial yields and prices are higher than residential. Tenants sign 3–5-year leases and often renew them. Companies, like families with children, do not want to move every six months. They invest in fit-out, adapt operations to the location and stay longer.

When buying commercial property, it is important to choose premises in zones licensed for commercial activity, for example DMCC and DIFC

Dubai Property Market Outlook

Neginski analysts expect changes in Dubai’s property market over the next five years, primarily driven by upgrades under the emirate’s development plan. Details below.

Improving areas and the transport network

The urban plan to 2040 focuses on connectivity between districts and public transport. The more daily journeys can be made without long commutes, the more resilient demand is for buying and renting property in areas where transport and the urban environment improve.

One of the key projects for the coming years is the Dubai Metro Blue Line. In 2025, the work started. After completion, Dubai’s rail network is expected to grow to 131 kilometres. The new line will strengthen connections between developing areas and existing demand centres.

In practice, a new metro line can increase property value and liquidity. Areas with strong transport links and metro access attract more tenants and buyers, giving the investor more reliable income.

Less intense price growth

The market is gradually moving from rapid growth to a calmer phase. In its Q3 2025 results, Knight Frank notes a slowdown in sales and expects a more restrained dynamic in 2026, including in the premium segment.

Neginski analysts believe price growth over the next few years will be less aggressive: around 10% per year on average, compared with 20–30% previously. For an investor, this reduces the risk of overpaying at the peak and makes it easier to buy at a justified price. Predictable growth is more reliable for long-term investment than a speculative spike because it helps keep the market stable and reduces the risk of price correction.

About the Author & the Company

Andrey Neginskiy

Real estate expert, CEO of Neginski

This article was prepared by the Neginski team — an international real estate agency with teams in the UAE, Moscow and Phuket. We support clients at every stage, from clarifying goals and selecting a project to completing the purchase and managing the property.

We work with 300+ developers, get early access to off-market launches, source rare listings and negotiate discounts. More than 30% of our clients come back for repeat purchases. Learn more about us

Disclaimer

The information in this article is for general guidance only and does not constitute individual legal, investment or immigration advice. Property purchase terms, instalment plans, mortgage financing, rental rules and UAE residency visa options depend on the specific project, developer, bank, property status and the buyer’s individual profile.

UAE laws and regulatory requirements may change. Before making any decisions, we recommend getting personalised advice and confirming the latest terms with the Dubai Land Department (DLD), the developer, the bank or licenced advisers.

Sources

This article is based on publicly available data, Neginski’s analysis and the team’s hands-on experience.

Links:

Dubai Residency Visa Through Property Purchase | Neginski Real Estate

Strategies for Investing in Overseas Property | Neginski Real Estate

Dubai Welcomes 17.55M Visitors | Ours Abroad News

Dubai’s Population Growth: Crossing the 4 million Mark

Is Dubai Property Worth It? Pros, Cons, Profitability & Safety | Invicta International Properties

Dubai 2040 Urban Master Plan | The Official Platform of the UAE Government

Dubai Real Estate 2025: Record Numbers, Reality Check for 2026

Dubai Residential Market Review Q3 2025

Mohammed bin Rashid lays foundation stone for Dubai Metro Blue Line

FAQ

-

Buying in Dubai makes sense if you have a market-appropriate budget (from $180,000) and you are comfortable with 6.5–9% per year for long-term rentals, up to 12% for short-term rentals and price growth from 35%. If your budget is smaller or you expect higher returns, this market is not a fit.

-

Your budget should include at least an extra 5% for transaction costs when buying on the primary market.

Additional payments include:

primary market: DLD registration fee (4%), admin fee up to $1,500;

secondary market: DLD registration fee (4%), 2–5% agent fee, NOC up to $1,360.

-

Service charges include security, cleaning, lifts, shared areas and sometimes cooling. If you ignore them, real yield can differ from the advertised figure by 2–5% per year.

the service charges range depends on the project and the class of the development and can be from 8 to 80+ AED/m² per year ($2 to $21+);

you can request data from the developer, the management company or check Dubai Land Department (Service Charge Index);

in new projects, the rate is often lower and increases after 1–2 years.

-

Both purchase options can be risky if you do not verify the seller or developer, the project and the documents.

Main risks:

off-plan property: construction delays or a frozen project, quality not matching expectations;

completed property: legal disputes over the property, interior wear and tear.

-

Reputation and documentation checks are mandatory:

request a list of completed projects;

confirm the construction stage with DLD or an analyst;

read reviews, check the Property Finder forum;

assess the land ownership structure and handover timelines.

-

unaccounted payments for utilities, service charges and property management fees;

vacancy due to a location that is not in demand among residents and tourists;

vacancy due to lack of reviews for the apartment or the building on Airbnb and other aggregator sites.

-

Any estimate is a forecast, not a guarantee. To calculate yield correctly, you need to factor in costs and the probability of vacancy.

What outcome you can expect when renting out property in Dubai:

long-term rentals: 6.5–9%;

short-term rentals: up to 12%, but with higher risks and volatility;

yield depends on the rental model, demand and how well management is set up.